CPI Results Stoke Tariff Cost Fears

- Cooler PPI numbers this morning have slowed the upward push in Treasury yields. While headline PPI was unchanged, beating the 0.1% expectation, it was more mixed in the internals. The goods side did see price increases that were offset at the headline level by weaker service prices, which may reflect softening demand (for example, travel accommodations down 4.1%). The bottom line is that the inflation question will remain front and center as we roll through the balance of summer. Currently, the 10yr is yielding 4.46%, down 3bps on the day, while the 2yr is yielding 3.94%, down 2bps on the day.

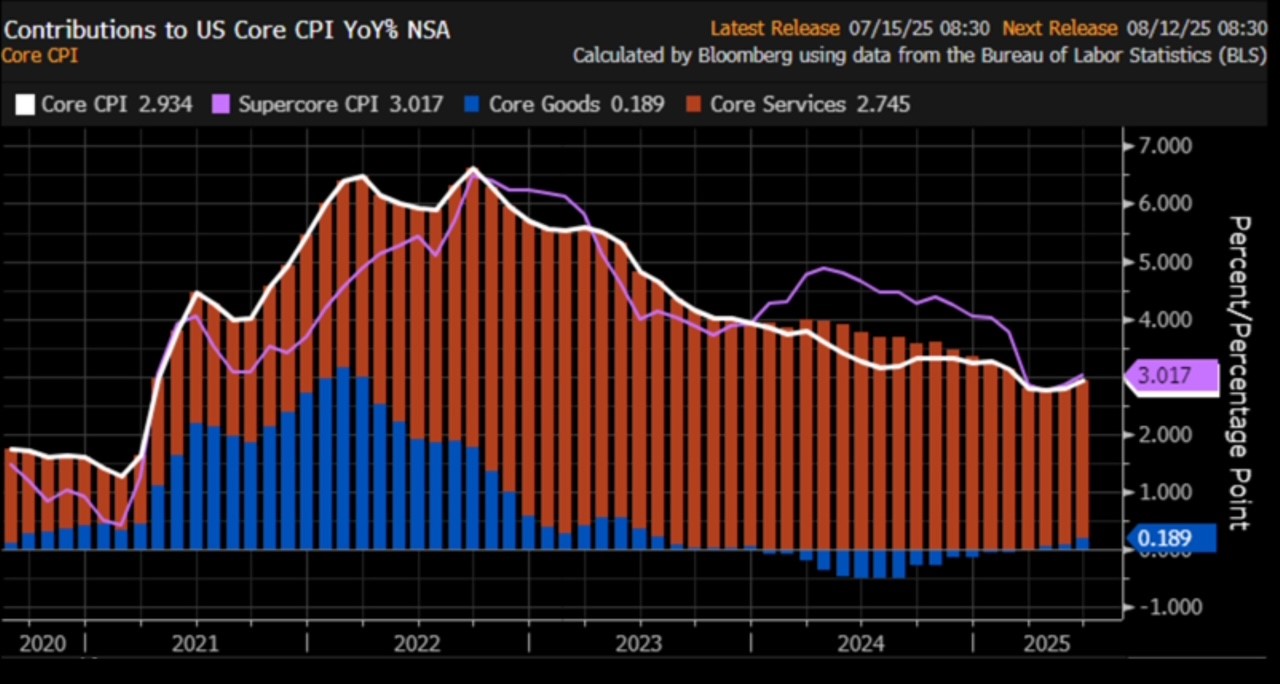

- Yesterday’s June CPI report may have been initially considered “in-line” but the fingerprints of tariffs and coming higher prices are there. Core goods prices are creeping up and this category was a source of deflation in 2024, but as tariff costs impact more items deflation has flipped to inflation. Within the core goods category, apparel, typically an imported item, rose 0.4% in June vs. a -0.4% decline in May. Household furnishings, another mostly imported good, rose 1.0% after a moderate 0.3% gain in May. Helping blunt that impact were price declines for both new and used cars. In fact, used cars have seen price declines for three straight months while new cars have seen two straight months of lower prices. One has to wonder how much longer that trend will persist?

