February Jobs Report – Reflects the Gathering Weakness Theme

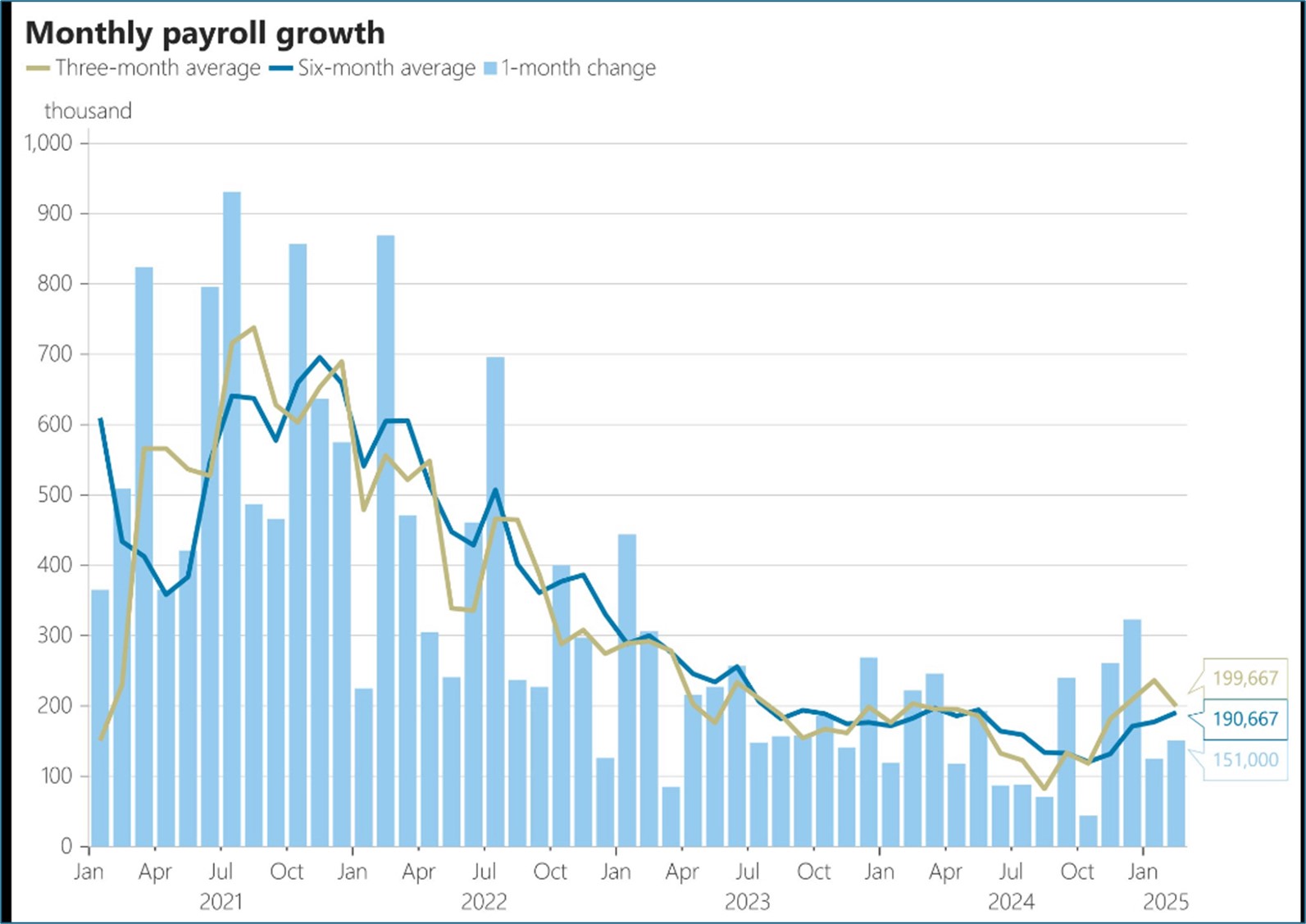

- February nonfarm payrolls rose 151 thousand, missing the 160 thousand expectation and 125 thousand in January (revised down from an initial 143 thousand). December was revised up by 16 thousand jobs bringing the two-month revisions to down 2 thousand. Private sector job growth was modest at 140 thousand which was off the 145 thousand expected but above the downwardly revised 81 thousand in January and ADP’s 77 thousand reported earlier this week. It needs to be noted that once again the monthly revisions are generally to do the downside which has been an ongoing theme for more than a year now. The Household Survey, however, painted a much darker picture (see next bullet point).

