Early Risk-On Tone has Treasury Yields Higher

- Treasury yields are lifting higher on the news that the April 2nd reciprocal tariffs may be more surgical in nature and not the broad-based salvo that some had feared. That has the market in a tentative risk-on tone as a consequence. We’ll see how that survives the day. Currently, the 10yr Treasury is yielding 4.30%, up 5bps on the day, while the 2yr is yielding 4.00%, also up 5bps on the day.

- This week will be frustratingly lean on first tier “hard” economic data, and what we do receive will have to wait till Friday. That means more focus on tape bombs from DC and the upcoming April 2nd “Liberation Day” as reciprocal tariffs are scheduled to take effect. The latest word is that they will be more surgical in nature which has risk assets rallying on the hope that the worst of the possible tariff scenarios is once again delayed.

- While new economic data is scarce this week, Friday’s Personal Income and Spending Report for February will round out the inflation reports for that month. Given the results of CPI/PPI/Import/Export prices, it’s estimated that core PCE will print a “high” 0.3% or even 0.4% which would be hotter than the core CPI print and a 0.3% print would mirror the January result. If that comes to pass it will certainly play into the patient pause approach that the Fed articulated at last week’s meeting.

- Despite a potentially higher read on inflation than most would like, we take some solace in the fact that the Fed just held with two rate cuts in their median forecast for 2025 despite projecting core PCE increasing to 2.8% by year-end compared to the December forecast of 2.5%. Thus, the Fed seems to be accepting that with the increased cost potential of tariffs, they are willing to look past that if the economy weakens. Thus, it seems the Fed is prioritizing growth over inflation, at least for the time being.

- Speaking of growth, in addition to the PCE inflation numbers in Friday’s report, we’ll be attuned to the personal spending numbers as well. Recall, retail sales in January were weak, and not much better in February. The Friday numbers are more comprehensive and adjusted for inflation, so they provide a better look at the all-important consumer. Expectations are that personal spending increases 0.6% vs. -0.2% in January, so a nice rebound is expected.

- Some more reports of note this week will be today’s preliminary S&P Global PMI series. Recall, it was this series that initially printed a sub-50 services number for February, but it was subsequently revised to 51.0. We’ll see where that figure lands this morning at 9:45 ET. Tomorrow brings the latest Conference Board’s Consumer Confidence numbers. In addition to the headline confidence reading, we’ll get its present and expected situations readings, not to mention the labor differential (jobs plentiful minus jobs-hard-to-get). All of those will be important “soft” reads on consumer confidence and labor market outlook. The preliminary read on durable goods orders for February will arrive on Wednesday which will give us a view of the capital goods side of the economy. The third and final estimate of fourth quarter GDP will headline Thursday’s numbers (save for the now topical weekly read on initial jobless claims). GDP is expected to increase two-tenths from the prior estimate to 2.5%.

- It seems pretty evident at this point that one of Treasury Secretary Scott Bessent’s top goals this year is to drive the 10-year note yield lower. In speeches, in interviews, week after week, he states and restates the administration’s plan to push them down and keep them down. Some of this is normal — keeping government borrowing costs in check has long been part of the job — but Bessent’s fixation on the benchmark US note is so intense that he’s forced some on Wall Street to tear up their predictions for 2025. In the past couple weeks, chief rates strategists at Barclays, Royal Bank of Canada and Societe Generale have cut their year-end forecasts for 10-year yields. In part, they said, it’s because of Bessent’s campaign to drive them lower. It’s not just the jawboning, they added, but the fact that Bessent can follow it up with concrete action like limiting the size of 10-year debt auctions. The obvious beneficiary are cheaper mortgage loans, not to mention cheaper financing costs to the U.S. Treasury

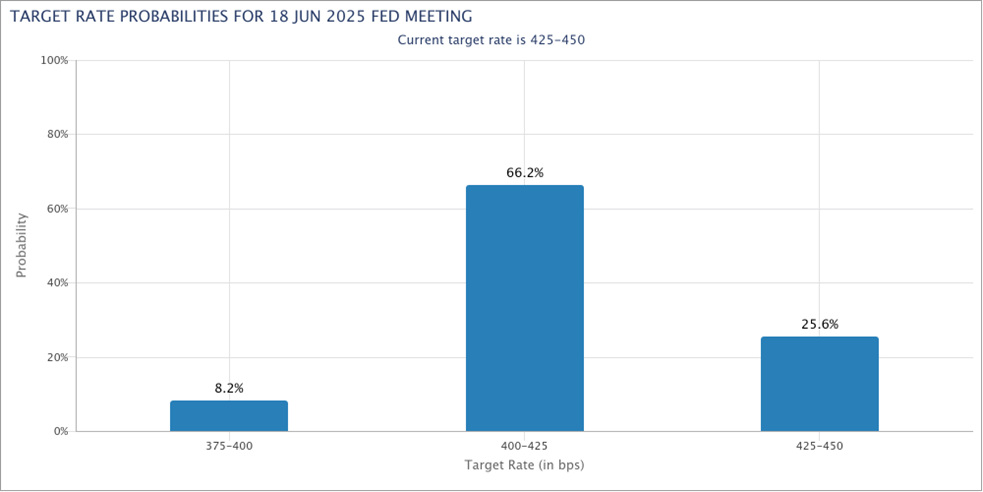

Futures Still Point to June for First Rate Cut

Source: CME

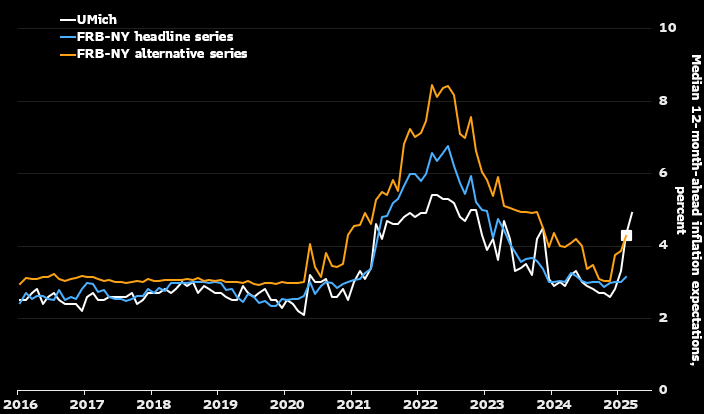

UMich. and FRB-NY 12-Month Inflation Expectations Reflect Tariff Price Fears

Source: Bloomberg

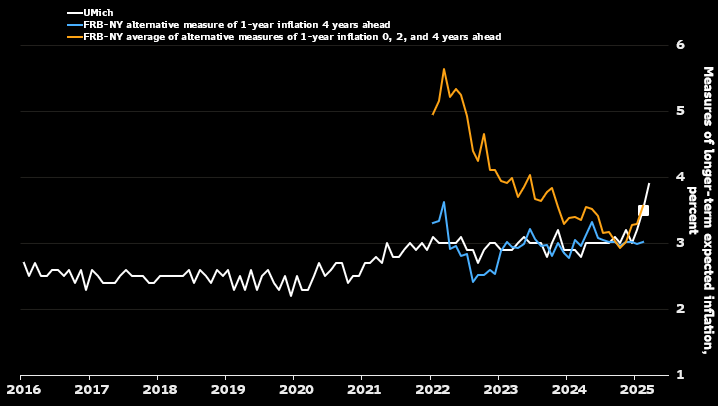

Longer Term Inflation Expectations – FRB-NY Measure Better Behaved vs. UMich

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.