February PCE Signals Some Softening in Inflation From January

February PCE Signals Some Softening in Inflation From January

- The markets are closed today for Good Friday but that doesn’t mean the data flow stops. The February Personal Income and Spending Report was released this morning with the all-important PCE inflation series, the Fed’s preferred price measure.

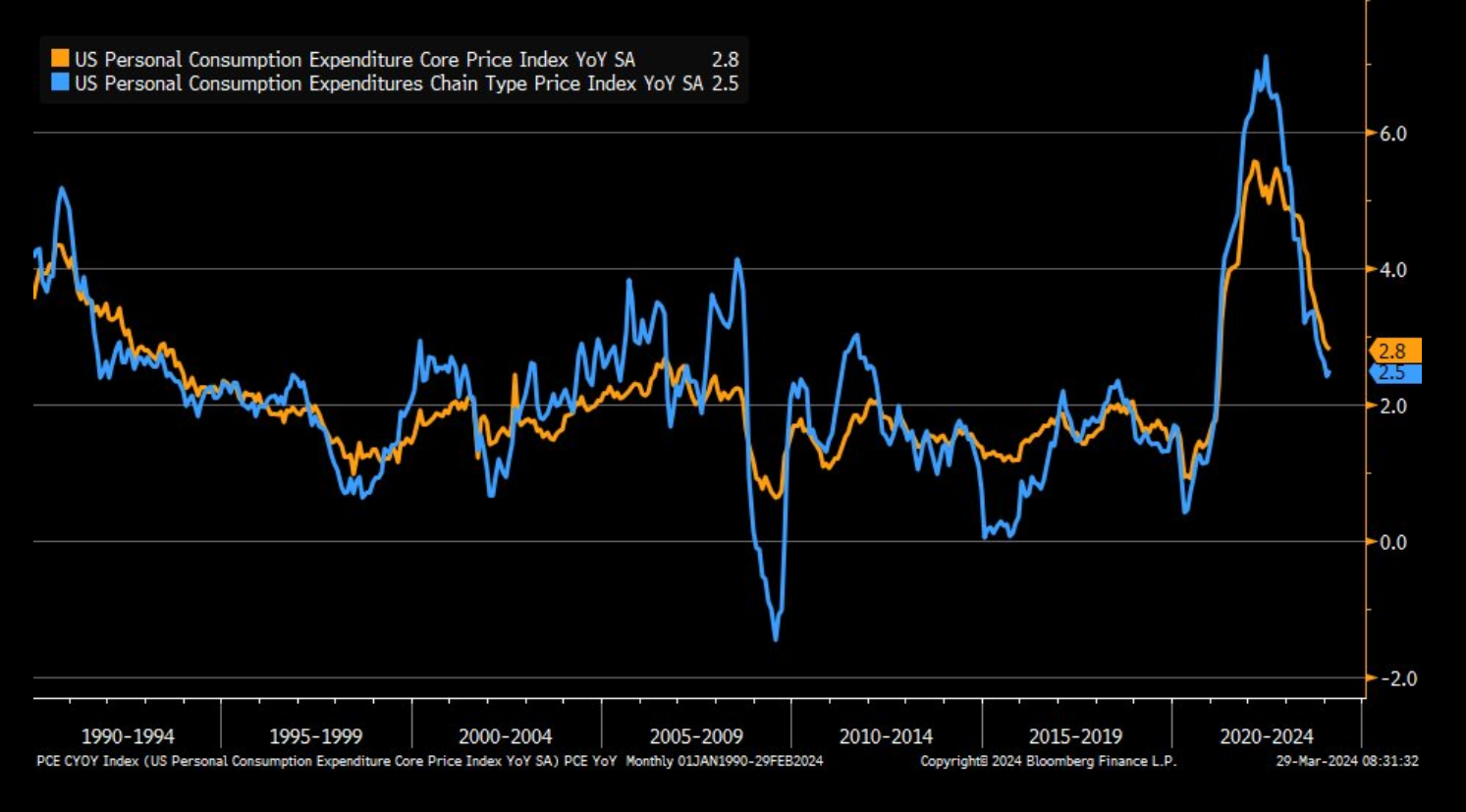

- February PCE inflation rose 0.3% (0.33% unrounded) vs. 0.4% expected and 1.0% in January. Core PCE (ex-food and energy) rose 0.3% (0.26% unrounded) matching expectations and improved from January’s upwardly revised 0.5% print (0.45% unrounded). On a year-over-year basis, overall PCE rose 2.5% which matched expectations but was a tenth higher than the 2.4% pace in January. Core PCE YoY rose 2.8% matching expectations but down from 2.9% in January. It’s the lowest YoY core rate in three years. Also, services prices rose 0.3% (0.256% unrounded) compared to the outsized 0.6% jump in January. That slowing in service-side prices will be welcomed by a Fed concerned about sticky prices in that segment of the economy.

- The spending numbers were positive as well. Recall, February retails sales were disappointing but that report is more goods-based whereas the personal spending figures are more comprehensive, taking in a larger swath of the service-side of the economy, and that’s were the spending gains have been occurring of late. Spending in February rose 0.8%, easily beating expectations of 0.5% and 0.2% in January. That’s the largest spending increase since September. Adjusted for inflation, spending rose 0.4% beating the 0.1% expectation and -0.2% in January. Services consumption increased 0.6% while goods spending rose just 0.1%.The biggest driver of the services-side spending was in international travel and air travel more generally. We’ve noted often this year how TSA boarding levels are consistently ahead of last year which was a return to pre-pandemic levels, and those full planes are showing up in the numbers.

- Personal income rose 0.3% for the month, just under the 0.4% expectation and off from the 1.0% gain in January. The moderation in income gain really comes from a reversal of the heavy dividend payments doled out by Costco in January. Wages and salaries increased 0.7% vs. 0.4% in January. So, while the headline income gain slowed, wages and salaries continue to motor higher. That will keep Fed fears of wage-price spirals front and center.

- These numbers will probably elicit something of a sigh of relief when the markets are able to trade the news on Monday. The continued lowering of the core rate YoY will be appreciated by the Fed. Recall their latest forecast had core PCE at 2.6% at year-end, so two-tenths to go. The moderation in service-side prices will be welcomed, but the continued strength in wage gains will have the Fed on the lookout for wage-price spirals. Call it a mixed to positive report, with some encouraging signs on prices but lingering concern over those wage gains and the potential impact on future inflation.

- Away from PCE but related, we wanted to mention a speech by Fed Governor Christopher Waller on Wednesday where he talked about his outlook for the economy and Fed policy. Recall, Waller had been one of the more hawkish at the Fed, and somewhat of a thought leader, but prior to the December meeting he started to shift his tone to something more moderate, perhaps signaling the change in tone by Powell at the December FOMC meeting where he softened his hawkish rhetoric. On Wednesday, he spoke of the hotter-than-expected inflation numbers so far in 2024, and while Powell appeared sanguine over the inflation rise Waller was more cautious. He spoke about wanting to see a few months of better data before deciding on a rate cut. Well, before the June meeting he’ll get his data with three new inflation and jobs reports. We think on today’s news he would call it a decent beginning but looking for more.

- Programming Note, we’ll be off next week for spring break and will return on Solar Eclipse Monday, April 8th. Until then, enjoy the Easter holiday.

Overall and Core PCE (YoY)

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.