Equity Profit-Taking Pushes Treasury Yields Lower

- Treasury yields are heading lower in this thinly traded market as profit-taking continues in the big Tech winners of 2024, and that has equity futures under pressure once again. With a limited data calendar, and no Fed speak, it will be the price action itself across equities that drive Treasuries. That said, with light staffing levels and year-end trades being wrapped up, don’t read too much into the price movements. Currently, the 10yr Treasury is yielding 4.56%, down 7bp on the day, while the 2yr is yielding 4.27%, down 6bp from Friday’s close.

- Just like last week, with the New Year holiday falling on Wednesday, this week is limited on new data, and the information we do receive will continue to be assimilated by a limited audience. Fed speak doesn’t return until next week, and even then, that will be light.

- As for what we will see this week it will be housing-related prior to Wednesday, then the usual first week of the month data starting with ISM Manufacturing on Friday. December Nonfarm Payrolls will not be released until Friday, January 10th, which provides another reason to ponder, “why am I even in here this week?”

- Later this morning we’ll get Pending Home Sales for November with sales expected to increase 0.8% vs. 2.0% in October. On a YoY basis, sales are expected to increase 7.9% vs. 6.6% the prior month. Pending sales are one of the few housing series based on contract signings and not closings so it provides a more real-time look at housing market activity and the possible effects of higher mortgage rates that transpired during October and much of November.

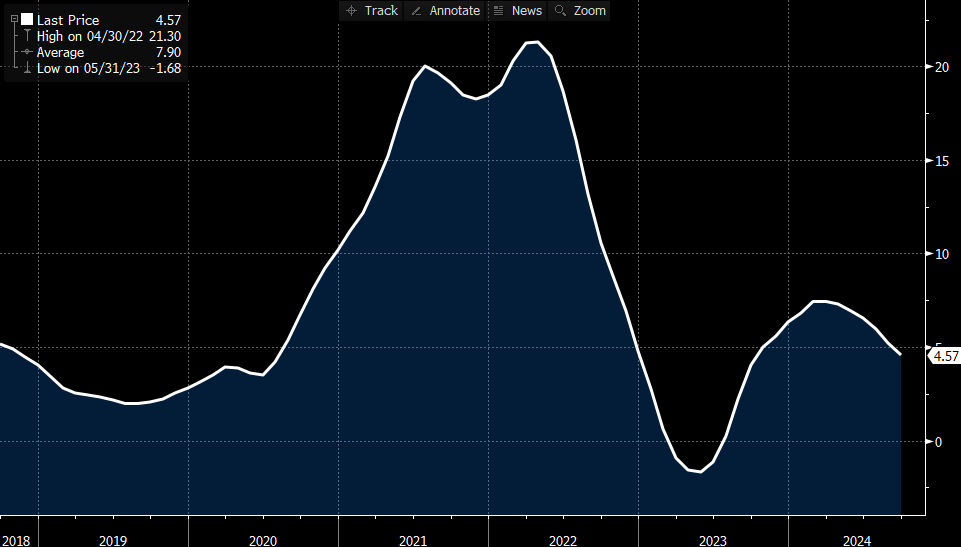

- Tomorrow, it will be the S&PCoreLogic CS 20-City Home Price Index (YoY). Expectations are that home prices in that group rose 4.10% in October vs. 4.57% in September. Keep in mind this index is a three-month rolling average, so the October results contain data back to August, so it does add to the lagging nature of the index, but it no surprise that the YoY price gains have been trending lower in the face of Fed rate hikes and previous double-digit price gains (see graph below).

- On Friday, the ISM Manufacturing Index for December is expected to remain in contractionary territory at 48.2 vs. 48.4 in November. The Prices Paid Index is expected to tick higher from 50.3 to 51.8. The Services Index is due next Tuesday with decent expansion expected once again in that sector.

- Looking ahead, the December Employment Report is expected to see 153 thousand new jobs vs. 227 thousand in November with the unemployment rate remaining unchanged at 4.2%. If expectations come to pass, the solid results will make the Fed’s likely decision to pause in January an easy one.

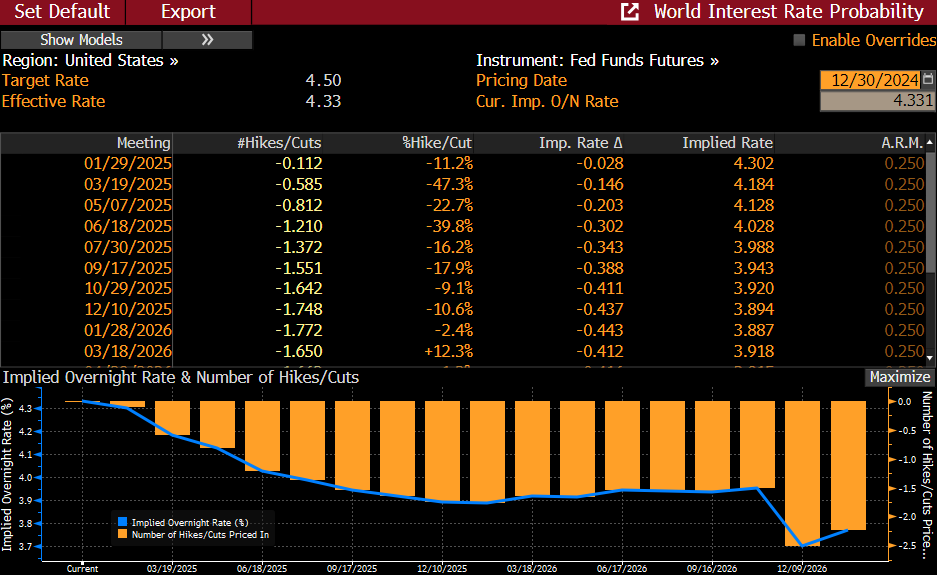

Fed Funds Futures: Still Seeing Next Rate Cut in June 2025 & Only 44bps in Cuts for all of 2025

Source: Bloomberg

30Yr Mortgage Rates Remain Volatile but Back Solidly in the 7+% Range Source: Bloomberg

Source: Bloomberg

S&P CoreLogic CS 20-City Annual Home Price Appreciation – Can You Spot Where the Fed Started Hiking Rates?

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.