Fed Continues to Pause but Hints at a September Cut

Meeting Highlights

- As expected, the Fed kept the funds rate range unchanged at 5.25% – 5.50%, and while the tone of the statement was less hawkish and didn’t overtly hint at a September rate cut, Powell’s post-meeting press conference did. They did, however, make some substantive changes to the statement that indicates the focus going forward will be more on the dual mandate and not solely inflation focused.

- In relation to the full employment mandate, they noted that job gains “have moderated” from “remained strong”. They indicated that the unemployment rate had “moved up but remains low” from just “remains low.” On inflation, they added that it remains “somewhat elevated” vs. “elevated” in the last statement, and “that some further progress” was made towards the 2% inflation target vs. “modest progress” in June.

- Perhaps the most substantive change was to the economic outlook with “the Committee is attentive to risks to both sides of its dual mandate.” The prior statement was “attentive to inflation risks” without recognition of the full employment mandate. The full statement and comparison to the previous meeting are in the attachment.

- Since this was not a quarter-end meeting there were no updated economic or rate forecasts. The only information coming from the meeting is the attached statement and the post-meeting press conference where Powell will add more color to today’s decision. (Post press conference take: Powell was a bit more dovish in the presser indicating a September cut could be on the table).

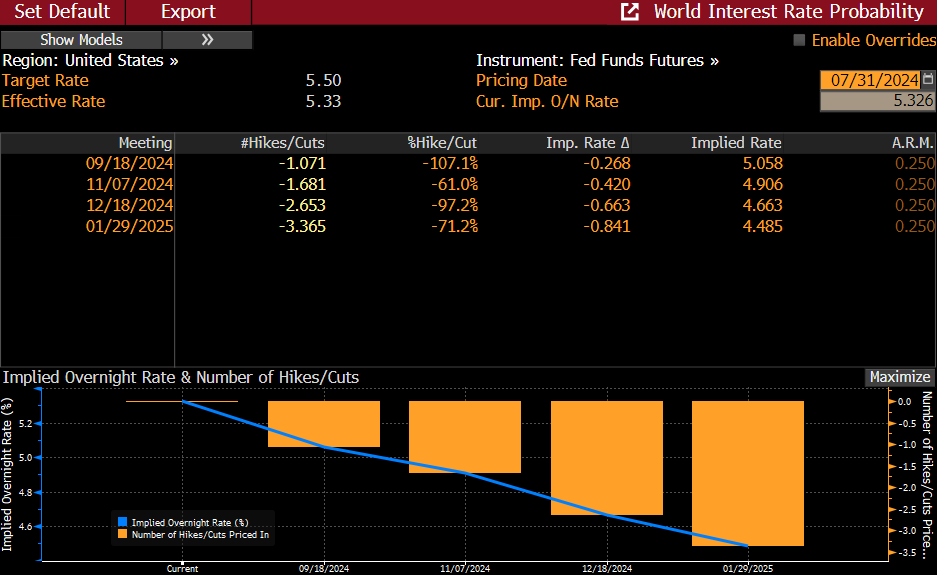

- Futures pricing prior to the announcement had the first full 25bps rate cut at the September meeting, with the 2025 year-end rate at 4.00%, implying two cuts this year and four cuts next year. Those futures levels continue to hold in early post-meeting trading (see table below).

- In the June forecast, the Fed saw core PCE ending 2024 at 2.8% then dropping to 2.3% in 2025, and finally hitting the 2% in 2026. It currently stands at 2.6%. Having already dipped below the Fed’s year-end expectation is often cited by those wanting the Fed to get on with rate cuts. The recent softening in economic/labor market data is also adding to calls to cut sooner rather than later but the back-up in the first quarter’s inflation results is still fresh with this Fed, despite it looking more like a seasonality problem and one-off price increases in January.

- In summary, the Fed delivered an as-expected meeting, recognizing the improvement in inflation during the second quarter, but still wanting to see more before committing to the first rate cut, most likely in September. The risk we see is that the recent economy/labor market softening accelerates in the interim making it harder to stem with quarterly 25bp rate cuts.

Fed Funds Futures See Rate Cuts in September and December Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.