Fed Keeps Two Rate Cut Projection for 2025, But Just Barely

Meeting Highlights

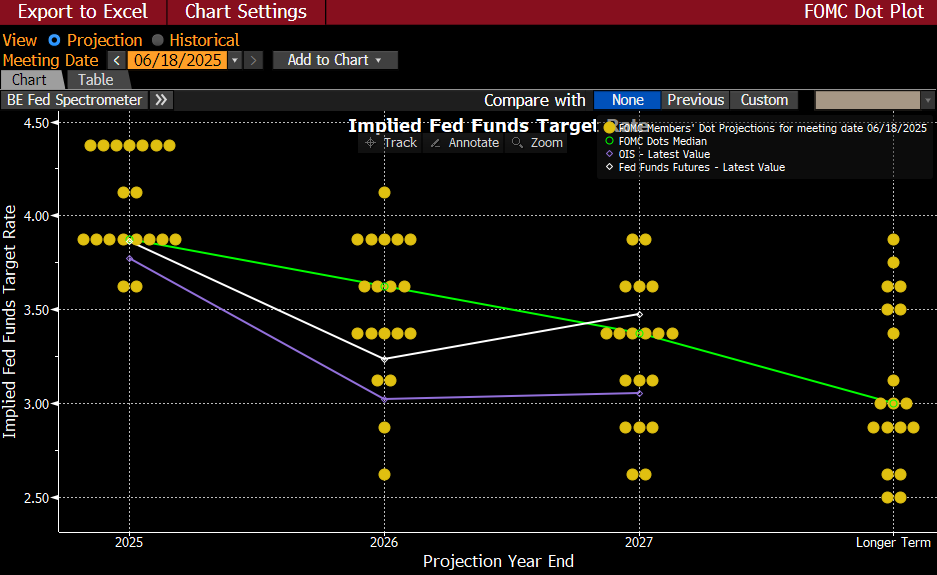

- As widely anticipated, the Fed held the target rate range at 4.25% – 4.50%. The updated rate forecast, or dot plot, still has 50bps in rate cuts in 2025, same as the March and December forecasts. However, the margin is narrower. In March, 11 of 19 participants called for two or more cuts by year end, but now that number is 10. One more shift higher and the median would have shifted to one cut. The dual cut outlook comes as the Fed reduced growth expectations and raised the inflation and unemployment outlook at the same time. So, that two-cut median is sitting on thin ice. In addition, they did reduce the expected rate cuts in 2026 from two to one cut. The vote was unanimous.

- There were few changes to the statement with the biggest change around the level of uncertainty. In the prior statement, uncertainty was characterized as ”increasing” whereas today uncertainty was deemed to have “diminished but remains elevated.” One could quibble with that distinction given the recent Middle East developments. The full side-by-side statement comparison is attached.

- Fed Funds futures pricing prior to the announcement had 47bps of cuts for 2025. After the updated dot plot projections, the futures market continues to price two 25bps rate cuts for this year (51bps). Given the uncertainties that still abound around fiscal policies, the 2026 projections were reduced from two 25bps rate cuts in the March forecast to one today.

- The long-run dot, or neutral rate estimate, was kept at 3.00% for the second straight update after being nudged from 2.50% to 3.00% during 2024. The increase in the rate over the past year is recognition that the post-pandemic economy is at a higher cost plateau than pre-Covid, with expected tariffs adding to the rise in costs. It’s a little surprising it wasn’t nudged higher given the potential higher costs from proposed fiscal policies (read tariffs). Think of the neutral rate as the eventual destination of the Fed’s rate-cutting cycle. It should be noted that the range of estimates remains quite wide with a high of 3.875% and a low of 2.50% with a total of 8 participants expecting a neutral rate higher than 3.00%, same as in March.

- On GDP, the Fed has 2025 growth at 1.4% vs. 1.7% in the March forecast. The pace is expected to improve slightly with 1.6% growth in 2026 and 1.8% in 2027. The 2026 level is 20bps below the March forecast while 2027 is unchanged.

- On inflation, in what was no doubt a challenging task given the still uncertain tariff impact, the Fed decided to err on the high side with median core PCE for year-end 2025 at 3.1% vs. 2.7% in the March forecast. We are currently at 2.5% as of April (May core PCE is expected to be 2.6% when it’s released on June 27). The 2026 forecast was raised from 2.2% to 2.4%, then to 2.1% in 2027 vs. 2.0% in March. Obviously, Fed members are still very concerned that tariffs will eventually leak into the inflation statistics in a material way.

- As for the labor market, the Fed’s forecast is for the unemployment rate to be 4.5% at year-end 2025 vs. 4.4% in the March forecast. That’s a recognition that slower growth expectations will cause the unemployment rate to rise. We are currently at 4.2%. For 2026, the rate is expected to be unchanged at 4.5% then 4.4% in 2027. All are higher than the March forecast and a reflection that a labor market rebound will be slow in coming.

- Overall, today’s information kept with the expectation of two rate cuts in 2025, but by the slimmest of margins, and they did reduce the expected cuts in 2026 to one from two. The slower growth expectation led to an uptick in the unemployment rate outlook with a glacially slow recovery from the expected unemployment increase. It seems to us the Fed is overestimating the tariff impact on growth and inflation such that if we receive better-than-expected inflation news during the summer, the slower growth and increasing unemployment profile will argue strongly for a rate cut in September.

Dot Plot from June FOMC Meeting

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.