Easing Political Strife and Solid Labor Market Data Keeps Pressure on Treasuries

- Treasury yields are higher this morning as some easing in the Korean political drama and decent labor market data so far this week, is putting pressure on Treasuries across the curve. The ISM Services Index remains to be seen at 10ET, so there is still a possibility for additional volatility (more on that below). Currently, the 10yr Treasury is yielding 4.27%, up 4bps on the day, while the 2yr is yielding 4.19%, up 1bp on the day.

- The short-lived martial law order in South Korea is over and investors are taking a sigh of relief, but talks are building for an impeachment hearing against President Yoon for his actions. So, the drama still has at least another act to play. Moving center stage in world political dramas is France where the French Parliament is expected to vote to dissolve the current government. Prime Minister Michel Barnier’s austerity budget proposal has the disparate factions that make up a working majority at odds with him and in some cases with other coalition members.

- It’s likely that should the no-confidence vote succeed (a simple majority of the 574-seat parliament is needed), it would fall to President Macron to appoint a new prime minister to lead the fractured government, but voting there can’t be held until July 2025, so the dysfunctional parliament would continue until that time. President Macron’s term runs to 2027, and he says he intends to fulfill his term. French bond yields have risen with the turmoil, but the fallout has been modest given Macron remains above the fray, for now. The unsettled nature of today’s action, however, will be another source of uncertainty as we head into 2025.

- This morning, ADP released their November Employment Change report finding 146 thousand private sector jobs vs. 184 thousand in October (revised down from an initially reported 233 thousand). The Bloomberg consensus was for 150 thousand jobs, so close to expectations. Education, health care and construction led the job gains. As for wage growth, job-stayers saw annual pay increase 4.8%, the first acceleration in two years, while job-changers saw pay increase 7.2% (see graph below). The BLS expectation for private sector jobs on Friday is 203 thousand vs. a drop of 28 thousand jobs in the hurricane-riddled October. So, another decent-to-solid report that doesn’t hint at deterioration in the labor market.

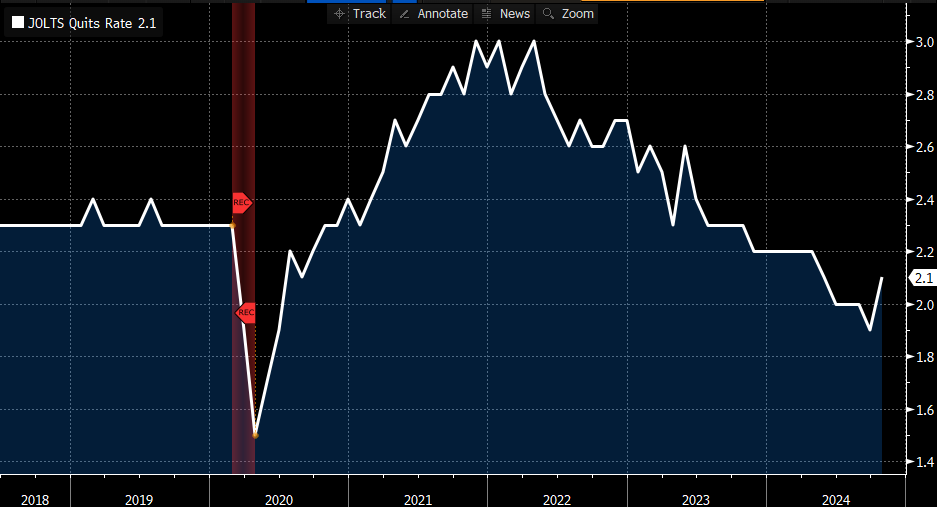

- In that same line of thinking, yesterday’s October Job Openings and Labor Turnover Survey (JOLTS) was positive with better openings than expected (7.744 million openings vs. 7.372 million in September). The Quits Rate also rose from 1.9% to 2.1% indicating a bit more confidence on the part of workers in leaving a job in search of another. That move higher puts it closer to the 2.3% pre-pandemic level and is another sign that the slowing in labor market momentum may be over for the time being. That will be welcomed by the Fed and plays into a first-of-year pause in the rate-cutting program.

- Later this morning the consequential ISM Services Index for November will be released. As we’ve noted for a while, the services-side has carried the economic ball with effectiveness and that is expected to continue with the Bloomberg consensus forecast at 55.7 vs. 56.0 the prior month and remaining well above the 50 dividing-line of expansion vs. contraction. Just as in the manufacturing index, the prices paid, employment and new orders metrics will be important in assessing inflationary pressures, future activity, and the jobs outlook in the services economy.

ADP Employment Report – Job-Stayers See the First YoY Wage Increase in Two Years

Source: Bloomberg

JOLTS Quits Rate – Rebounds to 2.1% (of Total Employed) but Still Trails Pre-Pandemic 2.3% Rate

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.