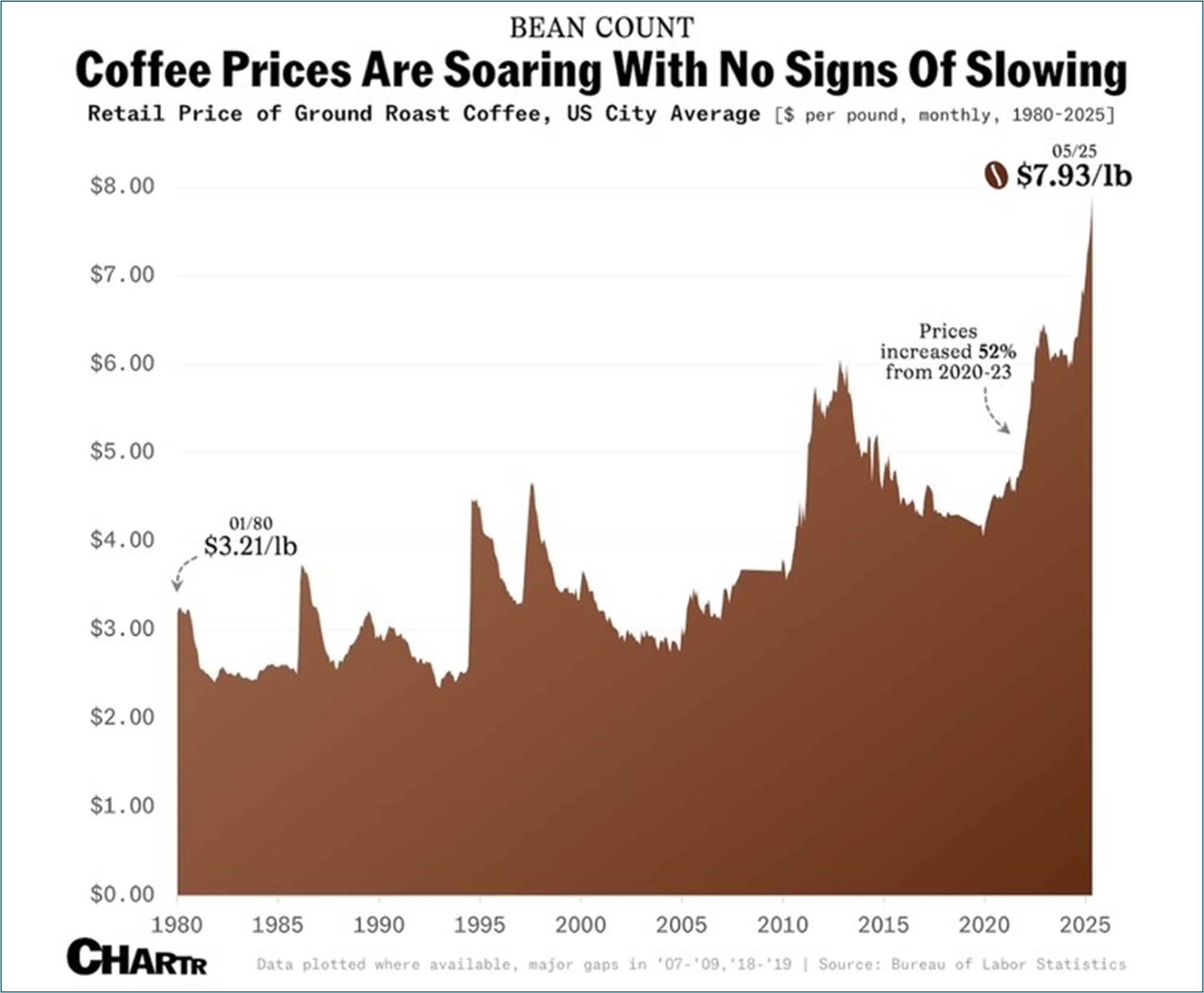

- Food also betrayed tariff costs, with the category up 0.3% for the second straight month after a -0.1% print in April. In that regard, will coffee become this year’s eggs for outsized price gains on what many consider an essential item? For June, coffee rose 2.2%, a gain that has held relatively constant over the last few months. However, my research at Costco found a 2 lb. bag of their inhouse brand had crept up from $12 to $15 in recent months but spiked to $18 in July. That’s a 50% increase since the start of the year for a pedestrian-quality coffee, and from a retailer that has some negotiating power. While egg prices have fallen back this year, coffee may be the next battle cry on the food inflation front (they carry nearly equal weight in the CPI basket), especially as Trump threatens major coffee producer Brazil with higher tariffs (see coffee price graph below).

- Also adding to the unease, core services ex-housing, the so-called Super Core, rose for a second straight month after a four-month downward trend. That’s not what the Fed wants to see, especially as goods prices are now trending higher as well (see graph below).

