Fed Officials Begin to Lay Out their Reaction Function for Future Rate Moves

- Treasury yields are waffling around unchanged this morning as a light calendar and a modest risk-on tone to equities open the morning. A 5yr Treasury auction awaits this afternoon and while the last three 5yr auctions have tailed, so far in September coupon auctions are five for five in stopping through the bid so one of those streaks will go down this afternoon. Currently, the 10yr is yielding 4.13%, up 1bp on the day, while the 2yr is yielding 3.58%, also up 1bp on the day.

- In a Rhode Island appearance yesterday, Fed Chair Powell reiterated much of what he said at last week’s FOMC press conference, noting that “near-term risks to inflation are tilted to the upside while risks to employment to the downside – a challenging situation” and that “there is no risk-free path”. Powell didn’t offer any clues as to his position for further rate cuts, nor how he’s thinking regarding the October FOMC meeting. He did say that “there has been a marked slowing in both the supply and demand for workers, an unusual and challenging development.” He added, “in this less dynamic and somewhat softer labor market, the downside risks to employment have risen.”

- At the same time, Powell reiterated that tariff costs will continue to take time to work through supply chains for several more quarters. So, nothing real surprising from Powell, but we would tag him as on board for another rate cut or two before year end, but not anywhere close to Stephen Miran’s more aggressive rate cutting posture. Of course, who is in that boat besides Miran?

- Fed Governor and Vice Chair of Supervision Michelle Bowman also spoke yesterday to the Kentucky Bankers Association and sounded more like the official who dissented at the July meeting for not cutting than the one that voted in the majority for a cut last week. “In terms of risks to achieving our dual mandate, as I gain even greater confidence that tariffs will not present a persistent shock to inflation, I see that upside risks to price stability have diminished. With softness in aggregate demand, and signs of fragility in the labor market, I think that we should focus on risks to our employment mandate and preemptively stabilize and support labor market conditions.” While not in Miran’s multiple-50bps-cut-boat, she is more than ready to follow last week’s cut with similar cuts in October and December.

- Meanwhile, other Fed speakers from yesterday, such as Cleveland Fed President Beth Hammack, Atlanta Fed President Rafael Bostic, and St. Louis Fed President Alberto Musalem are concerned that more inflation is coming such that they would be either no votes for more cuts, or at most (in the case of Musalem) one more cut.

- That’s not all. Chicago Fed President Austin Goolsbee was on CNBC yesterday and while typically one of the more dovish Fed officials, he mentioned that neutral was still 100-125 bps lower, but that “with inflation rising, we have to be careful” regarding rate cuts. In a Miran-inspired question, he mentioned he’s not thinking about 50bps rate cuts. It sounds to us like he’s on board with two more cuts this year, which isn’t surprising given his dovish tendencies, but he also made clear he’s not close to the more aggressive Miran point of view. In any event, just as the updated dot plots hinted at, there remains division on the FOMC that will make for interesting meetings through the balance of this year and certainly next year when a new chairman is installed in May.

- Tomorrow brings the increasingly important Initial Jobless Claims for the week ending Sept. 19. It’s becoming the go-to report with its weekly cadence and given that an increase in layoffs seems to be the next leg down if labor market weakening is indeed accelerating. As is evident in the above look at recent Fed speak, it’s clear the group is dividing into distinct factions with one convinced inflation is the overriding concern while the other is convinced the labor market is in a more tenuous situation. Between the jobless claims numbers tomorrow and then Friday’s PCE inflation series each group may have more fodder for their positions by the weekend.

- I recently sat down with Brian Barker, Chief Investment Officer for the SouthState Wealth Group, and we discussed the recent Fed rate cut and what he sees for policy and for the economy heading into 2026. It’s an interesting and timely discussion. When you have 30 minutes to spare, give it listen here.

