Fed More Cautious on Inflation While Beginning QT Tapering

Meeting Highlights

- As expected, the Fed kept the funds rate range unchanged at 5.25% – 5.50% and Powell’s comments were less hawkish than was expected, but there was disappointment expressed regarding the inflation news so far in 2024. This was acknowledged in the statement with this new addition: “In recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective.”

- They also subtly stepped back from the improving inflation situation changing this from the last statement, “the Committee judges that the risks to achieving its employment and inflation goals are moving into better balance” to: “employment and inflation goals have moved toward better balance over the past year.” A slight retreat from the earlier positive tone with the past tense language which seems a little hawkish to us, but we could be splitting hairs. The full statement and comparison to the previous meeting are in the attachment.

- Also, as expected, the Fed laid out details on beginning the tapering process for QT. They will reduce the amount of Treasury run-off from $60billion per month to $25billion, which was the below the market’s $30billion expectation. The MBS run-off will remain at $35 billion if prepayments can deliver, and any excess run-off over the cap will be reinvested in Treasuries. The tapering will begin next month. The lower cap will allow more Fed purchasing, along with any excess MBS run-off, which should be supportive of the intermediate part of the curve.

- Since this was not a quarter-end meeting there were no updated economic or rate forecasts. The only information coming from the meeting is the attached statement and the post-meeting press conference where Powell will add more color to today’s decision.

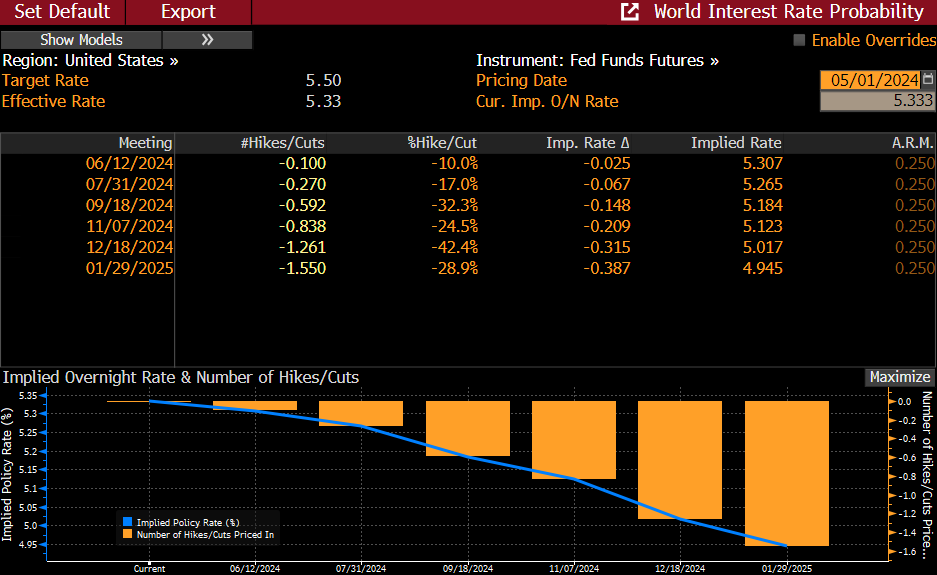

- Futures pricing prior to the announcement had the first full 25bps rate cut at the December meeting, with the 2025 year-end rate at 4.50%, implying three rate cuts next year. Those futures levels continue to hold in early post-meeting trading. It’s astonishing to consider that coming into the year, futures were projecting more than six cuts, and now we’re hanging on by a thread to a single end-of-year cut with only three more projected next year. (see table below).

- In the March forecast, the Fed saw core PCE ending 2024 at 2.6% then dropping to 2.2% in 2025, and finally hitting the 2% in 2026. It currently stands at 2.8%. The closeness of PCE to the Fed’s year-end expectation is often cited by those wanting the Fed to get on with rate cuts but given the inflation news this year the June forecast may adjust up the PCE outlook, which is all part of the higher-for-longer messaging.

- In summary, the Fed delivered an as-expected meeting, recognizing the lack of improvement in inflation this year, and that will keep the first rate cut on ice until much later in the year. While a rate hike wasn’t ruled out, Powell called it “unlikely” and that has Treasuries rallying off his comments that weren’t as hawkish as feared. Tapering of QT will begin next month with Treasury run-off slowing from $60 billion per month to $25 billion.

Fed Funds Futures Sees First Full 25bps Rate Cut in December

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.