DeepSeek Causing Deep Tech Losses

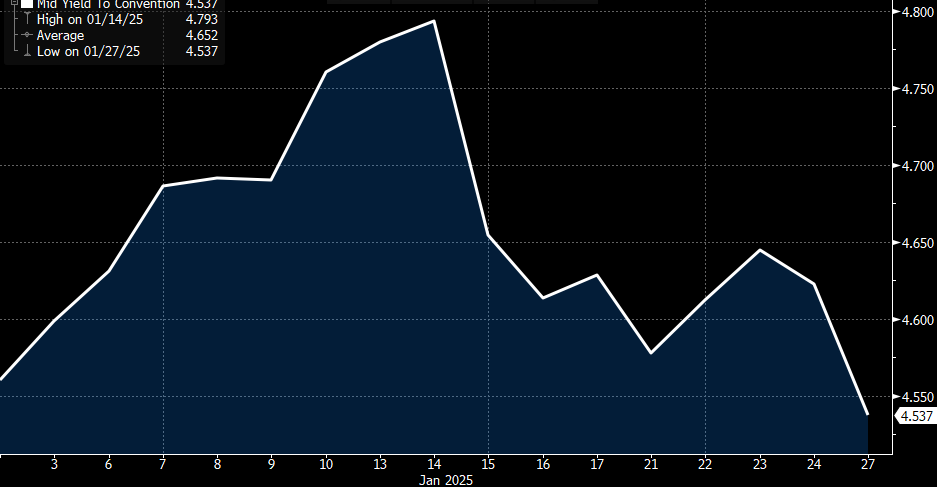

- Treasury yields are down big this morning as a Chinese startup in the AI business has roiled the industry and raised questions about America’s lead in this cutting- edge technology. That has tech stocks taking major hits with Treasuries the beneficiary of the equity selling (more on that below). Currently, the 10yr Treasury is yielding 4.54%, down 12bps on the day, and basically back to where it started the year, while the 2yr is yielding 4.20% down 7bps on the day.

- Is it a better mousetrap? That’s what the market is trying to figure out this morning as news that Chinese AI-startup DeepSeek has an AI alternative that uses less computing power, and expensive chips, to achieve similar results to ChatGBT and other American-made AI offerings. It’s the number one download at Apple and it’s throwing into question whether all the expensive, hi-tech chips and hardware involved in American AI are necessary. It’s put pressure on all the tech darlings associated with AI like Nvidia, Broadcom and many others. The NASDAQ is indicated lower by 3.5% but that’s improved from the 5% loss earlier in the morning. All this will take time to shake out but for now it’s shoot first, ask questions later and that has lent a strong bid to Treasuries as the week opens.

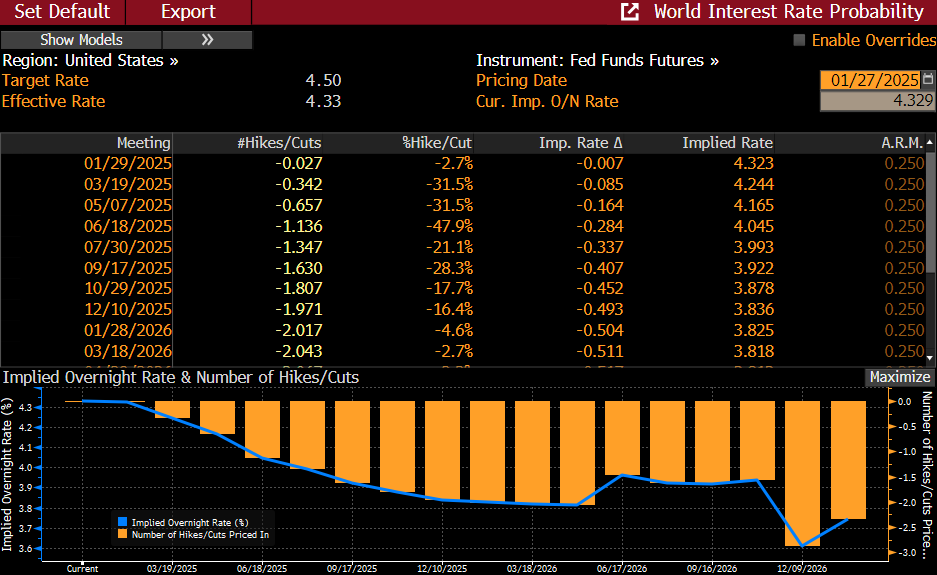

- Away from the turmoil in tech, it is Fed Week with the Wednesday rate decision expected to elicit the first pause since the Fed embarked on rate cuts back in September. The biggest event coming from the meeting will be the Powell press conference where he’s likely to be asked about Trump’s recent comments about knowing interest rates better than the Fed. While we expect he’ll swat away all questions regarding comments from the new administration, it will add some intrigue, at least, to what could otherwise be a rather boring affair. With no economic or rate update this month, the March 19th meeting holds more promise for better insight on the Fed’s future path for rate cuts, not to mention more time to assess policy actions and reactions from the Trump White House.