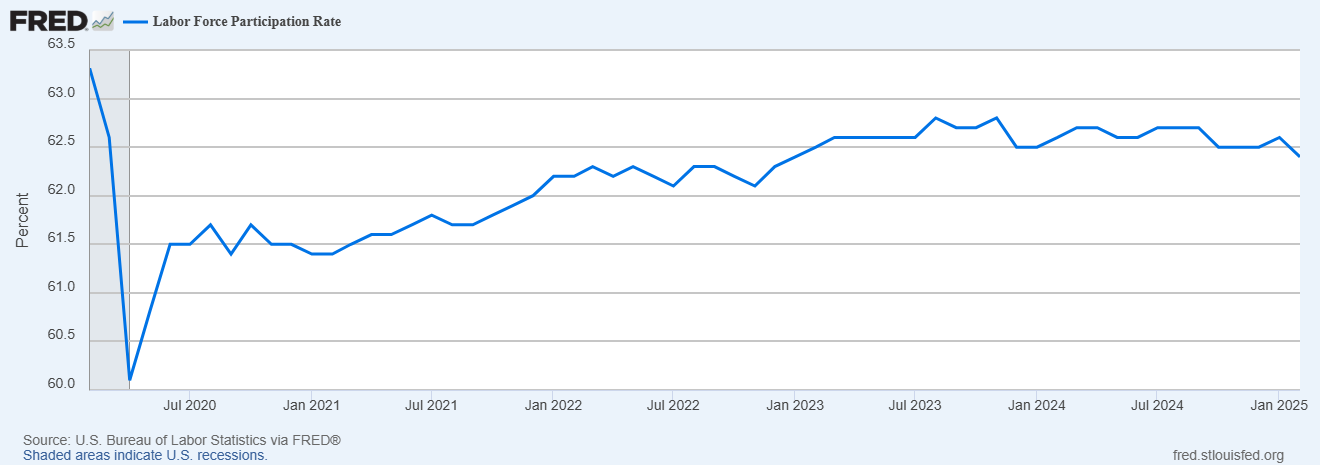

- The Household Survey, which is smaller in size than the Establishment Survey, and then extrapolated across population totals, generates the unemployment rate, labor force participation rate, etc.. The survey reported a reduction of 588 thousand jobs (largest drop since Dec. 2023) and a 203 thousand increase in unemployed persons. Total unemployed increased from 6.462 million a year ago to 7.052 million, an increase of 590 thousand. The survey also reported a 385 thousand decrease in the labor force. With the upward move in unemployed and decrease in the labor force the unemployment rate increased from 4.0% (4.011% unrounded) to 4.1% (4.139% unrounded), above the 4.0% expectation. With the decrease in the labor force, the Labor Force Participation Rate dipped two-tenths to 62.4%, missing the 62.6% expectation and January result. The participation rate has been range bound for quite some time, for instance, it was 62.6% a year ago. However, the two-tenths downward move is a sign that expanding the labor force seems to be frustratingly slow, if nonexistent. That’s probably not surprising given the uptick in deportations and net immigration slowing to a trickle.

- Job gains were strongest in healthcare/social assistance, a perennially strong category, (63k), financial activities (21k), and government (21k), but down from 41k the prior month. Obviously, state and local governments helped offset the federal job losses. Job losses were concentrated in leisure/hospitality (-16k), temporary help (-12k), and retail trade (-6k). It’s easy to see the strength in service sector hiring vs. the goods side of the economy and that is what we’ve been seeing across a host of reports with services really carrying the economy.

- Average Hourly Earnings rose 0.3% (0.% unrounded) MoM, matching the 0.3% expectations, but below the January gain of 0.5% (0.53%unrounded). The year-over-year pace dipped a tenth to 4.0%, missing the 4.1% expectation and January’s 4.1%. After two months of dipping a tenth, average weekly hours have stabilized at 34.1 hours for the second straight and missing the 34.2 expectation. A tenth of an hour may not sound like much but with 163 million full-time workers each tenth of an hour is just over $1 billion in wages. That lower level of hours worked per week will limit earnings which will in turn limit the consumers ability to spend.

- February’s jobs report was expected to rebound a bit from the weather-influenced weaker January report and that’s what happened. However, the gains were limited, and with the survey week around the 12th of the month, the data will be taken as somewhat stale given the fast-moving events in DC. In addition, given the clearly more negative picture provided by the Household Survey, the report can be characterized as adding to the weakening theme, albeit modestly so. Also, given the hyperactivity in the White House, more will be learned about the labor market from the weekly jobless claims series as it will provide a more real-time view of layoffs. That’s only half the picture, however, as the jobless claims numbers provide nothing as to the hiring side of the equation. As long as uncertainty, and a hesitant consumer remain front and center, it’s most likely we’re in for a period of low job growth, at best. Overall, no imminent distress was noted, but the softening will keep hopes and odds of a mid-year rate cut very much in play.

- Shifting gears, in the week ending March 1, the initial jobless claims totaled 221 thousand, a decrease of 21 thousand from the previous week’s unrevised level of 242 thousand. The continuing claims figure for the week ending February 22 was 1.897 million, an increase of 42 thousand from the previous week’s revised level of 1.855 million. The 4-week moving average was 1.866 ,million. With the DOGE job-cutting hatchet swinging at federal jobs, the initial claims for UI benefits filed by former Federal civilian employees totaled 1,634 in the week ending February 22, an increase of 1,020 from the prior week. So, a sizeable uptick in federal unemployment, but still not significant in the scope of the entire workforce. Until we start to see the jobless claims numbers rise closer to 300 thousand, we can still say that the employers are resisting the urge to fire and layoff existing employees.

- The ISM’s Services Index surprisingly advanced to 53.5 from 52.8 a month earlier. Expectations were for a slight dip to 52.5, with fears it could sliden below 50, signaling a contracting sector. In addition, the index of services employment climbed for a third month to 53.9, the highest since December 2021. A measure of costs paid for materials and services increased to one of the firmest readings since early 2023, underscoring the challenge Federal Reserve policymakers face as they look to further tamp down inflationary pressures. The survey showed orders growth accelerated in February, while another gauge showed order backlogs expanded by the most since July 2023. In all, this report refuted an earlier S&P Global Services PMI that initially had the sector contracting. Given the service-side of the economy has driven the expansion for the past year, the rebound noted in Thursday’s ISM report will allay some of the concerns that growth is slowing rapidly. While growth may be slowing, it seems like it’s not slowing dramatically and that will ease concerns with the Fed, and avoiding the need for a rate cut soon.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.