Fed Communication Front and Center This Week

Fed Communication Front and Center This Week

- After a week filled with inflation data, this week is light on new economic news but that leaves the stage for Fed speak and it should provide for tradable headlines. The big event in that regard will be Fed Chair Powell’s address at the Jackson Hole Economic Policy Symposium on Friday (more on that below). Currently, the 10yr note is yielding 3.89%, up 1bp on the day while the 2yr is yielding 4.07%, up 2bps on the day.

- This week is light on economic data, so it opens the door for Fed communication to move front and center. Of course, the big event is backloaded to Friday with Fed Chair Powell offering the keynote address at the Jackson Hole symposium on Friday at 10am ET. Before then, we’ll hear from Fed Governor Christopher Waller this morning, and that follows comments over the weekend from regional presidents Kashkari and Daly.

- Those weekend comments were instructive in that both opened the door to a September rate cut. That wasn’t surprising coming from Daly as she has been more inclined to go in that direction for awhile given comments she has made in recent weeks. A little more surprising was Kashkari’s dovish turn when he had been solidly in the hawkish, “more confidence is needed” camp. The uptick in the most recent unemployment rate seems to have spooked him indicating that the balance of risk to a slowing labor market has increased. It does say something when one of the more hawkish members is openly shifting tone to consider a September rate cut. Waller had been on the hawkish side until late last year and has expressed increasing confidence in getting inflation to the 2% target despite the first quarter uptick. His prepared comments, however, were just released and didn’t touch on his economic outlook.

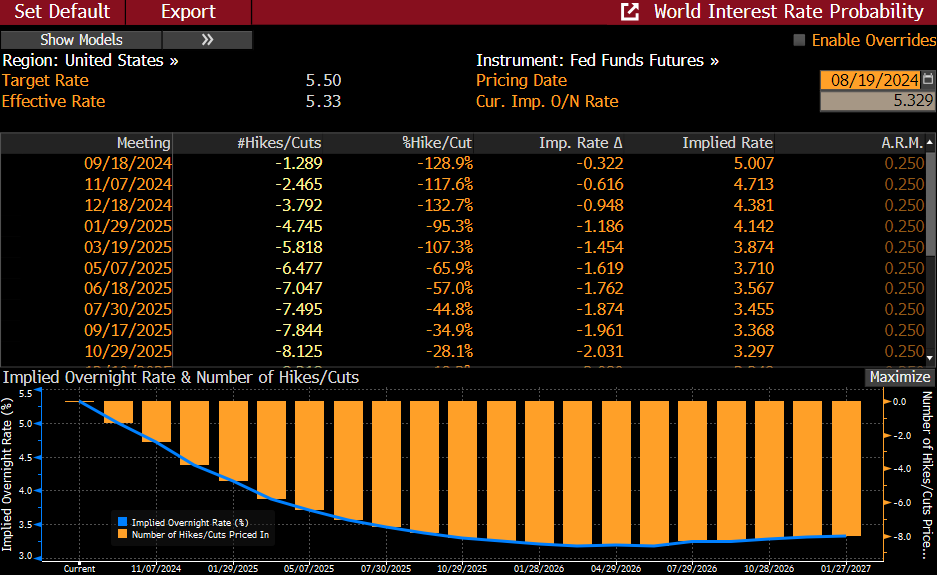

- Powell’s Jackson Hole address is expected to reveal a Fed open to rate cuts in September. Investors will be looking for any clues as to the size and timing, but that may be a bridge too far given the data dependent nature of this Fed that will get August employment and inflation reports before the September 18 FOMC meeting. It’s not Powell’s tendency to promise a decision when important data is still in the offing that could influence the decision. We still see 25bps cuts in September and December, followed by quarterly 25 bps cuts in 2025.

- The address may also touch on the neutral rate (the rate is neither restrictive nor accommodative). He may provide some thoughts that it has drifted higher in the post-pandemic economy, and while we don’t expect him to say something like, “we now believe the neutral rate is 3.00%” it has been edging up in the last two dot plots. The June dot plot had it at 2.75% after being at 2.50% since 2019. It wouldn’t surprise us to see it continue edging higher in future dot plots. It’s an important issue in that it helps to refine estimates of the future path of rate cuts and how low they may go.

- The other Fed communication this week will be Wednesday’s release of the minutes from the July 31 FOMC meeting. While it will be stale, and loses more luster coming just before Jackson Hole, it will provide some insight as to how seriously a July rate cut was discussed. Any discussions around the future of the Quantitative Tightening program will be of interest as well.

- Finally, the BLS will be releasing its annual benchmarking revisions to payroll totals on Wednesday. This comes after the BLS receives more comprehensive payroll data from the Quarterly Census of Employment and Wages report. It’s expected that the adjustment will be downward to payroll totals as analysts believe the birth/death model for businesses has been overstating births. Citi analysts put the payroll reduction in the 500 – 700 thousand range. While that wouldn’t be enough to revive hopes for a 50bps cut, it would be another signal that the labor market is not quite as strong as we thought it was, and to get on with rate cuts.

Futures Market Sees Nearly 100bps in Rate Cuts by Year-End. Seems too Aggressive to Us

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.