December Jobs Report Beats but the Picture is Cloudy

December Jobs Report Beats Expectations but with Some Noise

- Nonfarm payroll gains came in better than expected with 216 thousand new jobs vs. 175 thousand expected and 173 thousand in November (revised lower from an initial 199 thousand). Private sector jobs increased by 164 thousand vs. 130 thousand expected and 136 thousand in November. Revisions have been trending to the downside in 2023 and that held true once again with 71 thousand jobs cut from the prior two months. Also, yet again the Household Survey reported a much different number on jobs. In November, it reported 586 thousand new jobs but for December that flipped to a loss of 686 thousand jobs. So, combined with the consistently large downward revisions to the Establishment Survey in 2023, and the recent volatility in the Household Survey, it does give one pause as to how much to conclude definitively from the BLS report.

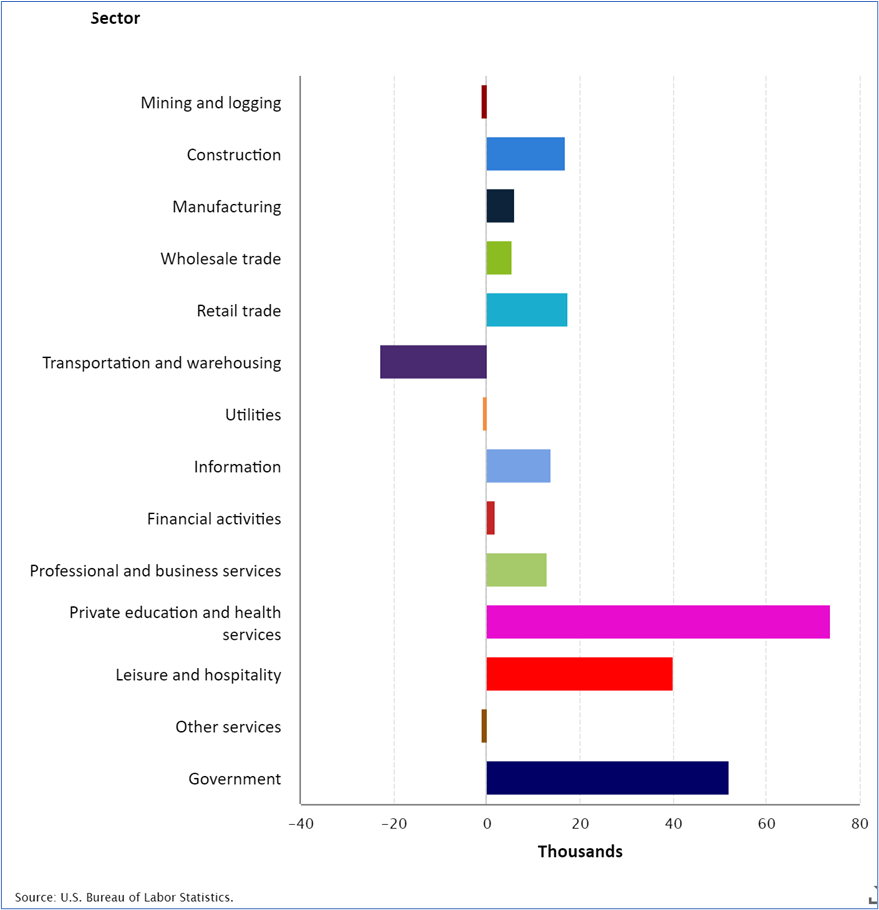

- Job gains were notable in the government sector (52k), leisure and hospitality (40k), and healthcare (38k). Job losses were notable in temporary help (-33k), and transportation/warehousing (-23k).

- In November wage gains reversed a moderating trend that started in August with a MoM gain of 0.4% and that was repeated in December vs the 0.3% expectation. In addition, the year-over-year pace increased to 4.1% vs. 4.0% in November and 3.9% expected. Average weekly hours, however, decreased from 34.4 hours to 34.3 hours. That makes four out of the last five months at 34.3 hours which represents the cycle low. Weekly hours peaked at 35.0 a year ago. Nevertheless, the solid wage gains may bolster the Fed’s higher-for-longer theme, and pour more water on March rate cut odds. Ideally, the Fed wants that YoY number to drift to around 3.5% to reduce the wage-push inflation potential, so certainly anything above 4% will harden their higher-for-longer stance, but the dip in hours worked does signal some easing in labor demand.

- The unemployment rate remained at 3.7% (3.74% unrounded) vs. 3.8% expected as the Household Survey reported an increase of 6 thousand in the ranks of the unemployed and a large decrease of 676 thousand in the labor force (the denominator in the unemployment rate calculation). That more than reversed the 404 thousand increase reported in November. It seems the much smaller Household Survey was impacted by the returning strikers in November which when extrapolated across the entire population induced some of the volatility we are seeing in the past two months.

- The decrease in the labor force led to the Labor Force Participation Rate decreasing from 62.8% to 62.5%. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6%. The decrease in December reverses a similar increase in November. An increasing labor force expands the pool of eligible workers and helps to keep a lid on excessive wage gains and the inflationary implications they entail. But with the aforementioned volatility in the data the Fed is not likely to react to the drop unless it’s confirmed over a several month period.

- All-in-all, another somewhat noisy report given the ongoing downward revisions in the Establishment Survey combined with the volatility in the Household Survey, but the Fed can use it to keep with the higher-for-longer theme and pour water on talks of a March rate cut. Considered with the other labor-related reports we saw this week (JOLTS, ADP, ISM) this report doesn’t signal any dramatic weakening in the labor market. While the wage gains remaining sticky, and the uptick in job gains, could lead one to think the jobs market is getting a second wind, the aforementioned volatility and downward revisions argue against reading too much into that take for now.

Change in Employment by Industry – Seasonally Adjusted

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.