Fed Officials Push Back on Aggressive Rate-Cutting Expectations

Fed Officials Push Back on Aggressive Rate-Cutting Expectations

- A concerted effort by Fed officials to push back on the market’s aggressive rate-cutting expectations following the FOMC meeting is generating some selling in Treasuries as the last full week of the year begins (more on that below). Presently, the 10yr Treasury is yielding 3.95%, down 11/32nds in price and the 2yr Treasury is yielding 4.44%, unchanged on the day.

- The push back from Fed officials on the market’s rate-cutting expectations that started with NY Fed President John Williams on Friday continued over the weekend, but the market remains unmoved. Cleveland Fed President Loretta Mester, one of the more hawkish members, said that the markets had gotten ahead of the Fed, and former NY Fed President Bill Dudley opined in Bloomberg that Powell’s dovish pivot is a “pretty big gamble.” Chicago Fed President Austin Goolsbee, one of the more dovish members, was on CNBC this morning and said he was confused by the market reaction. Atlanta Fed President Raphael Bostic speaks tomorrow and that’s it for planned Fed speak this week, but that’s not to say there could be some ad hoc commentary appear.

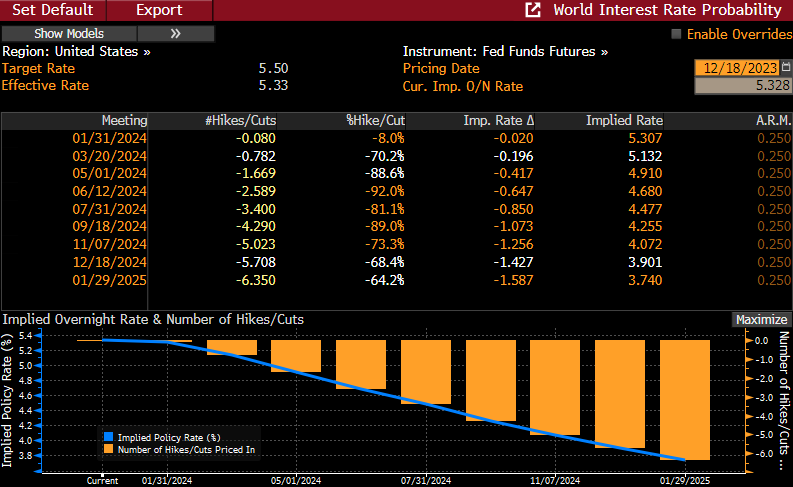

- As we mentioned above, despite the increased Fed push back the market remains largely in the same position that it took immediately after the FOMC meeting. Odds of a March rate cut remain over 70%, and over 140bps in rate cuts are expected for all of 2024, twice what the Fed just projected. Thus, it seems hard to un-ring the dovish pivot bell once it’s been rung (see fed funds futures table below).

- In addition to measuring the market’s reaction to the latest Fed speak, this week’s big event will be headlined by Friday’s November PCE inflation numbers contained in the Personal Income and Spending Report. Following the cool PPI release last week, calculations of the flow through into PCE centered around a dovish core print of less than 0.1% (0.06% to be exact), and that contributed to the robust Treasury rally last week.

- However, Bloomberg consensus remains for a 0.2% MoM core PCE print which would bring the YoY pace down to 3.3% from 3.5%. The overall rate is expected to be unchanged for the second straight month thanks to the continued drop in energy prices. That would bring the YoY rate down to 2.8% from 3.0%.

- By the way, the spending portion of the report is expecting an increase of 0.3% vs. 0.2% in October. If that comes to pass it will be another reminder that the consumer is not going away quietly, and if that spending pace continues into 2024 the expectations of March rate cuts would seem to be a tad too aggressive.

- Also on Friday, the preliminary read on November durable goods orders are expected to be up from a weak October report and that too would argue against bets for a rapidly slowing economy.

Fed Funds Futures Still See First Rate Cut in March and over 140bps in 2024 Cuts

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.