Fed Divergence is About to Meet New Data

- With no data on tap today, but plenty on deck for next week, the market is likely to mark time and consolidate price action after a busy Fed week. Two employment reports (Nov. and partial Oct.) and Nov. CPI due next week will lift some of the data blackout uncertainty, and that will be a very welcome development. Currently the 10yr Treasury is yielding 4.19%, up 5bps on the day, while the 2yr note yields 3.54%, up 1bp in early trading.

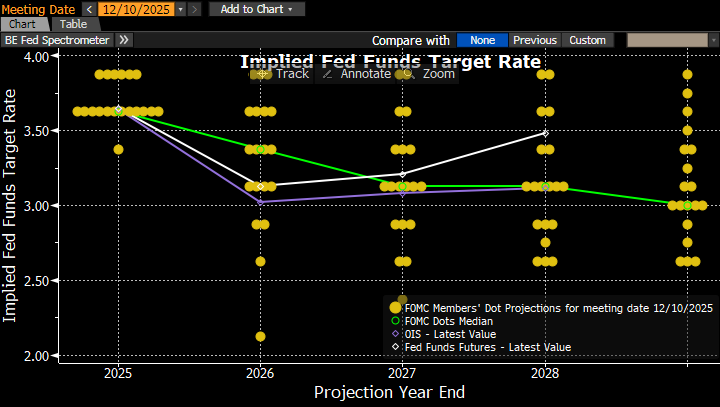

- Much has been made about the number of dissents at Wednesday’s FOMC decision to cut rates 25bps, and the wide range of views displayed with the new dot plot for expected Fed Funds rates. The three dissents were the most since 2019. Two dissents (Goolsbee and Schmid) were against the cut while one dissent (Miran) wanted 50bps in cuts. This is the third straight meeting where Fed Governor Miran dissented for a 50bps cut, so no surprise there that he continues to carry that torch.

- In addition to the dissents there were a total of six members in the dot plot that felt no rate cut was necessary. While two of the six are known via their declared dissents, four represent either non-voters or voters who agreed with the cut while signaling something different on the dot plot. The disparity doesn’t end there. Look at the following years in the dot plot and the range of rate views grows even greater. Analysts surmised that the building cacophony of voices will make achieving a consensus in 2026 akin to herding cats.

- We take a slightly different view. When the backlog of data clears and the current state and direction of both the labor market and inflation are better known Fed members will coalesce over a path forward. There are very few ideologues on the Committee that are intractable in their views. Just look at the recent history of Fed decisions that were routinely passed without dissent. Plus, as the policy rate moved lower, diverging views were unavoidable given the nebulous nature of the near-term landing spot known as the neutral rate. While dissents are likely to be a feature next year, once the fog from absent data clears, the state of the dual mandates, price stability and full employment, will come into focus for members and some of the disparities will disappear. Make no doubt, the new Fed chair in mid-2026 will have quite the chore in corralling a consensus.

- And we should also note that on Wednesday, something routine happened that usually goes unnoticed but not this year. The Board of Governors approved the returning 11 regional Fed presidents (the 12th, Atlanta Fed President Bostic, is retiring) for their positions next year. This approval usually happens without mention but the scuttlebutt this year was that Trump would pressure the Fed Board to view the regional presidents through a partisan lens in an attempt to further shift the FOMC voting constituency towards his liking. Thankfully, the Board resisted and provided their stamp of approval just as they have done in years past.

- The regional Fed presidents rotate yearly as voting FOMC members and for 2026 those voting will be Beth Hammack, Cleveland; Lorie Logan, Dallas; Anna Paulson, Philly; Neel Kashkari, Minneapolis. Those rotating off as voters in 2026 are Susan Collins, Boston; Austan Goolsbee, Chicago; Alberto Musalem, St. Louis; Jeffrey Schmid, Kansas City. It’s been mentioned that the new voters are slightly more hawkish but that’s hard to claim when Goolsbee and Schmid were dissenters against the Wednesday rate cut, and Kashkari has been one of the more vocal doves in the past year. So, we call it a push with very little shift in the hawk/dove dynamic for 2026.

