Fed Day Arrives

Fed Day Arrives

- Treasuries are trading mostly unchanged this morning with the FOMC rate decision looming this afternoon. We expect that will be the case until the 2pm ET announcement and press conference fill-in some information gaps related to Fed policy (more on that below). Presently, the 10yr Treasury is yielding 4.29%, while the 2yr Treasury is yielding 4.69%.

- Usually when an FOMC meeting arrives with no change in rates expected market uncertainty is reduced, but that’s not the case with this meeting. The key question is whether the three cuts forecast for 2024 at the December meeting continues to be the case today, or is it reduced to two cuts? While there are solid arguments for both sides of that debate, we do see an increasing possibility that the cuts are reduced to two. In addition, the four cuts forecast in 2025 could be dialed back given the uptick in inflation since December and the persistent economic strength.

- It would take only 2 of the 11 “dots” that had forecast three or more cuts in 2024 back in December to reduce their forecast today which would move the median to two cuts. Also, Fed speak since the January meeting has been consistent in pushing back on expecting a series of rate cuts this year. Atlanta Fed President Bostic, who is an FOMC voter this year and considered a moderate to slightly dovish voice, mentioned that he would be ok with a cut at some point this year, but followed by a period of waiting and assessing the market and economic response. When a moderate to dovish voice sees one cut and then waiting it makes one wonder where those three cut projections will come from.

- Any reduction in the planned cuts, both in 2024 and 2025, probably will cause a kneejerk response in the markets with equities trading lower as they seem to perpetually expect a dovish pivot that has yet to arrive and isn’t likely today. Treasuries too would be disappointed at the reduced rate-cutting expectations.

- That said, recall that Powell, in his recent Capitol Hill testimony, said the committee was “not far” from gaining enough confidence on the inflation trend to ponder rate cuts. Will the subsequent hotter-than-expected inflation reports alter his outlook? Will they strike the view that one or two months doesn’t signal a trend change, or will the reports rekindle concerns that service-side inflation remains too “sticky” to contemplate rate cuts?

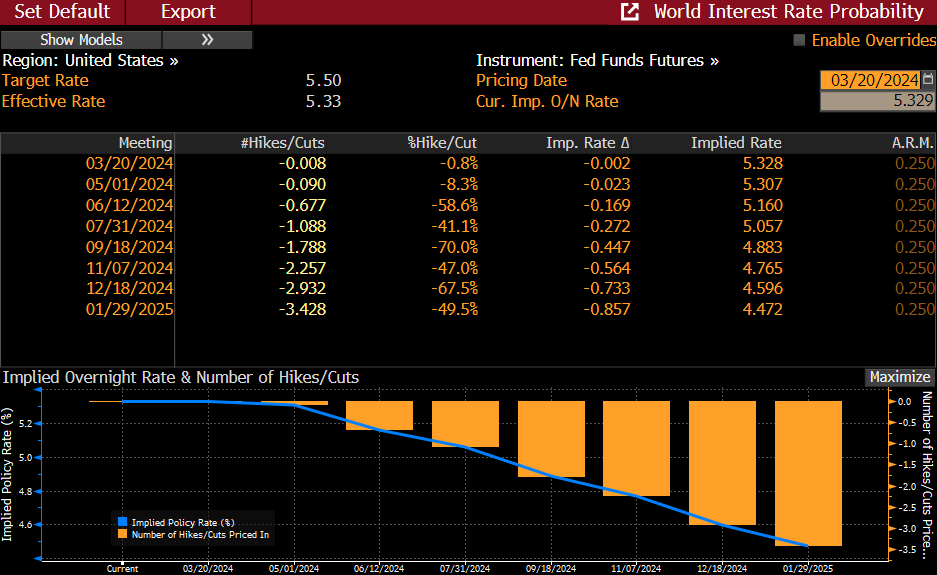

- Central to those questions is how will today’s inflation forecast shift? The December forecast had core PCE ending the year at 2.4%. It’s currently at 2.8% (2.849% unrounded) and would need to average 0.18% monthly to hit the December forecast with most of that YoY drop coming between now and June. With January’s core gain of 0.4% and February expected at 0.3%, it does represent renewed strength from the second half of 2023 when core PCE gains averaged a more pedestrian 0.16%. Will Powell characterize the upward shift in 2024 inflation as an anomaly or something to be concerned about? That will go a long way in determining whether mid-year rate cuts are still possible. Currently, Fed fund futures see just above even odds of a June cut, with three in total for the year (see table below).

- The meeting is also expected to offer some comments on the future of the quantitative tightening (QT) program. Currently, QT is running off $60 billion/month in Treasuries and up to $35 billion/month in MBS. We’re not likely to get much detail today other than they are having discussions on the matter. The minutes will probably offer up more details than what we hear from Powell today, but we could always be surprised. Projections from Wall Street have centered on tapering beginning in June or July with Treasury run-off cut to $30 billion/month with a goal of reducing the balance sheet to $6 trillion, or close to it.

- We’ll be back this afternoon with a recap of what we learned from today’s meeting and early thoughts on the press conference commentary.

Before The Decision, Fed Funds Futures See 59% Odds Of A June Cut And 73bps In Cuts For 2024

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.