December Jobs Report Will Lengthen Rate Cut Pause

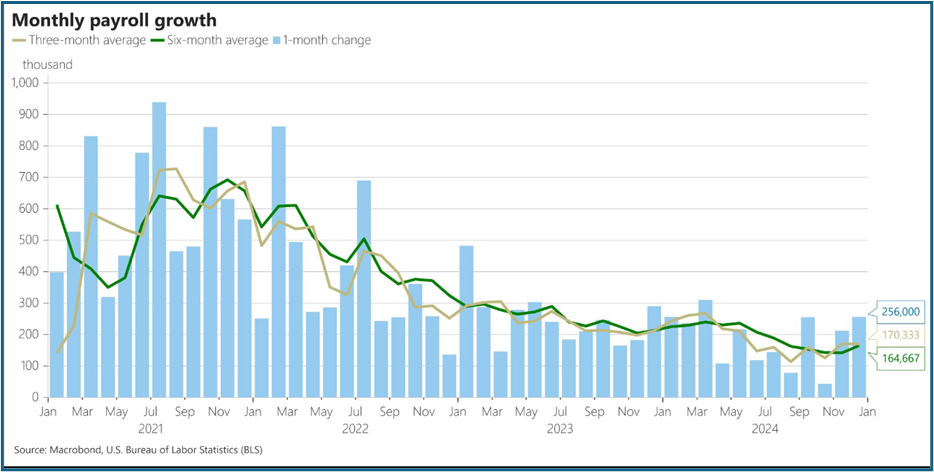

- December nonfarm payrolls rose 256 thousand, easily beating the 165 thousand expected and 212 thousand in November (revised down from an initial 227 thousand). October was revised up by 7 thousand jobs, which goes against the year-long trend of lower revisions. Private sector job growth was strong at 231 thousand which is well ahead of ADP’s 122 thousand reported earlier this week. With the increase in immigration, it’s thought that approximately 200k in monthly job gains are needed to maintain labor market equilibrium. That immigration inflow is likely to slow, perhaps dramatically, under the Trump administration, so that equilibrium level is likely to shift lower and if these job gains continue in the 200+ thousand plus area, wage increases seem likely.

- After diverging for months, the two surveys (Establishment and Household) told the same story. The Household Survey (which generates the unemployment rate, labor force participation rate, etc.) reported an increase of 478 thousand jobs with a decrease of 235 thousand in the ranks of the unemployed, although the overall unemployed remains elevated from last year (6.886 million vs. 6.315 million a year ago). It also reported a 243 thousand increase in the labor force. That more optimistic view of the labor market led to the unemployment rate decreasing from 4.2% (4.231% unrounded) to 4.1% (4.086% unrounded), which was below the 4.2% expectation which was also the rate in November.

