Fed Pushback on March Rate Cut Continues

Fed Pushback on March Rate Cut Continues

- Treasuries are finding another tough go of it to close out the week as solid economic data meets Fed pushback on March rate cut expectations, and when you add in what is normally a seasonally tough time of year, it’s not surprising to see the current weakness. Presently, the 10yr Treasury is yielding 4.18% and the 2yr Treasury is yielding 4.40%. The 2yr yield was 4.12% on January 12th, so you can see the more optimistic March rate-cutting odds are being worked off via higher yields.

- As mentioned above, the first of the year is traditionally a tough time for Treasuries, and when this seasonality combines with a torrid rally to end the year, and a solid slate of data so far this year, it’s not surprising that Treasuries are finding January a daunting landscape. Perhaps the more accurate view is that Treasuries have preformed fairly well given all the new year headwinds. That said, the strong retail sales report and the lowest level of jobless claims since September 2022 are just the latest reports that show no signs of an economy about to slow. That plays well with the Fed’s pushback on a March rate cut and that only adds pressure on Treasuries as the more optimistic rate cutting scenarios get dialed back further.

- As far as Fed pushback goes, one of the latest came from Atlanta Fed President Rafael Bostic who said yesterday that with all the uncertainty the prudent course is to be patient. He also said the worst outcome would be to cut too soon and have to raise again later. Well, some would argue the worst outcome would be to remain too restrictive too long and end up in a recession. Bostic is considered a moderate member with a slight dovish lean so his pushback seems to reflect that it is the dominant view on the FOMC at present. There are a few more Fed speakers today, and this is the last day before they go quiet prior to the January 31 meeting, so expect more pushback headlines.

- As for data, at 10am ET we get the first look at January’s University of Michigan Sentiment Survey and existing home sales for December. The big numbers from the Sentiment Survey will be the inflation expectations. Recall last month the survey had quite the dip in those expectations so the forecast for this morning’s numbers are more status quo. The 1yr forward inflation expectation was 3.1% in December and that is the forecast for this month. The longer-term 5-10yr inflation expectation is forecasted to tick up from 2.9% to 3.0%. The Fed wants inflation expectations anchored and while they would like these numbers to continue drifting lower, the nearly unchanged expectations will still be welcomed at the Fed.

- The biggest bit of data still to come before the January FOMC meeting will be next Friday’s December Personal Income and Spending numbers and the PCE inflation series, the Fed’s favorite. With the cool PPI numbers in hand it’s expected the PCE print will be rather friendly to the waning inflation pressure story. Some of the PCE measurements pull in PPI data, and with that some analysts have calculated core PCE could come around 0.1% MoM which would put the six month annualized rate solidly below 2%. While that might excite the market to get March rate cut odds back up, the Fed would probably have to see a real slowing in the labor market to move off their current patient stance.

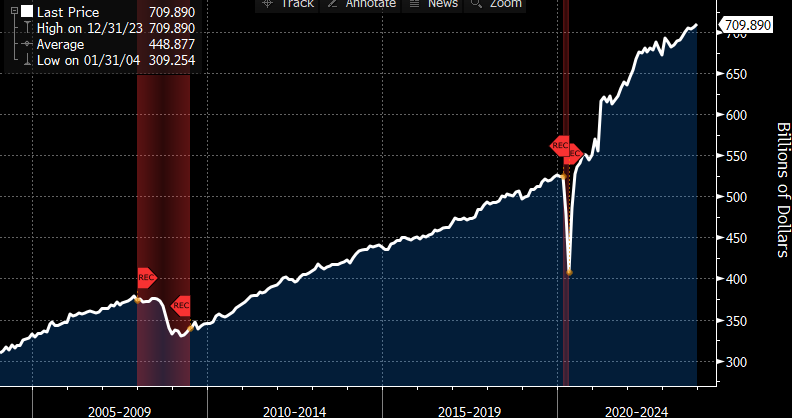

Retail Sales Climbs Past Pre-Pandemic Trend – Can’t Keep the Consumer Down

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.