Do Three Hot Inflation Reports Constitute a Trend?

Well, That Escalated Quickly

- Another hot inflation report in 2024 has Treasury yields moving to new year-to-date highs as thoughts of a June rate cut, and multiple 2024 cuts, get dialed way back. We delve deeper into the CPI numbers below and while we could wave off some of the worst, it will still present a rethink to the Fed’s recent forecasts for rate cuts and inflation expectations from the March meeting. Currently, the 10yr is yielding 4.50%, down over a point in price while the 2yr is yielding 4.96%, down 13/32nds on the day.

- When does a one-off morph into a trend? Well, three months of disappointing (read: hotter-than-expected) CPI reports could certainly fit that category. March CPI came in above expectations both on the overall and core and the details don’t offer much relief either.

- Overall CPI rose 0.4% (0.378% unrounded) which matched February but missed the 0.3% expectation. The core rate (ex-food and energy) followed suit increasing 0.4% (0.359% unrounded) which also matched February (0.358% unrounded) but was above the 0.3% expectation. Due to challenging base effects (0.1% from March 2023 rolled off the annual calculations) the YoY rate increased from 3.2% to 3.5%. That’s the highest YoY rate since September.

- Unlike the overall rate, core CPI YoY remained at 3.8% but was expected to dip to 3.7%. Base effects were more friendly to core as a 0.3% March 2023 rate rolled off. The next two months will see a 0.5% and 0.4% roll off, so that implies some improve will come in the YoY before June, but it will still be a long distance from a 2-handle, not to mention the 2.0% target. It’s safe to say, after three straight months of 0.4% MoM core prints in 2024, improvement in inflation is slowing, if not stalling.

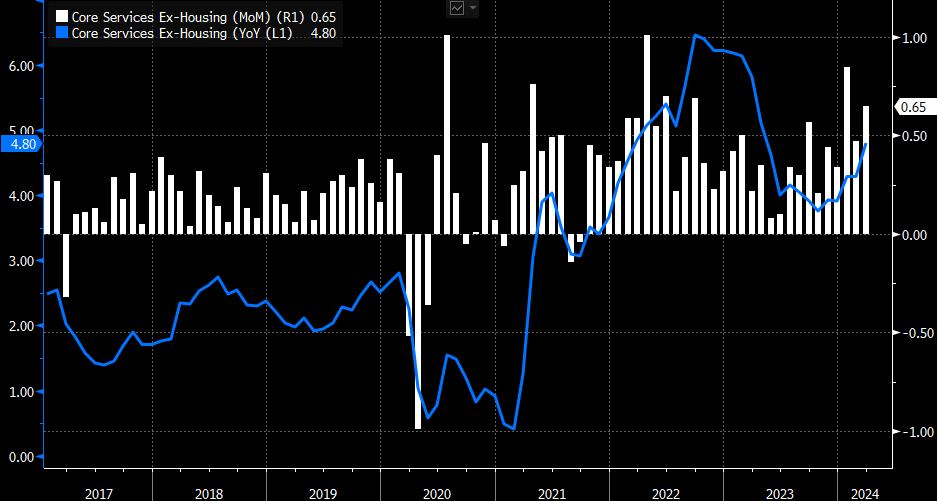

- The bad news doesn’t stop there. The super core services reading (core services ex-housing) rebounded from a 0.47% MoM print in February to 0.65% in March. So, after the second half of 2023 provided mostly 0.3% to 0.4% prints, we’re back to 0.5% and higher and that’s not a recipe for improving core numbers. Service-side demand remains strong and while wage gains have moderated some the 4.1% YoY pace in wage increases is well above the 3.0% long-term average, and so the wage-push spiral discussion will gather steam once again (see graph below).

- What’s interesting in today’s report is that the usual suspects, like owner’s equivalent rent (OER), didn’t drive the higher rate. OER rose 0.4%, same as February and down from 0.6% in January. Food rose only 0.1% vs. 0.4% in January. So, the food category that was a big story in the early days of the inflation saga appears to be falling into line. New and used cars also decreased in price in March vs. February. Air fares too declined in March after popping 3.6% in February. Medical care services, however, at nearly 8% of the index, rose 0.6% vs. -0.1% in February. The increase was driven by a 1.2% increase in health insurance. That category, however, is notoriously volatile and the methodology used to calculate it is convoluted to the eyes of a non-statistician. It involves margins and profits at health insurers and was a tailwind for inflation a year ago. So, we’ll be careful not to imply too much about it going forward.

- On net, the numbers are the numbers and trying to explain away three months of hotter-than-expected reports is a fool’s errand. The bigger issue in our eyes is the ongoing strength in core services. Some of that is from the health insurance category mentioned above, but it’s also being fed by consumer demand for services and the new jobs and wage gains that are being generated by that demand. That doesn’t seem to be going away anytime soon. That “stickiness” has been and will be a concern at the Fed and will knock back thoughts of multiple cuts this year. We’re also disappointed that OER, while well off 2023 highs, is declining but very slowly. Ultimately, we’re getting more comfortable with the Bostic-scenario of a late year (think fourth quarter) rate cut then a period of watching and waiting.

Core Services Ex-Housing – Disappointing Increase in March

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.