Don’t Count on a Slowing Economy Just Yet

Don’t Count on a Slowing Economy Just Yet

- Treasury yields are a bit higher this morning after a better-than-expected preliminary durable goods report for April and that follows a better-than-expected S&P May PMI report yesterday. So, as questions return as to whether the economy is really slowing, yields find themselves on the back front as an early close (2PM ET) and a long weekend beckons. Investors will return next week to confront the last April inflation report with the PCE series on Friday. Investors are hopeful of a 0.2% MoM print after a trio of 0.4% results in the first quarter. Currently, the 10yr note is yielding 4.49%, up 1bp on the day while the 2yr is yielding 4.95%, up 2bps in yield.

- The FOMC Minutes from the May 1st meeting, released on Wednesday, were expected to be hawkish, and they did not disappoint. However, they may have been past the sell-by-date coming after the friendlier April CPI and retail sales reports. What was perhaps a bit surprising was the number of officials that opined they wouldn’t hesitate to raise rates if necessary. Now that may have gone without saying but the fact that it wasn’t is one thing, but then to have Powell in the press conference speak of not considering rate hikes is certainly taking the dovish side of that discussion.

- What’s perhaps a bit surprising, as well, is that with the softer April CPI report, and weak retail sales numbers, the Fed speak this week continued to be unrelentingly hawkish. This has investors now thinking it doesn’t behoove the Fed to soften their tone until rate cuts are imminent. Why loosen financial conditions prematurely with softer rhetoric when the 2% inflation target remains distant? It does make some sense, but if investors are getting wise to the tactic does it not lose some of its effectiveness?

- Given the fact that second half 2024 inflation base effects will be much less favorable than the first quarter, and with sticky services inflation and still-elevated OER, it may well be a tough slog to get from 3% to 2%, so why jump the gun to a softer, gentler tone? That is, until the changing the goalpost discussion starts. We say that only partially in jest.

- In other news, new home sales for April disappointed just as existing home sales the day before. Sales for both categories were down sequentially and against expectations. The lack of inventory, which is keeping prices elevated, along with higher mortgage rates are making affordability a real challenge, especially for first-time buyers. This is where higher-for-longer is exacerbating inflation from elevated home prices due to the limited inventory, not to mention its impact on mortgage rates.

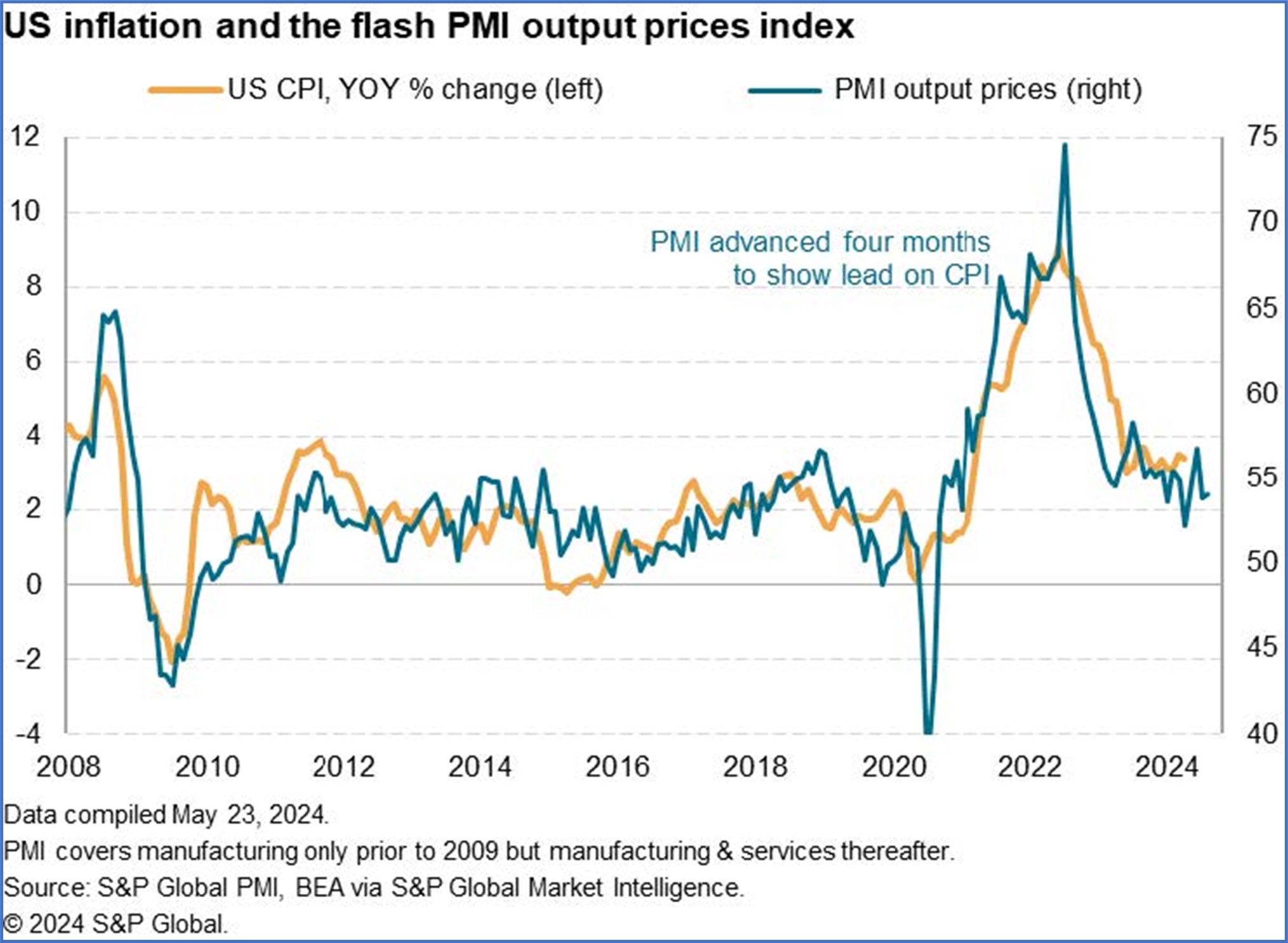

- Yesterday’s S&P Global Preliminary PMI figures for May were expected to be relatively unchanged from April but they surprised to the upside. The manufacturing sector rose to 52.4 vs. 49.9 expected and 50.0 in April. That’s a two-month high. The services side did even better, rising from 51.3 to 54.8 in May and 51.2 expected. That’s the highest services print in a year. The composite reading rose to 54.4 vs. 51.3 in April and 51.0 expected. That’s the highest reading in two years!

- The employment component, however, declined a bit as manufacturing gains failed to offset some shedding in the services side. Prices paid rose by the second highest in the last eight months, with most of that coming from the manufacturing side. The inflation rate across both manufacturing and services is higher than pre-pandemic levels but it’s down from the pace recorded over the past year. You take your victories where you can. In any event, the reports certainly don’t paint a picture of a slowing economy, and that will only feed the higher-for-longer beast.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.