Fed Pauses But Remains Noncommittal When Cuts Will Begin

Fed Still Noncommittal When Cuts Will Begin

- As widely expected, the Fed kept the funds rate range unchanged at 5.25% – 5.50% and continued to push back against rate cuts beginning soon. The biggest shift in the statement was to change “In determining the extent of additional policy firming that may be appropriate” to “risks to goals are moving into better balance.” There was an expectation that this phrase was due for a change given recent Fed comments and the updated forecast in December that reflected no additional rate hikes.

- They also added this, “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainable towards 2%.” So, no additional clarity on when the first cut as the Fed continues to push back on beginning cuts soon. The full statement comparison can be viewed in the attachment.

- Since this was not a quarter-end meeting there were no updated economic or rate forecasts. The only information coming from the meeting is the attached statement and the post-meeting press conference where Powell will add more color to today’s decision.

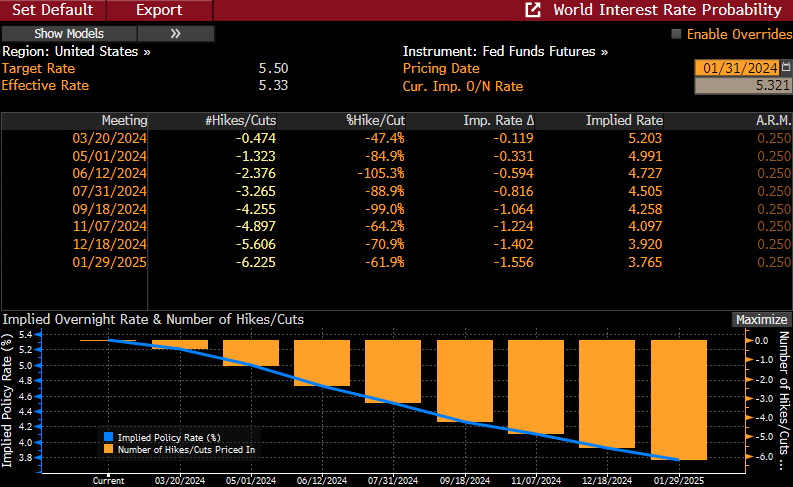

- Futures pricing prior to the announcement had the terminal rate of 5.33% with 144bps of rate cuts by year-end 2024, or an ending fed funds rate of 3.89%. Those futures levels continue to be mostly held in early post-meeting trading, but odds of a March rate cut are back below 50%(see table below).

- In the December forecast, the Fed saw core PCE ending 2023 at 3.2% then dropping to 2.4% in 2024. It currently stands at 2.9%. This dip in PCE below Fed expectations is often cited by those wanting the Fed to get on with rate cuts but the statement today continues the push back by citing a need for more confidence that inflation is moving sustainably to the 2% goal.

- In summary, the Fed delivered an as expected pause with a recognition of the improvement in inflation moving closer to the 2% target. They remain, however, data dependent as to when to begin rate cuts. With two additional CPI and employment reports before the March meeting, along with another PCE inflation print, it’s not surprising that Powell didn’t pre-commit to a rate cut today, but with six-month core PCE averaging 1.8% annualized the “confidence in getting to 2%” rationale for holding off on rate cuts will be put to the test in the next couple months.

Fed Fund Futures Now See Less Than 50% Chance for a March Rate Cut

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.