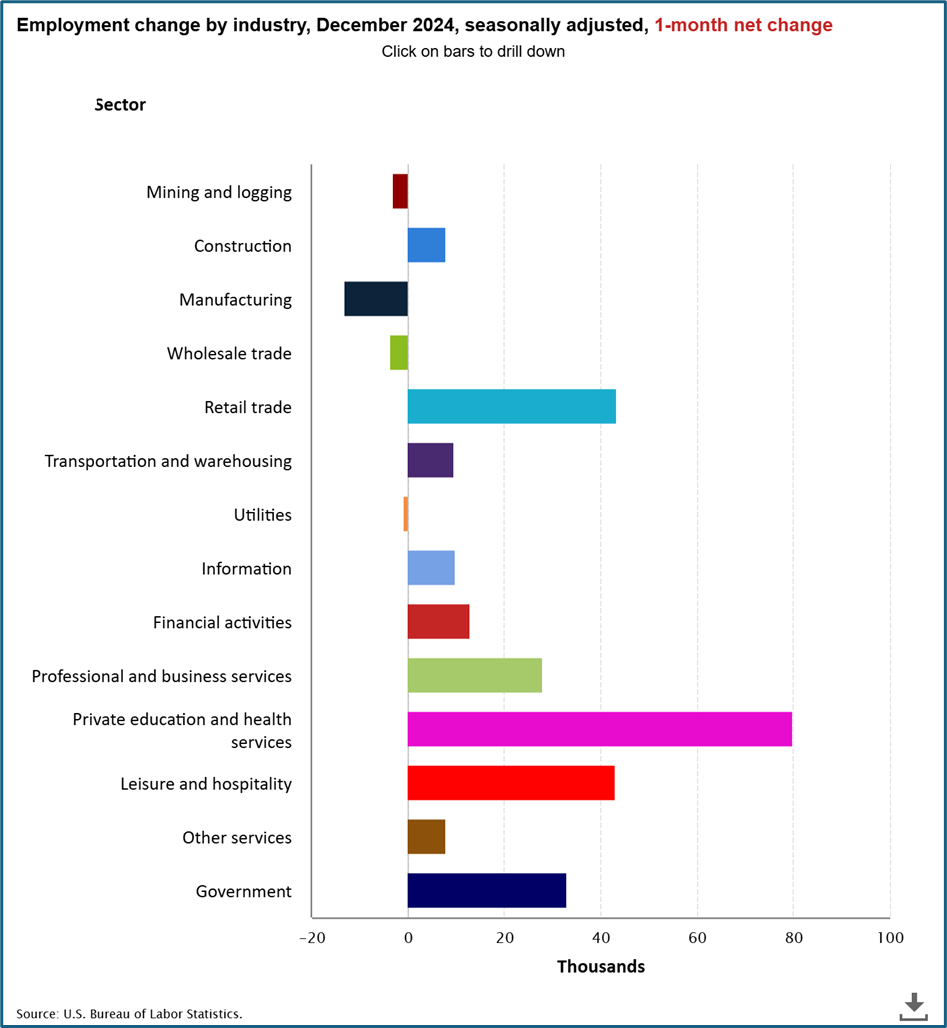

- Job gains were strongest in healthcare/social assistance, a perennially strong category, (70k), leisure/hospitality (43k), and retail trade rebounded after losses in November (43k). Government job growth continued strong, repeating November’s gain (33k). Job losses were concentrated in the manufacturing of durable goods (-16k), and after eight straight months where temporary help services shed jobs, they gained for the second straight month (5.3k). Thus, it’s easy to see the strength in service sector hiring vs. the goods side of the economy and that is what we’ve been seeing across a host of reports with services really carrying the economy and that trend seems likely to continue after the hiring in December.

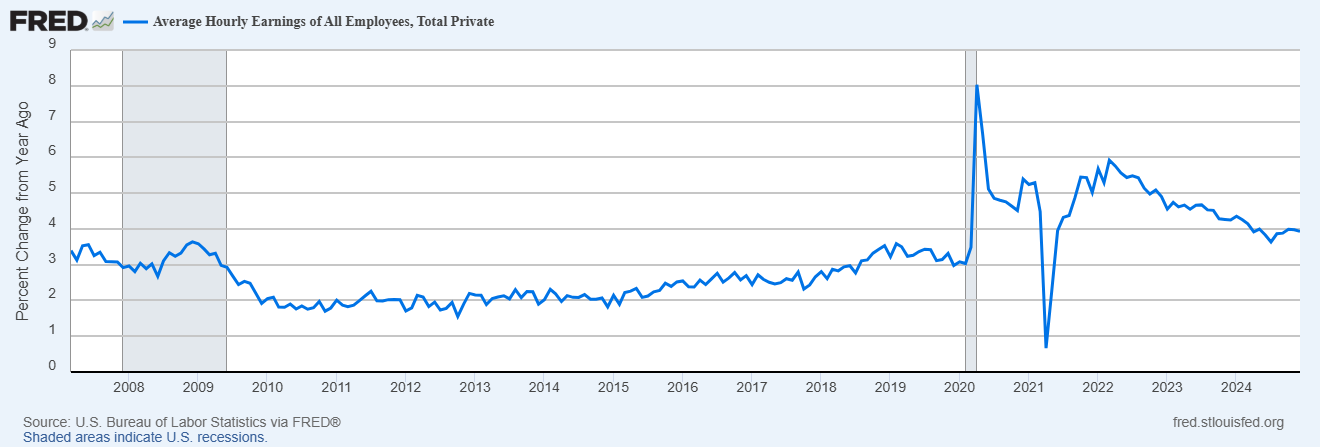

- Average Hourly Earnings rose 0.3% MoM, matching expectations but less than the 0.4% November gain. The year-over-year pace dipped to 3.9%, just under the 4.0% expectation which was the November result. Average weekly hours remained at 34.3 hours, matching expectations, and November’s results. If one were looking for a weakness in this report it would be the slight slippage in hourly earnings but that is a weak rebuttal, as the YoY rate remains well above the long-term 3.1% average.

- Despite the increase in the labor force, the Labor Force Participation Rate, remained at 62.5%, matching expectations, as overall population increased as well. The rate was 62.5% a year ago, so the participation rate seems to be plateauing at the current level.

- The December’s jobs report was expected to soften after the stronger-than-expected November report but that most definitely didn’t happen. There was really nothing in this report that speaks to slowing momentum, with the only solace for those seeking a resumption of rate cuts being that the impressive job gains are not pushing wage increases higher. Thus, one can say this report will extend the pausing of rate cuts into the second quarter, at the earliest, and if inflation rebounds it will rekindle talk of rate hikes, although the Fed will want to resist that about-face until it becomes untenable to do so.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.