Fed Speak Continues to Promise Higher-for-Longer

Fed Speak Continues to Promise Higher-for-Longer

- Treasury yields are moving a bit higher in sympathy with a hotter-than-expected UK CPI print. Supply could also be weighing slightly on the market with $16 billion in 20yr notes being auctioned this afternoon. Meanwhile, equity investors will be focused on the Nvidia earnings after the bell and that could set a risk-on or off tone which may reverberate back into Treasury yields. Currently, the 10yr note is yielding 4.43%, down 4/32nds in price while the 2yr is yielding 4.86%, down 2/32nds in price.

- As the light data week trundles along, the rather mundane headline event arrives with the FOMC minutes from the May 1st meeting. The expectation is for a hawkish skew to the comments, but coming before April CPI and retail sales that hawkish tone will be viewed with a bit more side-eye given the subsequent friendlier inflation and retail sales reports. So, expect some market reaction but it could be more asymmetric. That is, If the hawkish tone is a little less than expected that could boost Treasuries, whereas if the hawkish tone is what we get it may be shrugged off by the market given the more recent reports.

- Filling in for a lack of first tier data, Fed Speak has been constant this week with the latest headline maker being Fed Governor Christopher Waller. Waller is from the St. Louis Fed’s well-regarded research department and is something of a thought leader on the Fed. His view expressed yesterday was that while the April CPI report was better than the three previous, he would still give it only a C+. We are relieved Waller wasn’t our econ teacher with that tough grading scale. In any event, he did make a good point that when you go to the second or third decimal place looking for improvement, you’re not exactly dealing with dramatic success. He mentioned several more months of improvement would have to be seen before considering lowering rates and that puts us in the late third quarter or fourth quarter for a possible cut and that fits squarely with most of the views expressed by other Fed speakers this week. We think his speech, while brief, provides good insight into current Fed thinking and can be found here.

- Before the FOMC minutes this afternoon, we’ll get April existing home sales with a slight uptick in activity expected with sales increasing to 4.23 million annualized vs. 4.19 million in March. Sales have ranged between 4.00 million and 4.50 million since 2022. Prior to the hiking cycle, sales were in the 6.00 million to 6.50 million range so this is a good example of how limited inventory has put a damper on sales and has worked to keep prices higher than they may otherwise have been.

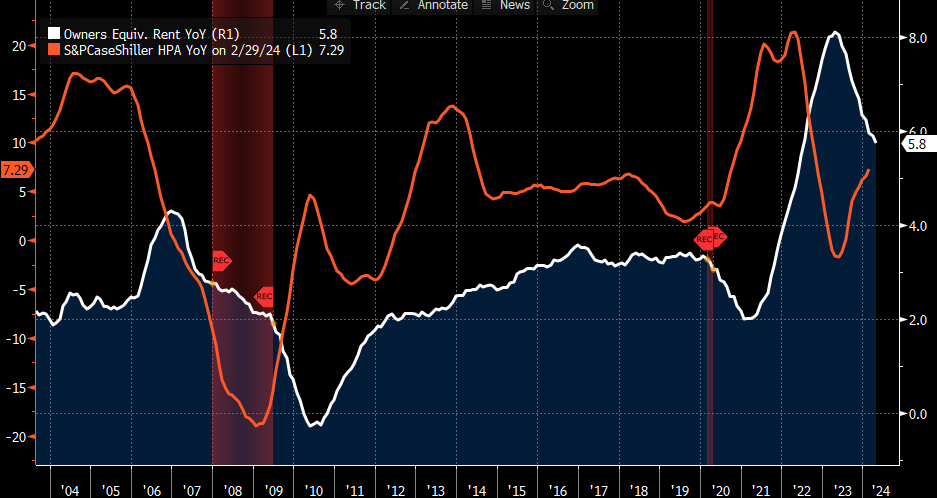

- Yearly home appreciation rates peaked at 20% in March 2022. As rate hikes continued fast and furious throughout the balance of the year appreciation rates slowed with early 2023 seeing some negative monthly prints. That has since reversed as inventory levels continued to fall and yearly appreciation rates are back in the 5% to 7% range (see graph below). Given home values are an important but lagging input into Owner’s Equivalent Rent (OER) the slowing in appreciation rates experienced in 2022 that are now appearing in lower OER monthly rates may be a short-lived experience. Given OER’s heavy 27% weight in CPI, it will make hitting the 2% inflation target a challenge. This is one example where higher-for-longer is feeding inflation and not slowing it.

- Finally, we will have our eyes on Thursday’s S&P Global Preliminary PMI figures for May. While not as famous as the ISM series it still provides an early look at May activity. Expectations are for the manufacturing sector to dip from 50.0 to 49.9 while the services side ticks lower from 51.3 to 51.2. The employment and prices paid components will get attention as well for the information provided on inflation and the labor markets in May.

Rebound in Home Appreciation Rates May Make OER Improvement Short-Lived

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.