Fed Cuts 25bps, Sees Two More Cuts in 2025

Meeting Highlights

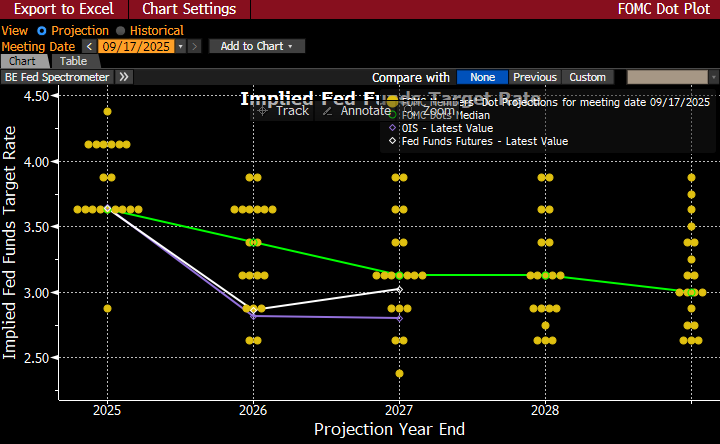

- As widely anticipated, the Fed cut the funds rate 25bps to lower the target rate range to 4.00% – 4.25%. The updated rate forecast, or dot plot, has another 50bps in rate cuts in 2025, up 25bps from the June forecast. They did, however, keep the number of expected cuts in 2026 at one, same as the June forecast. That would bring the range to 3.25% – 3.50% at year-end 2026. While it’s a more aggressive cutting schedule than the June forecast, it still falls short of the market’s more aggressive outlook of a 3.00% funds rate by year-end 2026. That incremental shift to a slightly looser policy, but still short of the market’s expectations reveals both the incremental approach of this Fed and its more divided composition as one member, the newly seated Governor Stephen Miran, dissented in favor of a larger 50bps cut.

- The notable change to the statement regards the slipping resilience of the labor market. The statement now notes that “job gains have slowed” and removed a statement that “labor market conditions remain solid.” In prior statements, the Committee relied on the apparent strength in the labor market to maintain its pause in 2025, until today. While concerns over the labor market developed during the inter-meeting period, inflation, while remaining stubbornly above the 2.00% target, seems to be absorbing tariff costs better than had been anticipated earlier in the year. That has allowed the Fed to forecast a slightly more aggressive easing schedule, but still short of market expectations.

- Fed Funds futures pricing prior to the announcement had nearly three cuts priced in for 2025 (68bps) and nearly six cuts by the end of 2026 (145bps). After the updated dot plot projections, the futures market continues to price three 25bps rate cuts for this year and 140bps in total cuts by year-end 2026. It appears the futures market still expects the Fed to move closer to its position of more aggressive rate cutting in future meetings.

- On GDP, the Fed has 2025 growth at 1.6% vs. 1.4% in the June forecast. Growth is expected to improve slightly to 1.8% in 2026 and 1.9% in 2027. The 2026 and 2027 levels are the same as the June forecast.

- On inflation, the Fed decided to maintain median core PCE for year-end 2025 at 3.1%, same as the June forecast. We are currently at 2.9% as of July (August core PCE is expected to remain at 2.9% when it’s released on September 26). The 2026 forecast was raised from 2.4% to 2.6% then to 2.1% in 2027, same as the June forecast. Obviously, Fed members are electing to relent some on the fight against inflation to address the weakening that has made itself known in the labor market which wasn’t apparent back in June.

- As for the labor market, the Fed’s forecast is for the unemployment rate to be 4.5% at year-end, same as the June forecast, which is somewhat odd given the recent concern over the labor market’s fading resilience. Unemployment is currently at 4.3%. For 2026, the rate is expected to be 4.4% then 4.3% in 2027. Those levels are a tenth lower than the June forecast, again an odd finding given the recent labor market weakening.

- Today’s new information reflects a new appreciation of the recent indications of labor market weakening, but the incremental approach taken by the Fed to slightly increase the pace of expected rate cuts remains behind the market’s expectations. As we came into the year, investors and the Fed attempted to anticipate the economy’s reaction to the new tariffs and trade protectionism with the overriding concern focused on the inflation impact. While price pressure has been evident, to date it has been limited while the recent labor market weakening has shifted the Fed’s focus and created a bit more urgency in the rate-cutting forecast. However, with inflation stubbornly above the 2.00% target, the Fed’s slightly more aggressive rate-cutting plans still trail market expectations. This Fed has been more incremental in its actions so the limited response today doesn’t surprise us, but we believe they remain pragmatic and will adjust policy according to the incoming information, it just may take longer than the more impatient market is wanting at this point.

Dot Plot from September FOMC Meeting

Source: FOMC

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.