December Retail Sales Beats Forecast, Putting Treasuries Under Pressure

December Retail Sales Beats Forecast, Putting Treasuries Under Pressure

- A hotter UK CPI report had Treasuries on the back foot as US trading began, and the strong retail sales numbers for December only added to the pressure, with short tenors backpedaling as the more aggressive rate-cutting expectations are dialed back a bit. With the consumer constituting two-thirds of the economy it bodes well for fourth quarter GPD, and early indications are they aren’t slowing too much in the new year. Presently, the 10yr Treasury is yielding 4.10%, down 11/32nds in price and the 2yr Treasury is yielding 4.34%, down 6/32nd on the day. The 2yr yield traded as low as 4.12% on January 12th, so quite the move higher this week.

- Never bet against the American consumer has been a staple in economic forecasting for a while, and that has never been as true as it has been this cycle. Overall sales increased 0.6% vs. 0.4% expected and 0.3% in November. Sales ex auto and gas rose 0.6%, matching November but double the 0.3% expectation. The all-important Control Group, which feeds directly into GDP, rose 0.8% vs. 0.2% expected and 0.5% in November. Clearly, a solid month of spending for the consumer and one that will help boost fourth quarter GDP expectations.

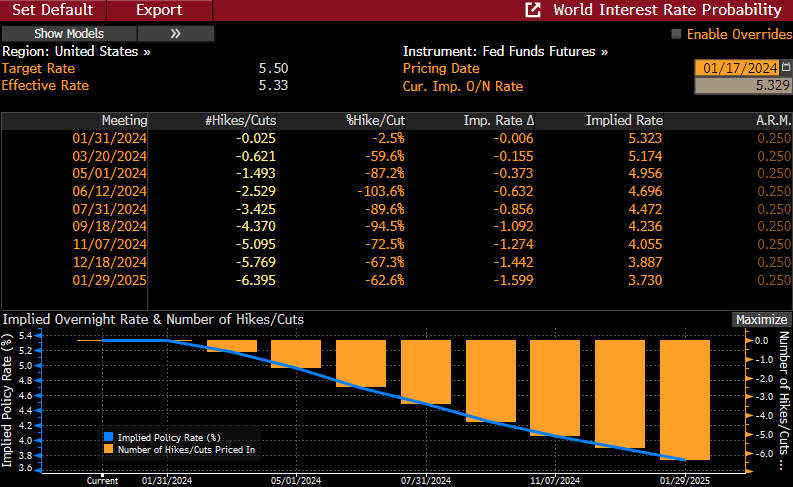

- Speaking of GDP, the Atlanta Fed’s GDPNow model has fourth quarter growth at 2.21%. That will be updated today after the retail sales numbers, so given that strength it would seem the forecast will get a boost. Suffice it to say, the economy carried solid momentum into the new year and that plays against March rate cut expectations as well. Surprisingly, even after the strong retail sales odds for a March cut are off recent highs but still over 50% (see table below). Sound like more push-back will be required from Fed speakers.

- Fed Governor Christopher Waller spoke yesterday on inflation, the labor market and monetary policy expectations, so a juicy speech for Fed watchers. Recall that Waller had been one of the more outspoken hawks in this hiking cycle, but he pivoted to a softer tone prior to the December FOMC meeting, beating Powell’s more famous pivot at the post-meeting press conference. In his speech yesterday, the key takeaway was the Fed is impressed that inflation has moved quite rapidly closer to the 2% benchmark without damaging the labor market. They clearly don’t want to blow it in the latter innings of this cycle by keeping rates too restrictive, so they are now more equally attuned to inflation and job market trends. He didn’t directly push back on the March rate-cut odds, only saying a cut is “likely this year.” The robust retails sales numbers today give the Fed comfort that the consumer is still standing strong, and that gives them further reason to be patient about when to begin rate cuts.

- There will be three more Fed speakers today, (Barr, Bowman, and Williams)and two more later this week (Bostic, Daly), so the ability to push back on those rate-cutting odds will be with us for the remainder of this week and that could keep pressure on the front end of the curve. After this week, the Fed goes into its pre-meeting quiet period so this will be their last chance before the meeting.

March Rate-Cutting Odds Off Recent Highs but Still Above 50%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.