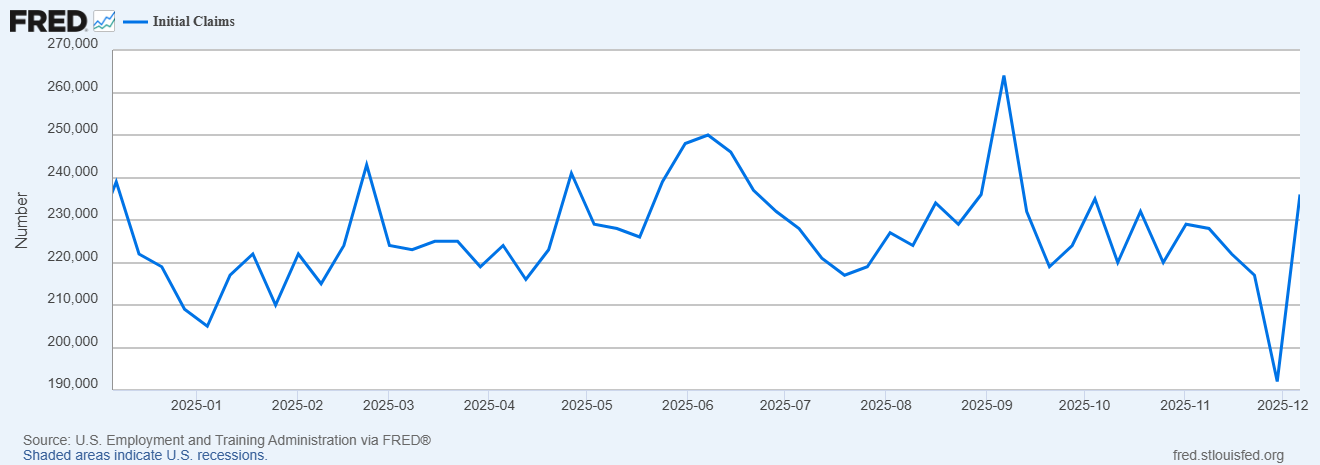

- In regard to assessing the labor market, this week’s jobless claims numbers only added to the confusion. In the week ending December 6, initial jobless claims were 236,000, an increase of 44,000 from the previous week’s unusually low 192,000. The 4-week moving average was 216,750, an increase of 2,000 from the previous week’s 214,750. The unusually low claims print occurred during Thanksgiving week, and seasonal adjustments often have trouble around holiday weeks so one can point to the latest figure as a return to the long-run trend of low 200k prints. So far, so good.

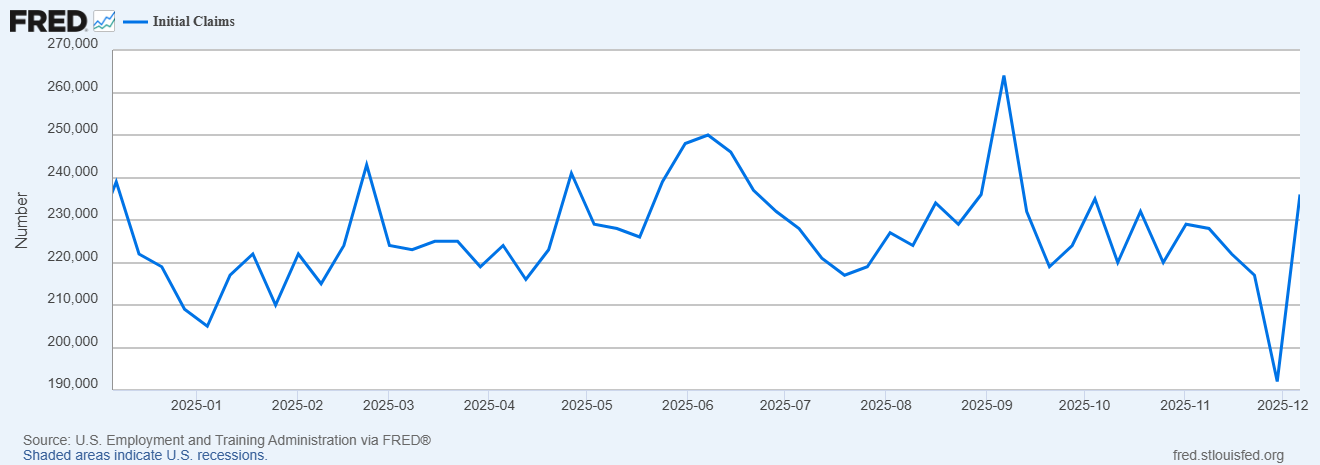

- Meanwhile, continuing jobless claims for the week ending November 29 were 1,838,000, a hefty decrease of 99,000 from the previous week’s revised level of 1,937,000. The 4-week moving average was 1,918,000, a decrease of 27,000 from the previous week’s revised average. While continuing claims were climbing for much of the year, the one-week drop wiped out all of the 2025 increase, perhaps indicating that the low hiring dam has suddenly burst. We’ll patiently wait for other data to confirm or deny this outcome, but it certainly is a curious result.

- One way to confirm the result will come next week when the BLS releases the November Nonfarm Payrolls Report, along with available Establishment Survey data for October. If the drop in the most recent continuing claims figure is to be believed, the November jobs report should surprise to the upside. However, surveys for the jobs report are taken mid-month so the claims drop for the 29th of November may have to wait for the December jobs report, but it does raise the ante on what we’ll see with next week’s November jobs release.

- We’ll also get November CPI next Friday, so a partial clearing of the data fog should happen by this time next week. Both headline and core CPI are expected to be 3.1% YoY. Also, next Wednesday the October Retail Sales Report will provide us with the latest view of consumer spending (expectations call for a decided increase vs. Sept.). That will be a key piece of data as we try to assess whether the dour consumer sentiments are still being ignored when it comes to aggregate spending.

Latest Dot Plot Reveals a Wide Variance of Views on Future Rates

Source: FOMC

Plunge in Continuing Claims Reverses a Year’s Worth of Increases – Is that Correct?

Meanwhile Initial Claims, After a One-Week Dip, Returns to Familiar Territory

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.