Data This Week Points to a 25bps September Rate Cut

Data This Week Points to a 25bps September Rate Cut

- After a solid bout of data yesterday that dispelled any notion that the consumer was retrenching, yields jumped higher with the 2yr back over 4% and the 10yr approaching that level. In fact, this week has produced solid data that has pushed odds of a 50bps rate cut much lower, while a solid consensus is building around a 25bps cut. The data on offer today will not change that outlook as investors look ahead to the central bank confab at Jackson Hole late next week (Aug. 22 & 23), and any policy signaling that may arise. Currently, the 10yr note is yielding 3.88%, down 5bp on the day while the 2yr is yielding 4.04%, down 6bp on the day.

- After a soft ISM Manufacturing report was followed by a surprisingly weak July jobs report, thoughts of imminent recession rose. A jump in jobless claims also signaled that perhaps the momentum in the labor market was taking another leg lower. Since then, reports have been decidedly better, especially this week. The latest in that line of reports was yesterday’s July Retail Sales report.

- Suffice it to say sales were better than expected and that was across the board. Auto sales especially rebounded after a cyberattack had laid low many dealer software systems nationwide in June. With sales and inventory systems restored, pent-up sales led to a nice bounce with headline sales increasing 1.0%, well ahead of the 0.4% expectation and the -0.2% dip in June that was partly a result of the cyberattack. Stripping out the auto and gas category, sales were ahead of expectations but trailed the robust June numbers (0.4% vs. 0.2% expected and 0.8% in June). The metric that feeds directly into GDP the so-called Control Group rose 0.3% beating the 0.1% expectation but trailing June’s 0.9%. The Atlanta Fed updated its GDPNow model after the numbers with the current outlook for third quarter GDP at 2.4%, certainly well clear of recessionary territory.

- The beat versus expectations allays fears of an imminent consumer slowdown, as once again, the demise of the American shopper has been greatly exaggerated. It also speaks to a possible shift in spending tendencies. The Retail Sales report is more goods-based while the consumer had been more on the services-side with travel and leisure topping much of their spending of late. Recently, however, some travel and leisure companies were reporting a slowing in recent activity. With the bump in this month’s sales, along with solid results from massive retailer Wal-Mart, perhaps the consumer is moving back towards the goods-side of the economy. In any event, it’s welcome news that follows other reports that the economy is not falling apart.

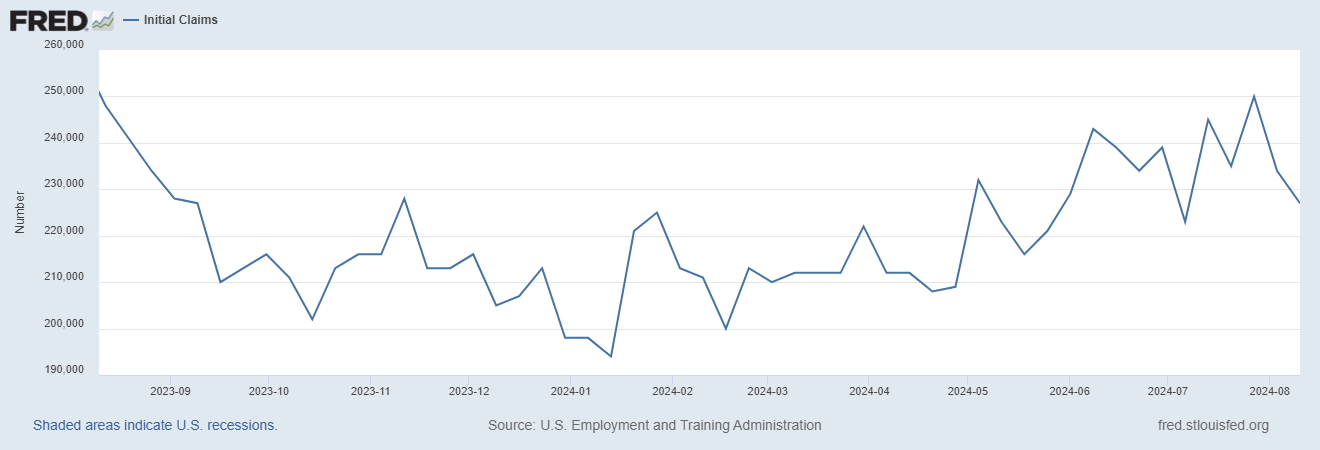

- The other big number yesterday that soothed nervous investors was the Weekly Initial Jobless Claims report. The most recent claims number was 227 thousand vs. 235 thousand expected and 234 thousand the prior week. It was the lowest claims number since July 6. The number had popped to 250 thousand before the July jobs report and that spooked investors that more significant layoffs were about to take place. Claims in the mid-250 thousand range aren’t necessarily alarming, that would come when they move over 300 thousand, but it was obvious they were slowly moving higher through much of this year. This recent backsliding tells us that layoffs remain rather muted which speaks to ongoing strength in the economy.

- The University of Michigan will be out with its preliminary look at consumer sentiment for August at 10am ET. Expectations are for sentiment to tick up but remain rather dour. Inflation expectations are expected to be nearly unchanged from July with the 1yr outlook unchanged at 2.9% and the 5-10yr range a tenth lower at 2.9%. Earlier this week the NY Fed’s latest Consumer Survey found a notable decline in inflation expectations which, with well-anchored inflation expectations, gives the Fed another rationale for cutting in September.

- One last thing, earlier this week Lelia and I recorded a podcast where we discussed the latest economic and Fed outlook and Lelia provided some strategies and trade ideas given the expected rate-cutting cycle. You can find the podcast link here.

Initial Jobless Claims Dip to the Lowest Level Since July 6th

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.