Fed Convinced Higher Inflation is Coming

- Fed Governor Christopher Waller was on CNBC this morning declaring that a rate cut in July is possible. “I think we’re in the position that we could do this and as early as July. That would be my view, whether the committee would go along with it or not.” While I’ve remarked earlier not to dismiss the July meeting, Waller’s message is most definitely not what we heard from Powell and company on Wednesday. Waller’s comments, and he is a member with influence, will at least add some spice to the intervening period between summer meetings, and I think we’ve identified one of the two “dots” that still see three cuts by year-end. Whether it was Waller’s comments, or just an absence of bad news elsewhere, the market has a modest risk-on tone this morning with equities poised to open higher (Dow indicated up 160 points). Currently, the 10yr Treasury is yielding 4.42%, up 2bps on the day, while the 2yr is yielding 3.94%, unchanged on the day.

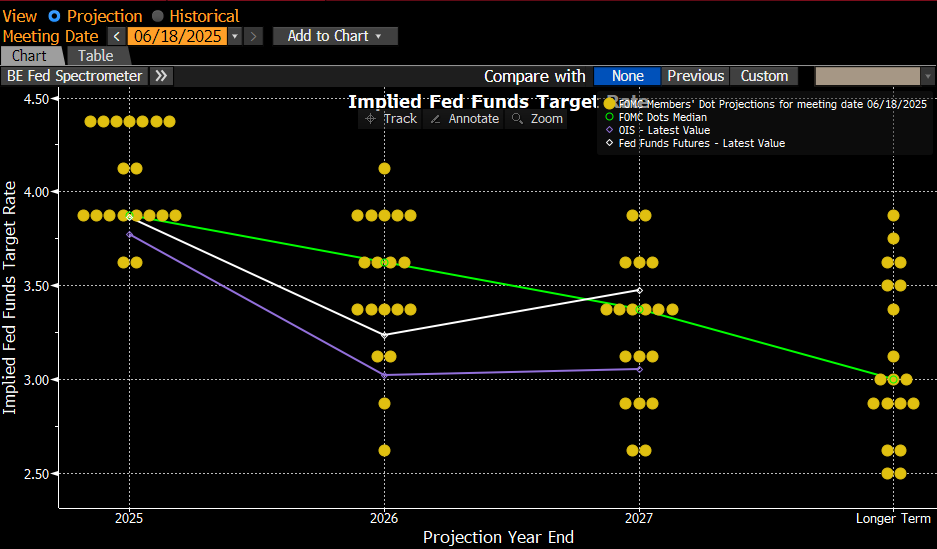

- Well, the Fed did leave two rate cuts in their median expectation in the updated dot plot. The kneejerk reaction to that news was a dovish interpretation by the market. However, upon further review the meeting left no doubt of a creeping hawkishness at the Fed. That stems from a belief that inflation, while cool in the spring, will move higher as tariff costs are more fully absorbed into the economy.

- While the updated dot plot still had two rate cuts by year end, there was a clear shift by members towards less cuts. Back in March, only 4 of 19 members thought no cuts would be coming this year. That number grew to 7 this week. If one more member had reduced their rate-cutting forecast the median would have moved to one cut in 2025. Also, the median in 2026 was reduced to one cut from two in the March forecast. So, clearly the committee seems convinced inflation is headed higher, it’s just a question of how much.

- Powell’s post-meeting press conference also focused on the risk of higher inflation arriving, with no mention or hint that September may offer a rate-cut. That’s in spite of a decidedly more concerning growth and unemployment forecast. 2025 GDP was downgraded from 1.8% in March to 1.4% while core PCE inflation is expected to move over 3.1% vs.2.7% in March. We’re currently at 2.5%. The forecast also shows improvement from those levels is expected to be glacially slow over the next two years.

- In fact, the economic forecast has a whiff of stagflation to it with slower growth, higher inflation, and unemployment projections. Even then, it was evident from the totality of the information that the Fed remains much more concerned about inflation than the prospect of a slowing economy. We’ll just add that that attitude is easy to have when unemployment remains at a relatively low 4.2%. If it starts climbing, like they expect, standing pat will become harder, especially with the White House already very vocal about wanting cuts now.

- To be clear, we don’t think Chair Powell is intimidated by such verbal broadsides, but we would add that should inflation continue to look docile over the summer months a September cut is possible. That meeting falls mid-month so members will have the luxury of the August CPI and employment reports. That said, any combination of higher inflation and/or a still resilient economy probably delays a cut until December, or 2026, despite the White House’s wishes.

- Meanwhile, the latest initial jobless claims numbers continue to show a labor market that is slowly losing momentum. In the week ending June 14, seasonally adjusted initial claims totaled 245,000, a decrease of 5,000 from the previous week’s revised level (revised up by 2,000 from 248,000 to 250,000. The 4-week moving average was 245,500, an increase of 4,750 from the previous week’s revised average. This is the highest level for this average since August 19, 2023, when it was 246,000.

- The advance number for seasonally adjusted continuing claims during the week ending June 7 was 1,945,000, a decrease of 6,000 from the previous week’s revised level. The 4-week moving average was 1,926,250, an increase of 13,000 from the previous week’s average. This is the highest level for this average since November 20, 2021, when it was 2,004,250. Thus, while no clear alarm bells are evident, the low-fire, low-hire economy appears to be continuing. The Fed obviously wants this somewhat stable condition to persist, but with uncertainty continuing to hang over so much of the economy is that a fair expectation?

June Dot Plot – 2 Rate-Cut Projection Survived, but just Barely (and who are the 2 members expecting 3 cuts?)

Source: Bloomberg

Futures Still Hanging onto the 2-Cut Outlook by Year End Source: CME

Source: CME

Continuing Unemployment Claims – Reflects the Low-Hire Environment

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.