- The biggest report to be released this week will be Thursday’s first look at fourth quarter GDP with 2.7% annualized growth expected vs. 3.1% in the third quarter. Personal consumption is once again expected to be the driver of growth with 3.2% growth in consumption expected vs. 3.7% in the prior quarter. On the inflation front, the quarterly inflation annualized is expected to be 2.5% vs. 1.9% while the core PCE Price Index is expected to also be 2.5% vs. 2.2%. The Atlanta Fed’s GDPNow model is still projecting 2.99% first quarter GDP growth but the model hasn’t been updated since Jan. 17, so expect that estimate to change this week.

- Friday’s Personal Income and Spending report for December is part of Thursday’s GDP release, so it takes some of the luster off the release, but it will allow us a look at all the metrics in December. The Fed’s preferred inflation measure, PCE, is expected to increase 0.3% vs. 0.1% in November as higher energy prices drive the uptick. The YoY rate is expected to increase a tenth to 2.5% vs. 2.4% in November. The core PCE (ex-food and energy) is expected to increase 0.2% vs. 0.1% in November. The YoY rate is expected to be unchanged at 2.8%. The slight back-up in inflation adds to the case for a Fed pause.

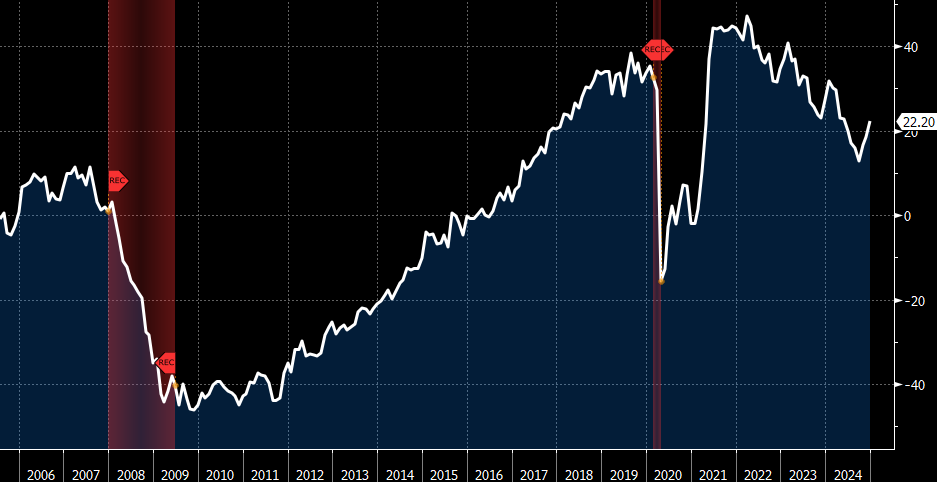

- Other reports of note this week will be tomorrow’s preliminary Durable Goods numbers for December with better orders but lighter shipments vs. November. The Conference Board’s Consumer Confidence report for January will also be released tomorrow with the Jobs Plentiful – Jobs Hard to Get measure getting the most attention at the Fed. Recall, after months of declines in this measure it’s posted three straight months of improvement in the jobs picture which feeds into the Fed’s belief that the labor market is strong enough to withstand a pause in rate cuts (see graph below).

- As an aside, and purely anecdotal, we drove by an old shopping mall this weekend that had been repurposed years ago into a Hispanic-focused shopping center. It’s typically wall-to-wall parking on the weekends but this time it was a ghost town. While the economic impact of deportations has been focused on sectors that rely on immigrant labor, like agriculture, construction, and hospitality, these Hispanic-focused shopping areas seem destined to take a hit too, and one suspects nearly every decent size metro area in the US has them. Just food for thought as we try to navigate the economic impact of these new policies being implemented.

Futures Market Sees June Meeting as First Rate Cut with 49bps for all of 2025 Source: Bloomberg

Source: Bloomberg

10yr Treasury Yield Makes Roundtrip Since Start of Year Thanks Most Recently to DeepSeek Source: Bloomberg

Source: Bloomberg

Conference Board’s Jobs Plentiful – Jobs Hard to Get: After a long Downtrend in Jobs Plentiful it’s Improved 3 Straight Months Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.