Fed Prepared to Hold in the Face of Softening Data

Fed Prepared to Hold in the Face of Softening Data

- If we told you that overnight the Bank of Japan raised rates, European inflation readings surprised to the upside, and renewed hostilities in the Middle East boosted oil prices you would probably bet Treasury yields would be up, but you would be wrong. While global worries abound, Treasury investors are more interested, apparently, in the string of softening data we are receiving, making a September rate cut nearly a done deal but just not today (more on that below). Currently, the 10yr note is yielding 4.10%, down 4bp on the day, and the lowest yield since March 11th, while the 2yr is yielding 4.34%, down 2bp on the day, and the lowest yield since February 1st.

- We’ve arrived at another Fed Day, and while the FOMC is widely expected to hold pat on rates, the focus will be on the press conference and how much Powell will tip his hand for the September meeting. We suspect he’ll talk up the better inflation data received since the first quarter but won’t commit to a September cut. There’s still plenty of inflation data to come before the September meeting, so we’re likely to be reminded that the Fed is data dependent and still needs a bit more confidence that inflation is trending to 2% before cutting rates. We’ll be back this afternoon, after the rate decision, highlighting what we learned from the meeting.

- Part of the Fed’s patience stance is built on the belief the economy and labor market are still in a good place, allowing them to maintain an unchanged funds rate for over a year now. There has, however, been some softening in both economic and labor market data recently that may get the Fed to squirm just a bit, but probably not relent on pausing today.

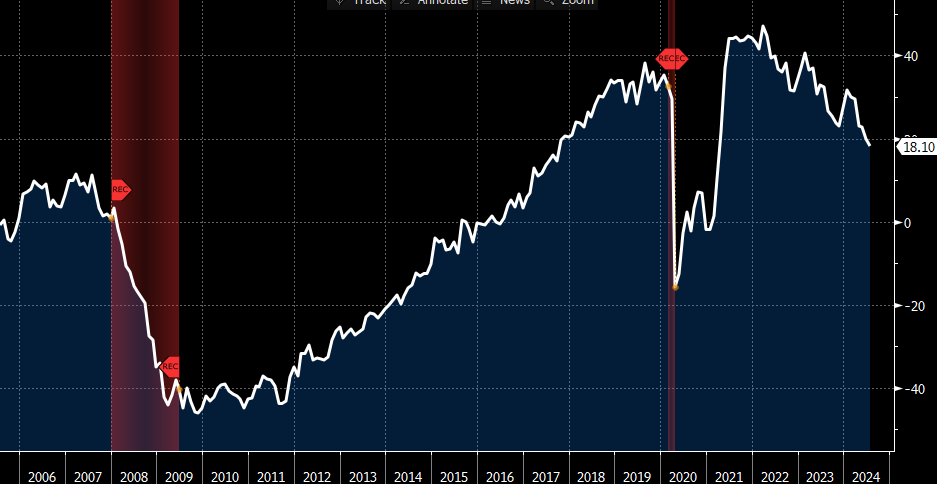

- One item mentioned yesterday was the slippage in the Conference Board’s Labor Differential Gauge (jobs plentiful – jobs hard to get). It dipped to a three-year low, but as the graph below shows, relatively speaking, it’s still not bad compared to the Great Financial Crisis recession. It’s another indication that while economic/employment momentum is clearly slowing it’s not dramatic at this point. The question for the Fed is will that softening suddenly accelerate into something more difficult to stem?

- We received more of the same this morning with the July ADP Employment Change report which found 122 thousand private sector jobs compared to 150 thousand expected which matches June’s gain. It’s the lowest increase since January. What’s more, wage gains for job-stayers slowed to a three-year low of 4.8% YoY, while job-changers declined to a cycle low of 7.2% YoY. The softening in both the headline job growth and wage gains is another signal of softening labor market momentum. The expectation for Friday’s BLS private sector job gains is 141 thousand vs. 136 thousand in June.

- Yet another sign of moderation arrived this morning with the Fed’s preferred wage gauge coming in under expectations. The June quarter’s Employment Cost Index (ECI) rose 0.9%, missing the 1.0% forecast and the 1.2% first quarter gain. The ECI is the most comprehensive of compensation measures as it encompasses benefits along with payroll taxes paid by the employer. The annual gain of 4.1% is just above the 3.9% average hourly earnings gain in the last BLS employment report, but today’s ECI YoY pace is the lowest since December 2021. That three-year low thing seems to be a recurring theme lately.

- The moderation in wage gains certainly eases concerns over wage-push inflation pressures, but the question asked above is topical. While the softening in the economic/labor market numbers of late is inflation friendly, and something the Fed is after, the pace of deceleration tends to accelerate once a trend is established. Again, that won’t alter the Fed’s decision to pause today, but the pace of softening will clearly be something to watch between now and the September 18th meeting.

Conference Board’s Labor Differential (Jobs Plentiful – Jobs Hard to Get) – At a 3yr Low, but We’ve Seen Worse

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.