Fed Cuts 50bps, Sees Nearly Another 50bps by Year-End

Meeting Highlights

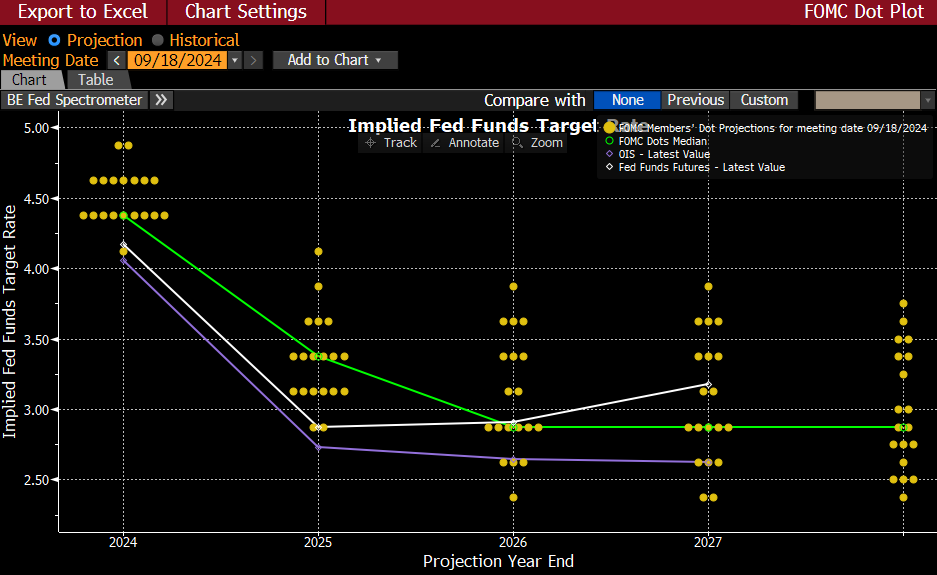

- Well, the 25 or 50bps rate cut debate has been settled with the Fed cutting the funds rate by 50bps moving the target rate range to 4.75% – 5.00%. The updated 2024 rate forecast, or dot plot, now sees nearly another 50bps in rate cuts in 2024 ending the year at 4.375%. That forecast could be met with a pair of 25bps cuts in November and December, or another 50bps cut in December. Today’s rate cut was the first since March 2020 and comes two and half years after rate hikes commenced. Fed Governor Michelle Bowman was the sole dissenter which is not surprising as she has been vocally one of the most hawkish members.

- The June forecast for 2025 had 100bp in rate cuts and that remains the same with this forecast but given the more aggressive rate cuts now planned in 2024, the funds rate is forecast to end 2025 at 3.375%. While that’s much lower than the 4.00% June forecast, it’s still above the 2.9% futures forecast prior to today’s rate decision.

- There were several changes to the statement with inflation “making further progress” from “modest progress” in June, and reflecting shifting concerns from inflation to the labor market they characterized job gains as having “slowed” from June’s “moderated” framing. They also added that the “Committee has gained greater confidence that inflation is moving sustainably toward 2%.” Another sign that concerns are clearly shifting from inflation to jobs. The full side-by-side statement comparison is attached.

- Futures pricing prior to the announcement had 60% odds of a 50bps cut but it was slowly retreating during the day after peaking near 70% in early morning trading. Before the meeting, futures were forecasting a total of 113bps in rate cuts by year-end, and after the updated information, the futures market is at 124bps in cuts.

- After nudging the long-run dot from 2.562% to 2.75% in June, they nudged it higher again to 2.875%. That’s the third straight increase in the so-called neutral rate forecast which had been at 2.50% since 2019. It’s a recognition that the post-pandemic economy is at a higher cost plateau than pre-Covid. The increase in the neutral rate remains well below the lowered fed funds rate and is expected to remain so until 2026, indicating restrictive policy is expected to remain in place through next year. That will obviously be subject to incoming labor market data that may pressure the Fed to cut more aggressively if further cooling is noted. Or, if inflation reignites it could slow the pace of 2025 rate cuts.

- On inflation, with the cooling inflation picture during the summer, the Fed lowered their 2024 core PCE forecast from 2.8% to 2.6% reversing the increase in the June forecast which came after the first quarter uptick in inflation. We are currently at 2.6%. After last week’s CPI and PPI reports the market expects core PCE to tick up to 2.7% YoY despite a benign 0.2% MoM expectation (a 0.1% MoM result is rolling off from last year). The 2025 and 2026 forecasts were kept mostly the same as June’s at 2.2% and 2.0%, respectively.

- As for the labor market, the Fed’s new forecast is for the unemployment rate to tick up to 4.4% at year-end, vs. 4.0% in the June forecast. That’s not surprising given the August unemployment rate was 4.2%, and with the larger rate cut the Fed obviously sees a risk for more labor market weakness before the cuts stem the slowing. For 2025, unemployment is forecast to remain at 4.4% and 4.3% in 2026, both are above the June forecast, and again reflect increased concern with the labor market.

- On GDP, the Fed has it at 2.0% for 2024 vs. 2.1% in the June forecast. That’s a bit confounding as the first two quarters were near 3.0% and the third quarter, and the Atlanta Fed’s GDPNow model, is forecasting a 3.0% third quarter. That would take quite a bit of weakening in the fourth quarter to result in 2.0% for the year. The pace is expected to remain at 2.0% in 2025 and 2026, which is unchanged from the June forecast. The GDP projections, while weaker in 2024 than we expected, reflect ongoing economic strength so far in 2024 which buttresses the Fed’s belief in their soft-landing call.

- Overall, while there was uncertainty as to whether the cut would be 25 or 50bps, the Fed delivered a 50bps cut with nearly another 50 expected by year-end. The June forecast of four 25bp rate cuts in 2025 remains, but the 2026 cuts were reduced from four to three. Given the more aggressive start, ending funds rates are more than 50bps below the June forecast.

- The press conference will afford Powell an opportunity to add more color to the Fed’s latest forecast today. Given the larger 50bps cut, he’s likely to downplay it as a one-time move to jumpstart rate cuts and should not be interpreted as a panic move, but to preempt labor market weakening. He’s likely to reiterate each meeting is now “live” and any moves will be data dependent.

Updated Dot Plot – Nearly 100bps in Cuts in 2024 and Another Four Cuts in 2025

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.