CPI Yields Few Surprises but also Few Improvements

- Treasury yields are lower on the day as some bets were circulating that CPI would come hotter-than-expected. It didn’t and that led to a dip in yields. While CPI didn’t surprise to the upside, it didn’t show much improvement either and that will have traders marking down rate cut expectations in 2025 (more on that below). Currently, the 10yr Treasury is yielding 4.36%, down 7bps on the day, while the 2yr is yielding 4.25%, down 9bps on the day.

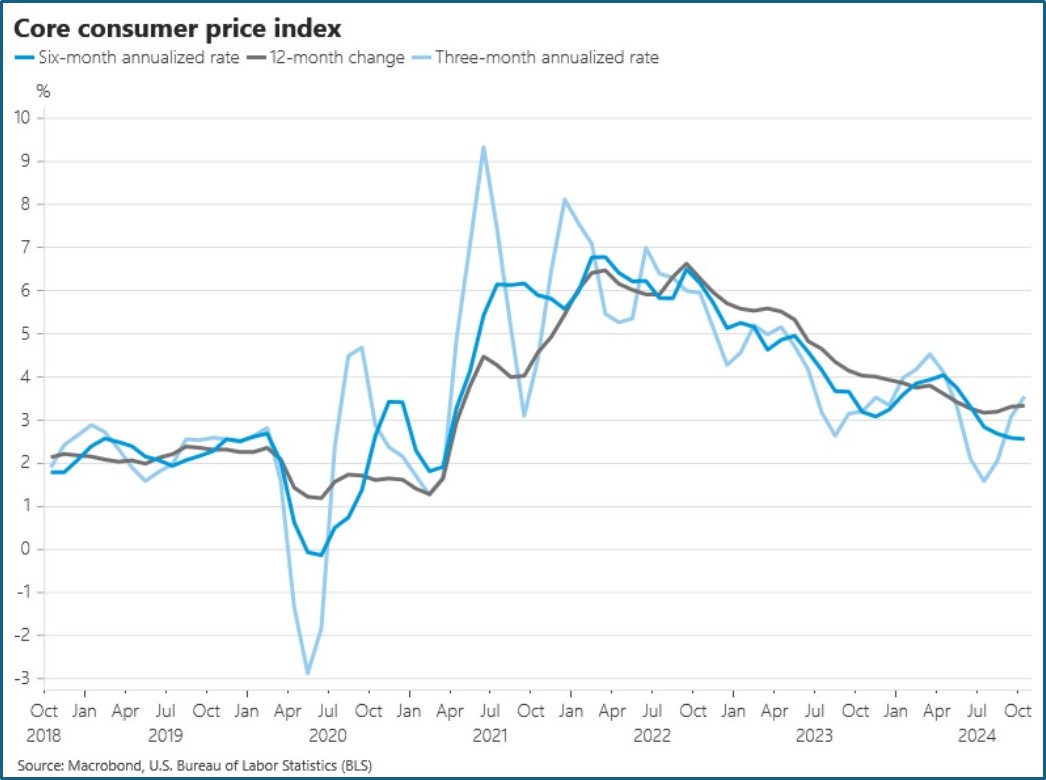

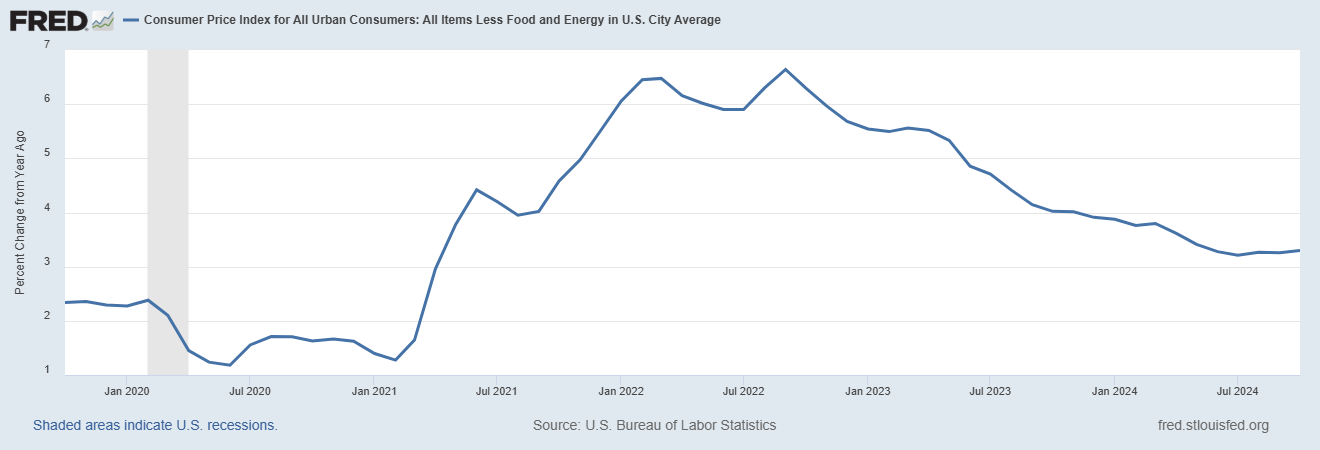

- October CPI numbers are out this morning with core CPI MoM rising 0.3% (0.28% unrounded), matching expectations with the YoY rate at 3.3, also matching expectations, and unchanged from September. It’s the third straight month at that monthly pace so some concern will be expressed that the favorable inflation trend during the summer may be pausing here. It’s probably not enough to derail a December rate cut by itself, as we still have PPI and PCE numbers, not to mention another round of November data before the December 18th rate decision. It will, however, put downward pressure on 2025 rate cuts, which have already been ratcheted down.

- One of the areas of CPI that we focus on, that had been sources of “stickiness”, Owner’s Equivalent Rent (OER) ticked up to 0.4% from 0.3% in September but still off the 0.5% spike in August. The Fed is eyeing the 0.2% to 0.3% range as that was the level that prevailed prior to the pandemic. So, the long-awaited rollover in OER (the largest component of CPI at 27%), remains yet to occur. Until this metric of housing expense moves back to the pre-pandemic range of 0.2% – 0.3% improvement in overall and core CPI is going to be challenging. Core Services Ex-Housing, another sticky piece of the inflation picture, improved to 0.314% from 0.40% in September so some improvement there and the lowest since July.

