Fed Cuts 25bps, Updated Dot Plot Shows One Cut in 2026

Meeting Highlights

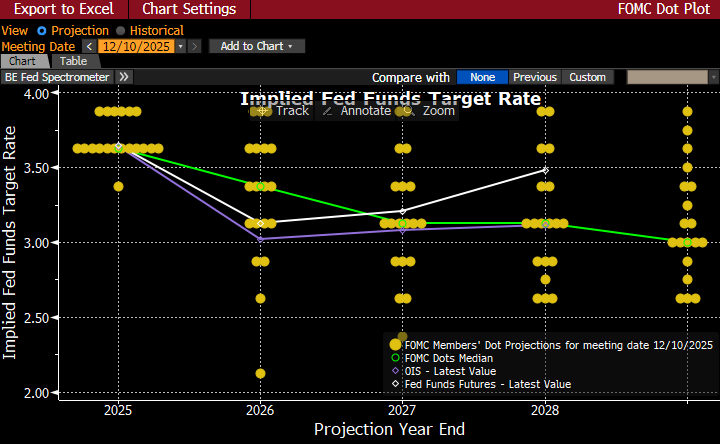

- As widely anticipated, the Fed cut the funds rate 25bps to lower the target rate range to 3.50% – 3.75%. The biggest uncertainty heading into the meeting was the updated rate forecast, or dot plot. In September, they had the funds rate hitting 3.25% -3.50% at year-end 2026. Given the subsequent rate cuts this year, that implied a single 25bps cut in 2026. The median rate in today’s dot plot reflects one 25bps rate cut in 2026 to finish the year at 3.25% – 3.50%, essentially unchanged from the September forecast. That would put the rate just above the so-called neutral rate, or the rate that is neither restrictive nor accommodative.

- Of course, the FOMC will have a new Fed Chair in May, and the odds are the new chairman, given Trump’s desires, will be more inclined for rate cuts than Powell; thus, the futures market continues to bet there will be closer to two cuts next year. There were three dissents in total: Miran who wanted a 50bps cut, and Goolsbee and Schmid wanted to pause. However, the updated dot plot shows six members penciling in a higher rate for this year end than the 3.50% -3.75 that was approved today. Those represent either “silent dissents:” from non-voters and/or “soft dissents” from voters who went with the majority today but harbor reservations. That implies a more divided Fed than the vote tally reflects. That will make additional cuts a heavier lift in 2026.

- The notable change to the statement regards the unemployment rate. In the September statement it was characterized as having “edged up but remained low”. In today’s statement unemployment “edged up” with the “but remained low” stricken from the sentence. That was essentially the only material change.

- The committee did decide to begin purchasing $40 billion in TBills beginning on December 12 and continuing as needed to “maintain an ample amount of reserves.” Given these are Tbill purchases don’t confuse this as Quantitative Easing. It’s merely a move to improve liquidity in reserves. It should have no impact on the price of longer duration coupon-bearing Treasuries.

- Fed Funds futures pricing prior to the announcement had two cuts priced in for 2026 (50bps). After the updated dot plot projections, the futures market continues to price two 25bps rate cuts for next year. Thus, the futures market expects the Fed, despite today’s dot plot, to be slightly more aggressive with rate cuts next year stemming from the expected change in leadership mid-year, and/or a belief in a weakening economic picture.

- On GDP, the Fed has 2025 growth at 1.6% same as the September forecast. Growth is expected to improve to 2.3% in 2026 and 2.0% in 2027. The 2026 and 2027 levels are improved from the September forecast.

- On inflation, the Fed lowered the median core PCE for year-end 2025 to 3.0% vs. 3.1% from the June and September forecasts. We are currently at 2.8% as of September. (October, November, and December core PCE are not expected to be published until January 2026). The 2026 forecast was lowered a tenth to 2.5% then 2.1% in 2027.

- As for the labor market, the forecast is for the unemployment rate to be 4.5% at year-end, same as the September and June forecasts. As of September, the unemployment rate was 4.4%. For 2026, the rate is expected to be 4.4% then 4.2% in 2027. Those levels are nearly identical to the September forecast.

- Today’s update is little changed from the September forecast and with the absence of data during the intermeeting period that is not a surprise. By the January 28th FOMC meeting the committee will have both the November and December jobs reports as well as CPI data. PCE inflation data for December will likely happen on the Friday after the meeting. In any event, the committee will be in a much better place data-wise in January to assess policy rates, but the next refresh of the rate and economic forecast won’t happen until March. Then, we’ll have the impending leadership change in May looming on the horizon, so it may not be until the June 17th meeting that much adjustment to the rate outlook changes from today’s view. Don’t read too much into the decision to purchase Tbills, that won’t impact longer duration coupon-bearing yields. QE is still yet to be employed, most likely by the new chairman.

Dot Plot from December FOMC Meeting

Source: FOMC

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.