Dovish Fed Comments Spark Treasury Rally

Dovish Fed Comments Spark Treasury Rally

- Investors liked what they heard yesterday from the Fed, particularly Fed Governor Christopher Waller (more on that below). Those good feelings that rate cuts could be coming earlier in 2024 than previously thought continue to reverberate this morning, along with an upwardly revised 3rd quarter GDP estimate that saw lower core inflation than previously estimated. Presently, the 10yr Treasury is yielding 4.26% and the 2yr 4.64%.

- Fed speak returned this week and with five speakers yesterday alone there were bound to be some headlines made. Fed Governor Michelle Bowman reiterated her familiar refrain that one more hike would probably necessary. Typically that would prompt some selling but her comments were largely ignored as they were preceded by Fed Governor Christopher Waller. With the departure of former St. Louis Fed President James Bullard, Waller has assumed something of a leadership role in the hawkish contingent, and that seemed natural with his St. Louis Fed pedigree. His comments yesterday, however, were definitely not hawkish but rather on the dovish side. He mentioned that with progress on both the inflation front and some slowing in job growth the next move could be a rate cut. That sent yields lower, especially on the short-end, and increased odds of rate cuts as early as March. Plenty of Fed speak remains this week with Powell scheduled to appear on Friday, so we’ll see if any pushback comes from the Chairman.

- Trying to ascertain the state of the consumer is central in determining the course of the economy and it’s getting quite tricky to draw firm conclusions. Despite numerous consumer polls showing the consumer is quite sour on the economy, and struggling with inflation, early results from Black Friday and Cyber Monday were mostly strong. In addition, the TSA reported that Sunday set a new record for air travelers, eclipsing the 2019 level. Then there is the news that car loan delinquencies hit a decade high and the one area showing increasing credit demand was for extension of credit card borrowing limits. So despite, proclaiming economic angst, the consumer continues to spend in a healthy manner despite some stresses starting to appear. In that regard, while the inflation numbers from tomorrow’s Personal Income and Spending Report will get most of the attention, the spending component in the report is expected to see some slowing after the consumer stepped up strong in September. Sales are expected to slow from a 0.7% MoM gain to 0.2%, but that would still represent a gain after the strong September results, so not exactly indicating the consumer is sheltering in place awaiting a recession

- As mentioned above, tomorrow’s Personal Income and Spending Report for October will be mostly about the inflation numbers. Overall PCE is expected to increase just 0.1% MoM vs. 0.4% in September while the YoY rate slows to 3.1% vs. 3.4% in September. Core PCE is expected to increase 0.2% MoM vs. 0.3% in September with the YoY pace slowing to 3.5% vs. 3.7% the prior month. If expectations are met the YoY core rate will be the lowest since April 2021 and below the Fed’s year-end 3.7% forecast. So, a favorable read on inflation is expected but keep in mind the Fed will get November CPI numbers just before the December FOMC meeting. That will be the last read on inflation, but for now a pause remains the prohibitive favorite as we close in on the meeting.

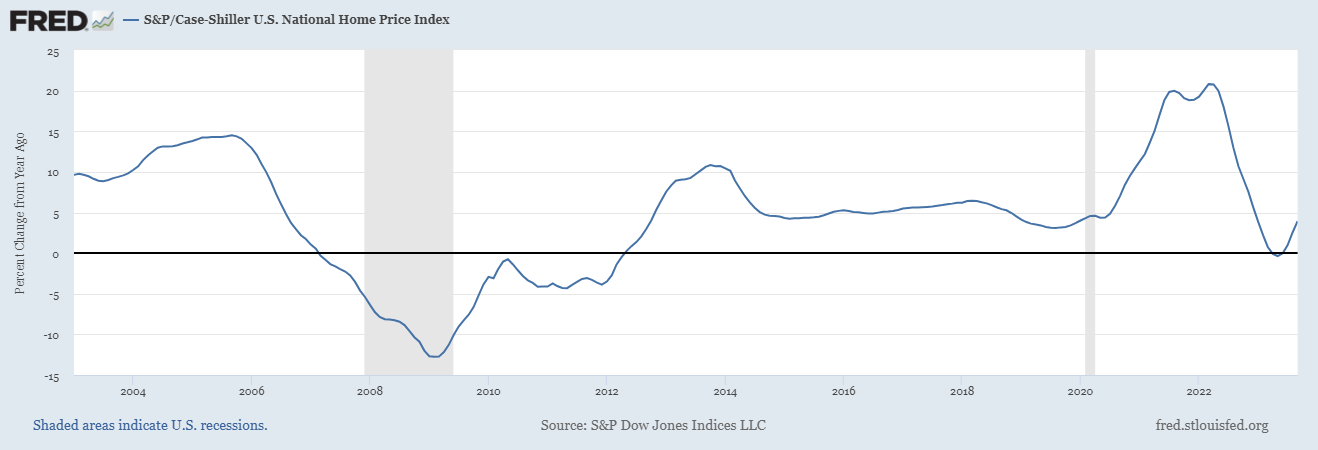

- We’ve received some housing data this week and while at first it may have seemed to be conflicting, it probably tells a deeper story. On Monday, new home sales for October disappointed as sales activity slowed. Altogether that’s not too surprising given the increase in mortgage rates, but with builders able to buydown those rates it had been one pocket of strength in the housing market. The report also showed that the average selling price fell 10% YoY. That doesn’t mean builders were cutting prices but rather home buyers were trading down to less expensive homes in order to make the numbers fit the family budget. That trading down phenomena may explain some of the sour mood that consumers proclaim about the economy. Meanwhile, yesterday’s S&P CoreLogic 20-City Home Price Index saw a YoY gain of 3.9%. That’s certainly well off the double-digit gains from 2022 but it does seem to show that a bottom has developed in the slowing in home appreciation (see graph below).

- Finally, the Fed’s Beige Book on economic conditions across the 12 Fed districts was released today and for the first time in the hiking cycle it found the economy to have weakened since the last review six weeks ago. The report, prepared this time by the Atlanta Fed, will form the basis for the Fed staff’s economic discussion for the December 13 FOMC meeting. Sales of discretionary items and goods were noticeably softer but travel-related expenditures continued without much slowing. While certainly not a recession call, the first report to note the economy weakening will play well with the pause scenario for December and likely into 2024.

- Programming Note: We will be away tomorrow and Friday so the next Market Update will be Monday, December 4th.

Looks Like the Slowdown in YoY Home Price Appreciation has Bottomed

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.