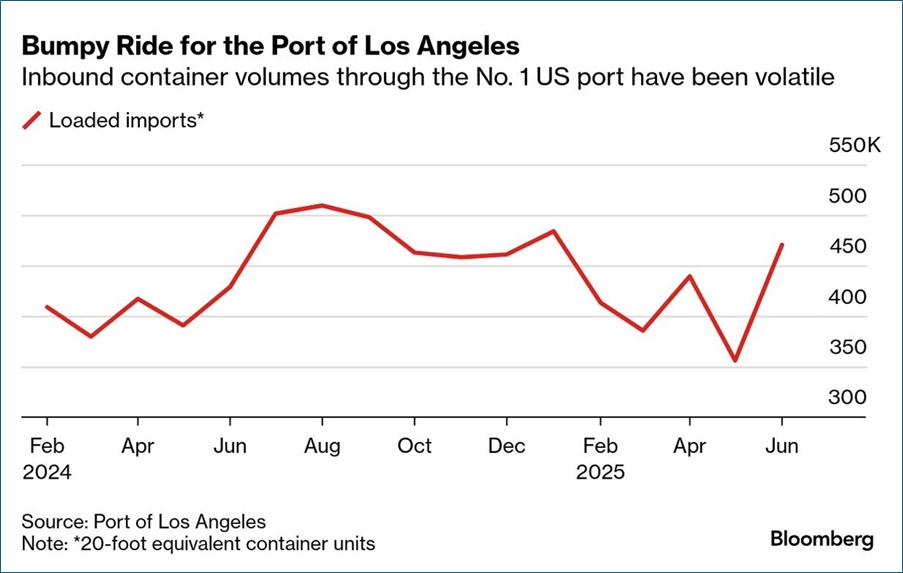

- Companies stuffed inventory purchases in the first quarter, prior to the tariff war, and those inventories are, or near, depleted. Somewhat offsetting that inventory runoff are the delayed higher tariffs on China that are due to expire August 1. That looming deadline has led to a surge in container traffic from China into Los Angeles area ports. The surge started in June and per port activity appears to be continuing in July. Those goods will presumably carry the 30% tariff, but not the triple-digit rate that is scheduled to be reinstated in August, although the consensus is that will be negotiated down.

- The overriding point is that goods prices appear likely to continue higher, and with core service prices also reversing higher where will the offset come to keep inflation in the sub 3% region? One area may be the single-largest CPI component: Owner’s Equivalent Rent (OER). The lagging nature of OER was a fly in the ointment of lower inflation numbers a couple years ago, but it finally started rolling over late last year. However, it seems to have leveled off around 0.3% MoM when it was at 0.1% – 0.2% pre-pandemic. We really could use another tenth or so dip in OER to help offset some of the higher goods prices that could be coming. If the economy and labor market fail to roll over during this time, the decision to cut in September could be more contentious and that is evidenced by the current 52% odds of a rate cut.

- The CPI report was followed today by a look at wholesale pricing pressure with June PPI. Recall, part of the reason behind the big drop in retail-level inflation (read: CPI) in 2022 and 2023 was deflation in wholesale prices that was partially passed on in lower retail prices. Wholesale prices are no longer falling but the climb earlier in the year has stalled. The question is will tariff costs begin appearing in intermediate inputs, particularly steel and aluminum?

- Overall PPI for June was unchanged vs. 0.1% in May with the YoY rate decreasing to 2.3% vs. 2.7% in May. PPI Ex Food and Energy was also unchanged vs. 0.1% the prior month with the YoY pace slowing to 2.6% vs 3.2% in May. It should be noted gains were found in the goods side with service side deflation offsetting that, for now. With CPI and PPI in hand, and after tomorrow’s Import/Export Price Report, analysts will quickly calculate estimates for the Fed’s preferred PCE inflation gauge that will be published on July 31st. Given the modest move in PPI, we don’t expect a major upside surprise to that inflation measure – core PCE estimate is 0.3% MoM – but we could see it creep higher as the summer months give way to fall.

- Tomorrow, we get a break from inflation reports and focus on the consumer with the June Retail Sales Report. Expectations are that overall sales rose +0.1%, representing something of a recovery from May’s -0.9% drop that was dented by slowing auto sales that came after a pre-tariff surge earlier in the year. Within the details of the release, investors will be focused on the Control Group-a direct feed into GDP- which is seen up +0.2% after May’s +0.4% and April’s -0.1%. This would put the second quarter average at 0.17% compared to the first quarter’s 0.27%. This rather lackluster rebound is not encouraging, especially after first quarter personal consumption was revised down to a quarterly-annualized pace of just +0.5%; the lowest since the second quarter of 2020. Right now, the Atlanta Fed has second quarter GDP at 2.6%, so we’ll see how that gets adjusted following these latest sales numbers.

- Finally, Kevin Smith and I will co-host a webinar next Tuesday at 2pm ET to review our midyear economic outlook, 2nd quarter investment portfolio performance, and strategies that will prosper in 2026. Please consider subscribing to what we are sure will be an informative 30-minute discussion. The subscription link can be found here. We would love to see you there, at least virtually!

Both Overall and Core CPI YoY Trending Higher and not Likely to Reverse Course Soon

Core Goods Price Swings from Deflation to Inflation as Tariff Costs Start to Arrive. Meanwhile, Core Service Costs also Edge Higher

Source: Bloomberg

June Surge in Container Traffic is Reportedly Continuing in July to Beat Scheduled Tariff Hikes in August ugust

ugust

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.