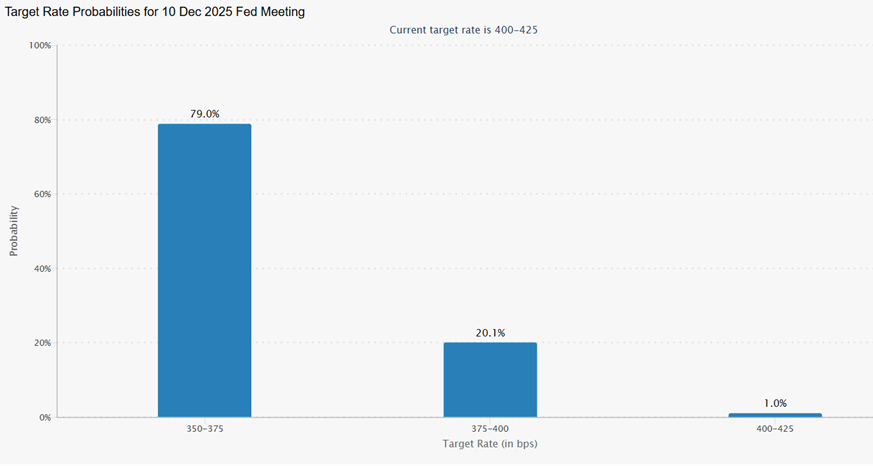

Futures Firmly on Board Two More Cuts This Year

Source: CME Group

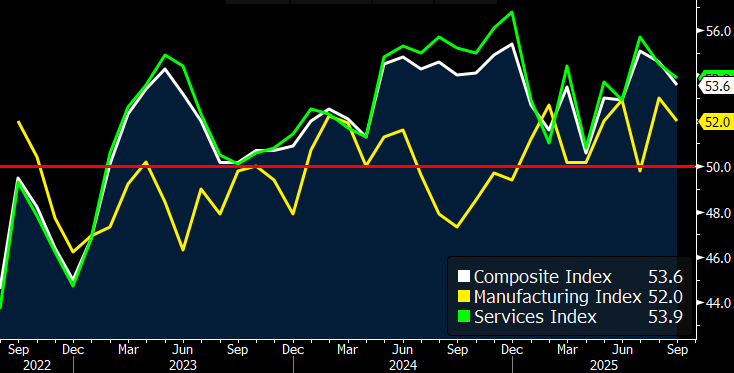

S&P Global Preliminary September PMI’s – Still in Expansion Territory but Growth is Slowing

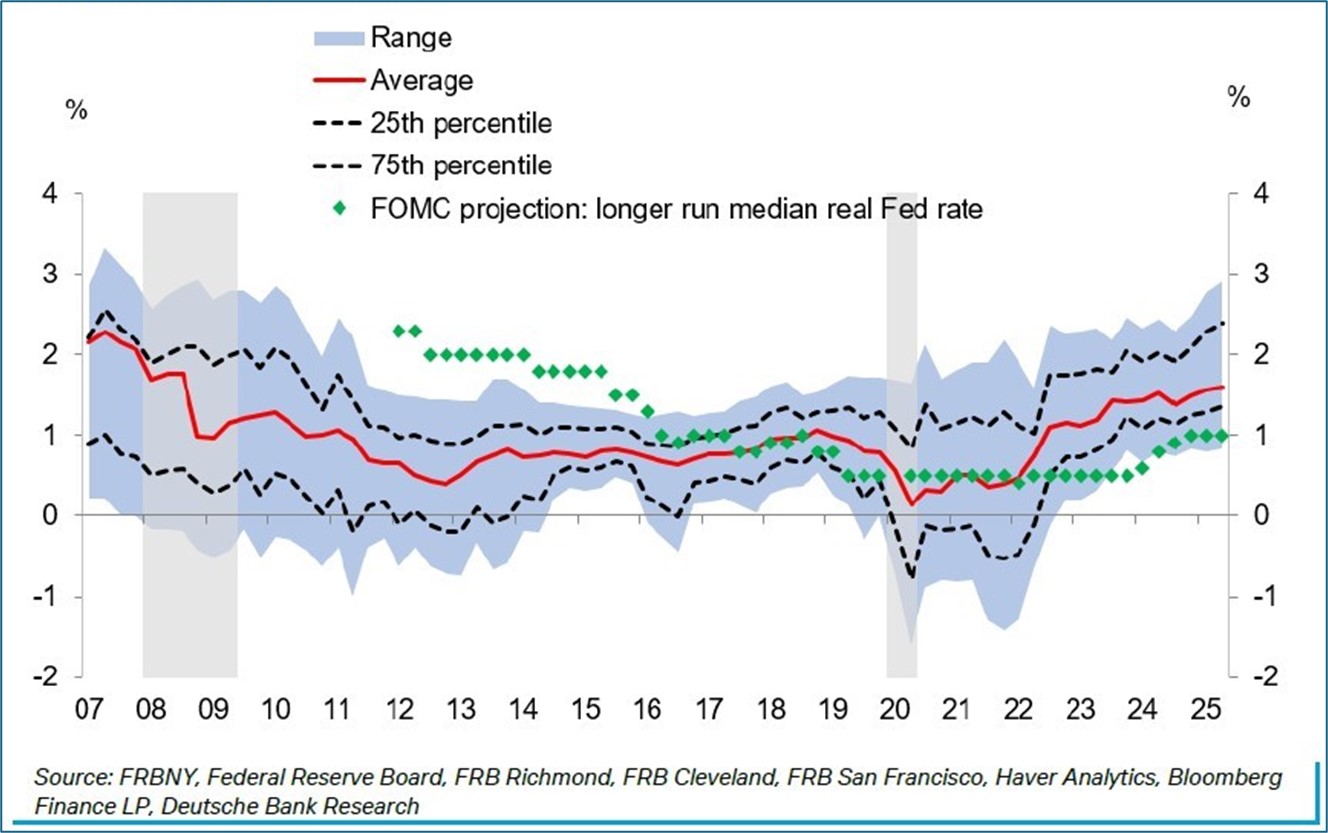

Measures of R* “The Real Neutral Rate” Over Time

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.