Fed Speak Should Add Color to Last Week’s 50bps Cut

Fed Speak Should Add Color to Last Week’s 50bps Cut

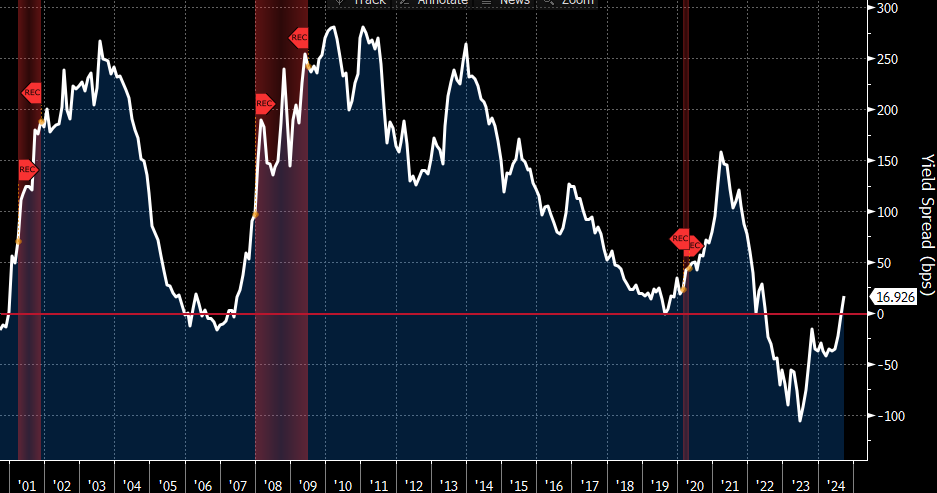

- Treasury yields are under pressure as coming supply and early Fed speak is of the dovish variety which is increasing odds that the outsized rate cut last week may be followed by more. That increases odds that a recession, or material slowing, is avoided. The 10yr–2yr spread is back in positive territory and if Fed rhetoric continues to be dovish, more steepening could be in the offing (see graph below). Currently, the 10yr is yielding 3.78% up 4bps on the day, while the 2yr is yielding 3.61%, up 2bps on the day.

- Fed speak is probably the leading event this week. More than a half a dozen officials, including Powell on Thursday, are due to chime in on policy after the 50bps cut last week and whether investors should expect more of the same. Minnesota Fed President Kashkari has already opined on CNBC this morning as a supporter of the 50bps cut, and for another 50bps in cuts by year-end (matching the updated median dot plot). He admitted that’s quite a shift for him since he had been one of the more hawkish members previously. He felt the balance of risks had clearly shifted from inflation to the labor market, with a feeling that they should have probably cut in July. ·

- It’s important to realize that when most of the hawkish members have changed their spots, except for Bowman, more cuts are coming so it’s more a matter of whether they will be of the 50bps variety, or the more modest 25bps. As for November, the 25 or 50 decision will likely come from the October jobs report which will drop the Friday before the November 7th rate decision. If it portrays a labor market continuing to lose momentum a 50bps cut could certainly be possible.

- Looking at the data this week, Friday’s August Personal Income and Spending report will headline the new releases. With all the other August inflation data already in hand, analysts are estimating core PCE to come in somewhere around a “high” 0.1% or “low” 0.2%. In either case, it would be cooler than the latest core CPI print. With the shift towards the full employment mandate the PCE series loses some of its previous star power, but it will still have a say in policy. A cool print won’t change the rate-cutting calculus much, but a surprise hot print probably makes a 50bps cut harder to stomach for the inflation hawks.

- Maybe as important going forward will be the spending numbers in the report. Recall, last week’s Advance Retail Sales report was decent, but the personal spending numbers in Friday’s report are more comprehensive, including more services-side categories, so we’ll be curious what it shows. So far, the consumer has held strong, and we suspect that will continue, but if a slowdown is noted that could add to case for larger rate cuts at the November meeting.

- One last thing is the global economy looks to be taking another leg lower in momentum. Eurozone PMIs this morning were almost universally weaker-than-expected, and when you add in the China slowdown that looks more and more like a balance-sheet recession (similar to our Great Financial Crisis), it speaks to a lengthy period of demand contraction, unless Xi unleashes a fiscal stimulus program to offset the demand weakness, but he has shown no willingness yet to throw more debt at the problem. Thus, global growth prospects don’t look so hot. The Fed typically doesn’t weigh international issues heavily in policy deliberations, but with global slowing looking to be spreading, it certainly is a secondary consideration for a Fed that doesn’t want to get behind the rate policy curve to the downside after being late with the rate hikes.

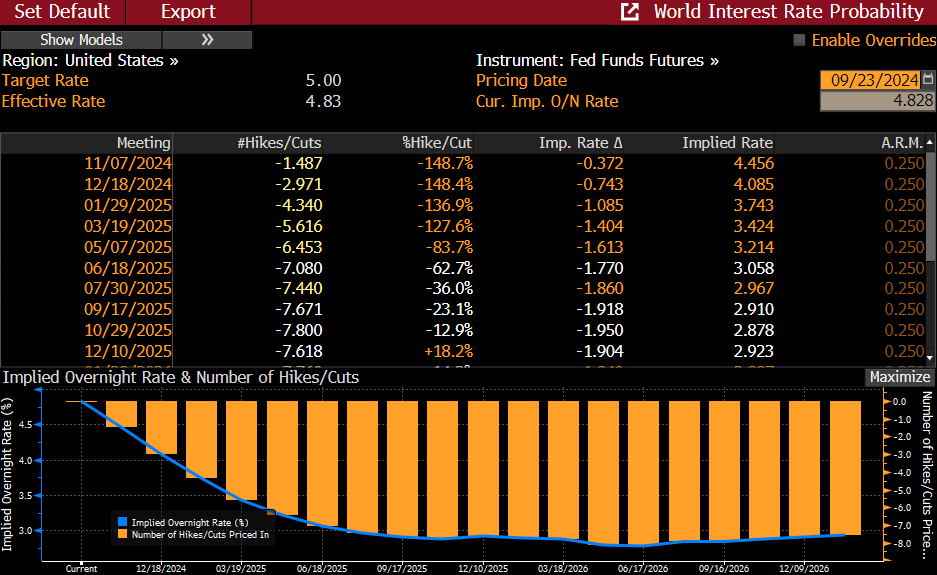

Odds of a 50bps Cut in November at 48% with Nearly 75bps in Cuts Expected by Year-End

Source: Bloomberg

10yr–2yr Treasury Spread Back in Positive Territory – Could Get Steeper if Fed Rhetoric Points to More Outsized Rate Cuts

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.