CPI Meets Expectations but Hints that Further Improvement will be Challenging

- Treasury yields are moving slightly lower this morning as November CPI came in mostly as expected which firms up odds for a rate cut next week and belied some whispers that the report could be on the hot side. We suspect, however, that further improvements in the months ahead may be hard to come by (more on that below). Currently, the 10yr Treasury is yielding 4.21%, down 2bps on the day, while the 2yr is yielding 4.12%, down 4bps on the day.

- November CPI came in right on the screws as to expectations with both the overall and core increasing 0.3% MoM. The overall YoY rate ticked up a tenth from 2.6% to 2.7% while the core YoY rate remained unchanged at 3.3%. This as expected report should remove the final potential stumbling block to a rate cut next week, but hints that a pause is coming.

- When one exes-out food, energy, and shelter you still get a 0.3% MoM increase for each which reflects the broad-based nature of the November increase. In addition, for those wanting to know, the core rate to three decimals was 0.308%, so a somewhat “high” 0.3% rounded reading, but not enough to prevent a rate cut next week.

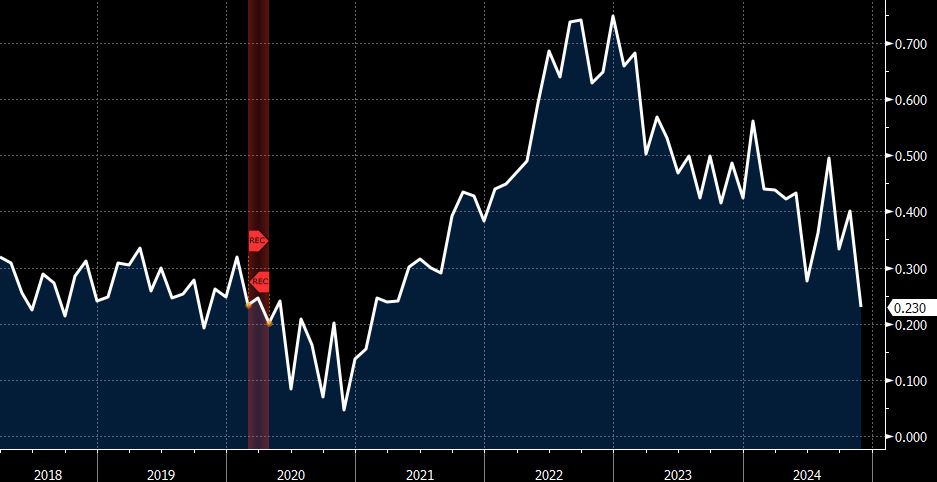

- ·On a positive note, Owner’s Equivalent Rent finally moved lower to 0.23% MoM vs. 0.41% in October, dropping the YoY rate to 4.9%, the lowest since April 2022. The monthly increase is back in the 0.2%-0.3% range that persisted pre-pandemic and if it holds it will be key to eventually bringing the YoY rate back towards the 2.0% target. OER is always a big deal with CPI as it’s the largest single component at 27% of the basket. However, the fact OER significantly improved but the overall stayed at 0.3% speaks to the broad-based increase, which is not what the Fed is looking for.

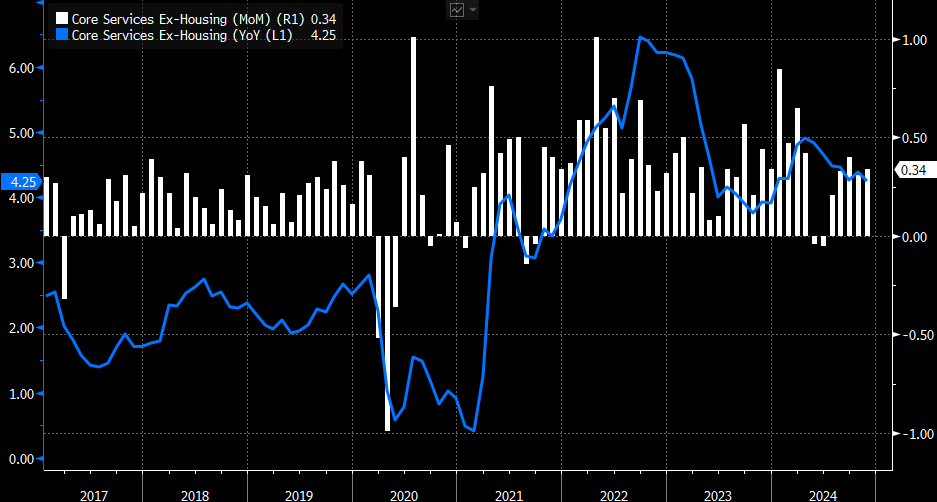

- The other area that has proven sticky, core services ex-housing, continued to be just that. The MoM increase ticked higher from 0.31% to 0.34%, but the YoY rate is trending lower at 4.25%. the lowest this year. So, a slight uptick in the monthly rate reinforces the sticky nature of this metric, and given the momentum in the services side of the economy it’s likely to be printing in the 0.25%-0.35% range for the time being.

- This is the fourth consecutive 0.3% increase for core CPI, and the 0.308% increase is the second largest since the first quarter. If OER rebounds higher, and/or core services ex-housing lifts a bit it could be enough to print a 0.4% MoM gain which would points to the likely pause by the Fed after next week’s expected cut.

- Also, deflating goods prices over the last 18 months have ended. Higher car prices pushed up core goods prices 0.3% after a 0.05% gain in October and 0.17% in September. That puts more pressure on core services and OER to trend lower to see overall inflation improvement in the months ahead.

- PPI follows tomorrow with a 0.2% MoM gain expected but with the YoY rate on Final demand ticking higher from 2.4% to 2.6%. We’ll reiterate again, the tailwinds from mid-2022 through mid-2023 when wholesale prices were dropping has ended with prices grinding higher since mid-2023. That pass through from wholesale to retail will be another headwind for CPI to cover that last mile to the 2% target, and another reason we expect a Fed pause in early 2025.

- Once PPI is in hand, and secondarily Import/Export Prices on Friday, the estimate for core PCE will be refined further. Right now, expectations are that the Fed’s preferred inflation gauge will be 0.2% MoM with the YoY rate ticking higher from 2.8% to 2.9%. Keep in mind, however, this report will arrive two days after the FOMC rate decision next week.

Core CPI Stalling at 3.3% YoY as MoM Gains were 0.3% for Fourth Straight Month Source: Bloomberg

Source: Bloomberg

Owner’s Equivalent Rent Moved Back into the Pre-Pandemic Range and the lowest Since 2021 Source: Bloomberg

Source: Bloomberg

Core Services Ex-Housing Ticked Higher to 0.34% MoM but YoY Rate Continues to Trend Lower at 4.25% Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.