Doves Take Flight at Jackson Hole

Doves Take Flight at Jackson Hole

- The Treasury market is trading in the afterglow of Powell’s dovish pivot at Jackson Hole, and with another week of limited data it should be a rather range bound week. We talk more about the Jackson Hole revelations below but suffice it to say the rate-cutting cycle will begin in September with every meeting thereafter “live” for further cuts. Currently, the 10yr is yielding 3.79% down 1bp on the day, while the 2yr is yielding 3.90%, down 2bps on the day.

- Most Jackson Hole addresses by the Fed Chair are consequential but sometimes they are not. Put Friday’s address firmly in the former category. Powell’s keynote speech unambiguously dovish and opened the door wide to a rate cut in September with more to follow. Our number one take from the address was the concern over the labor market and “not wanting any more cooling” there. In combination with that, Powell said he had greater confidence that inflation was trending to their 2% target. Thus, it’s clear that the full employment mandate has moved into the starting lineup after sitting on the bench for the last two-plus years as it regards policy decision-making.

- Back in June we had forecast rate cuts beginning in September at 25bps and following at every quarter end meeting with year-end 2025 funds at 4.00%. Given Powell’s increased labor market concerns, we now think every meeting will be “live” rather than just quarter-end meetings. We also think they would rather stick with 25bps moves, but that could be bumped to 50bps if labor market weakness looks to be accelerating. As far as September is concerned, the Fed will see the August employment report next week and that will be key in determining whether it’s 25bps or 50bps. If the report is as weak as July, and July is not revised higher, then it could tilt the scale towards 50bps.

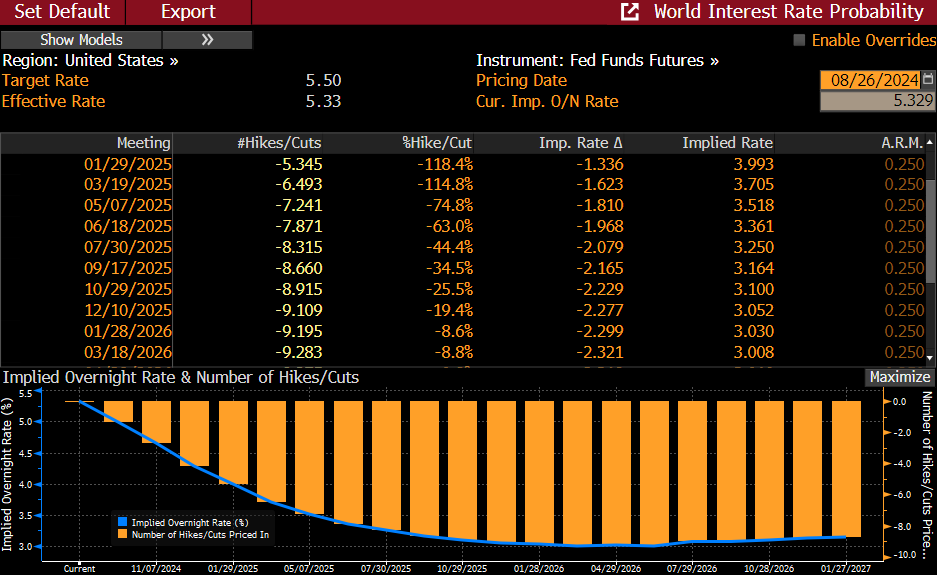

- We think, however, there were some one-off weather-related issues in July that may provide the basis for a better August report and/or upward adjustments to July such that we are still in the 25bps camp, but we’re ready to move to higher ground if need be. The futures market still sees 100bps of cuts by year-end implying a move at the three remaining 2024 meetings with one being a 50bps cut. The futures market also sees another 125bps in cuts next year bringing the funds rate to 3.00% by December 2025. Interestingly, many analysts are contemplating the new neutral rate to be around 3.00%, so it’s probably not a bad target to shoot for over the next fifteen months.

- On Friday afternoon Joe Keating and I recorded a podcast where we discussed in more detail what we learned from Powell on Friday and what that may mean for yields and the economy. Once the episode drops, I’ll provide the links to everyone. Hopefully, you and your clients will find it entertaining and informative.

- The incoming data this week is again on the light side with Preliminary Durable Goods Orders for July already out this morning and outside of strong aircraft orders it was a somewhat disappointing read compared to expectations and June’s numbers were revised lower. Apart from that, the July PCE inflation numbers will be released Friday, along with personal income and spending figures. With CPI, PPI, and import/export prices already in hand the potential for a surprise inflation print is low. The expectation is core PCE will increase 0.2%, same as June, with the YoY rate ticking up a tenth to 2.7% vs. 2.6%. The focus will be, however, on that second decimal place and whether it’s a “high” 0.2% or a “low” 0.2%. Given Powell’s Jackson Hole comments about increasing inflation confidence, it would take a real miss to upset the rate-cutting apple cart, and with all the other inflation data in hand a surprise of that magnitude will be unlikely. Hopefully, those aren’t famous last words.

Futures Market Sees 100bps of Rate Cuts This Year and 125bps Next Year

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.