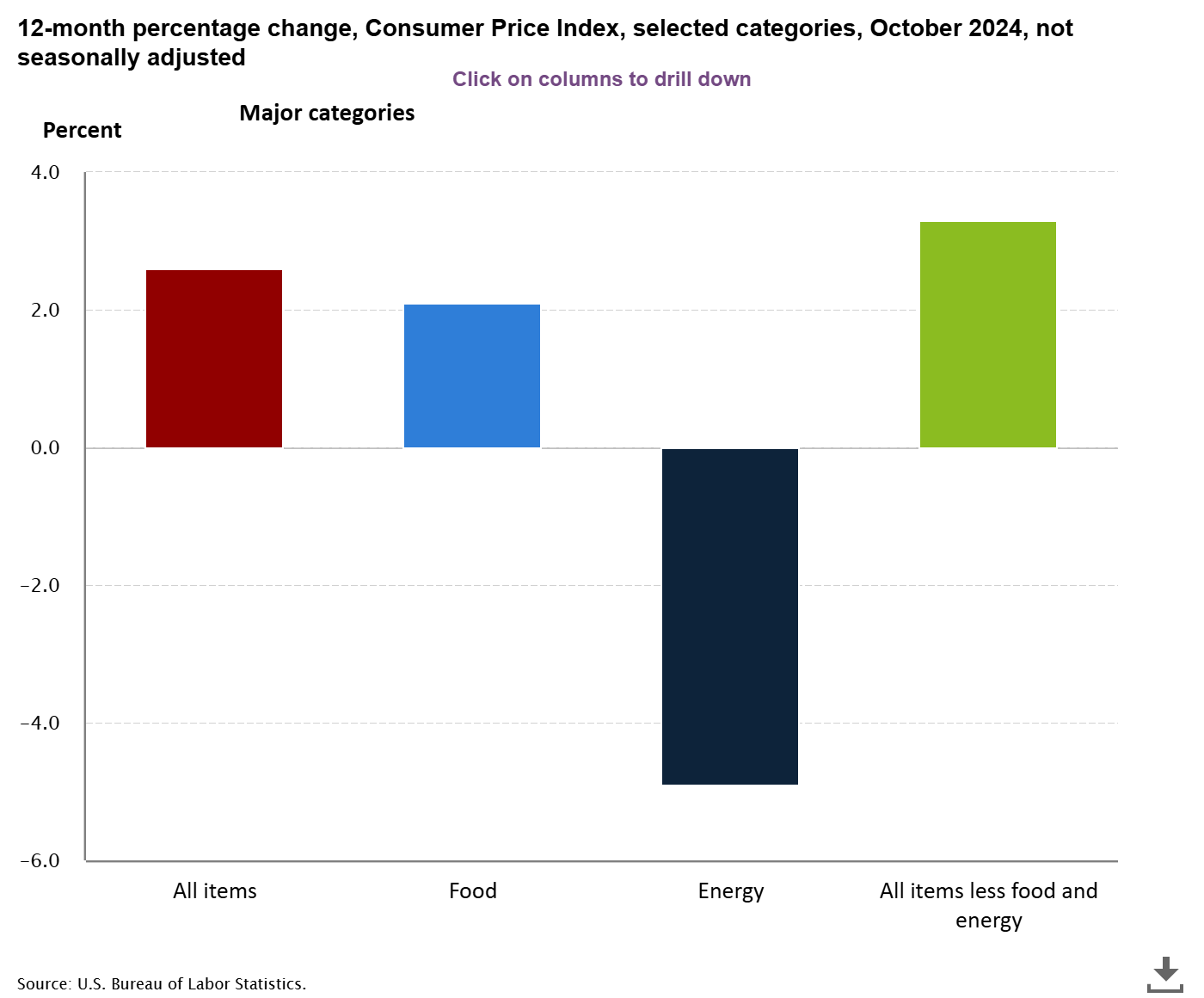

- Overall CPI rose 0.2%, as expected and matching September’s result, while the YoY rate ticked up to 2.6%, as expected, from 2.4% in September. We’ve mentioned in the past that the second half of 2024 would be challenging as a series of 0.1% and 0.2% monthly prints roll off from 2023. So, replacing them with 0.2% prints is not going to result in much improvement in the YoY rate. That may change in the first quarter of 2025 when inflation rates spiked in 2024, but some of that may be seasonal in nature such that we see it spike again. This doesn’t dent the outlook for a December rate cut with policy still solidly in restrictive territory, but the market is probably right to downsize expectations for a four-pack of rate cuts in 2025, especially if the labor market doesn’t deteriorate.

- On a positive note, yesterday’s NY Fed Consumer Survey showed moderating household inflation expectations across all the major time horizons. Year-ahead inflation expectations declined by 0.1 pp to 2.9%, the lowest since the early stages of the pandemic. Fed speak was heavy yesterday as well with Richmond Fed President Barkin (voter) saying, “Tomorrow looks different based on whether you take more signal from levels or trends… the trend [in core inflation] has been great… but the level is still above our 2 percent target. So, inflation might be coming under control, or the level of core might give a signal that it risks getting stuck above target.” Given today’s results that risk of “getting stuck above target” may be coming true.

- Tomorrow brings October PPI and that is expected to show a gain of 0.2% in final demand, matching September’s result. A gain of 0.3% in core PPI is expected which would be quite the uptick after September’s 0.1% print. Final demand YoY is 1.8% and the core YoY rate is 2.8%. Once PPI numbers are released, analysts will have the opportunity to back into PCE estimates, the Fed’s preferred inflation measure, which will be released on Black Friday.

Core CPI YoY – Getting Stuck at 3.3%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.