Cooler PPI Clears the Stage for CPI Tomorrow

- Treasury yields are a tick lower this morning as the cooler PPI report for August paves the way for a possibly friendly CPI. The lowered BLS benchmark revision to job totals from the four quarters ending March didn’t prompt a durable move lower in yields yesterday, perhaps that news was telegraphed, not to mention fairly dated at this point. 10yr Treasury supply looms this afternoon and CPI tomorrow so that will keep any rally attempts on a short leash. Currently, the 10yr is yielding 4.07%, down 2bps, while the 2yr is yielding 3.50%, down 1 bp on the day.

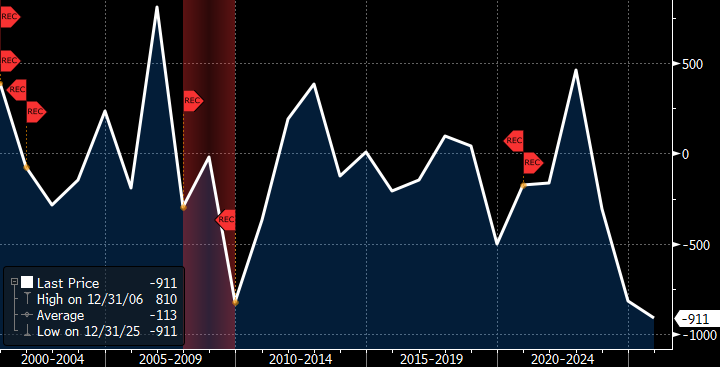

- The annual benchmarking adjustment to BLS job totals from 2Q24 through 1Q25 was released yesterday and totaled a -911 thousand reduction in payrolls over that time. That downward revision is larger than the 682 thousand expected and the 818 thousand downward revision last year. The implication is that the jobs market was weaker than initially reported and it continues a trend of large downward revisions in the last two years (see graph below). That will take the estimated job growth during that time (2Q24 through 1Q25) from 1.758 million to 847 thousand, or 70.58 thousand per month. Quite a difference from the originally reported 146.5 thousand per month.

- This revision is an annual process and represents the final adjustment to payroll totals that follows the initial monthly estimate and subsequent two-month revisions. The data for this final revision comes from the Quarterly Census of Employment and Wages that uses state-level unemployment insurance data that includes 95% of US jobs; thus, it’s the most comprehensive look at US-level employment and helps “true-up” the prior estimates to the hard data.

- Questions will now be asked as to whether these back-to-back large downward adjustments represent an issue with the current BLS process/competence or, more generously, is a result of the post-covid economy diverging from pre-covid trends that were used in developing the BLS’s statistical methods. It’s a fact that the monthly survey response rates have dropped significantly post-covid and that obviously has made estimates subject to wider error bands, and the birth-death model of business creation/demise in the post-covid era certainly needs adjusting as it’s been consistently over-estimating job creation that is just not happening in this post-covid world.

- One should keep in mind however, that with an economy of nearly 160 million workers (159.54 million) a downward adjustment of nearly 1 million, while large, represents just 0.57% of the total employed. While that may not be statistically significant, it does affect Fed policy decisions that in this case could have rate cuts coming later than they probably would have with a more precise estimate.

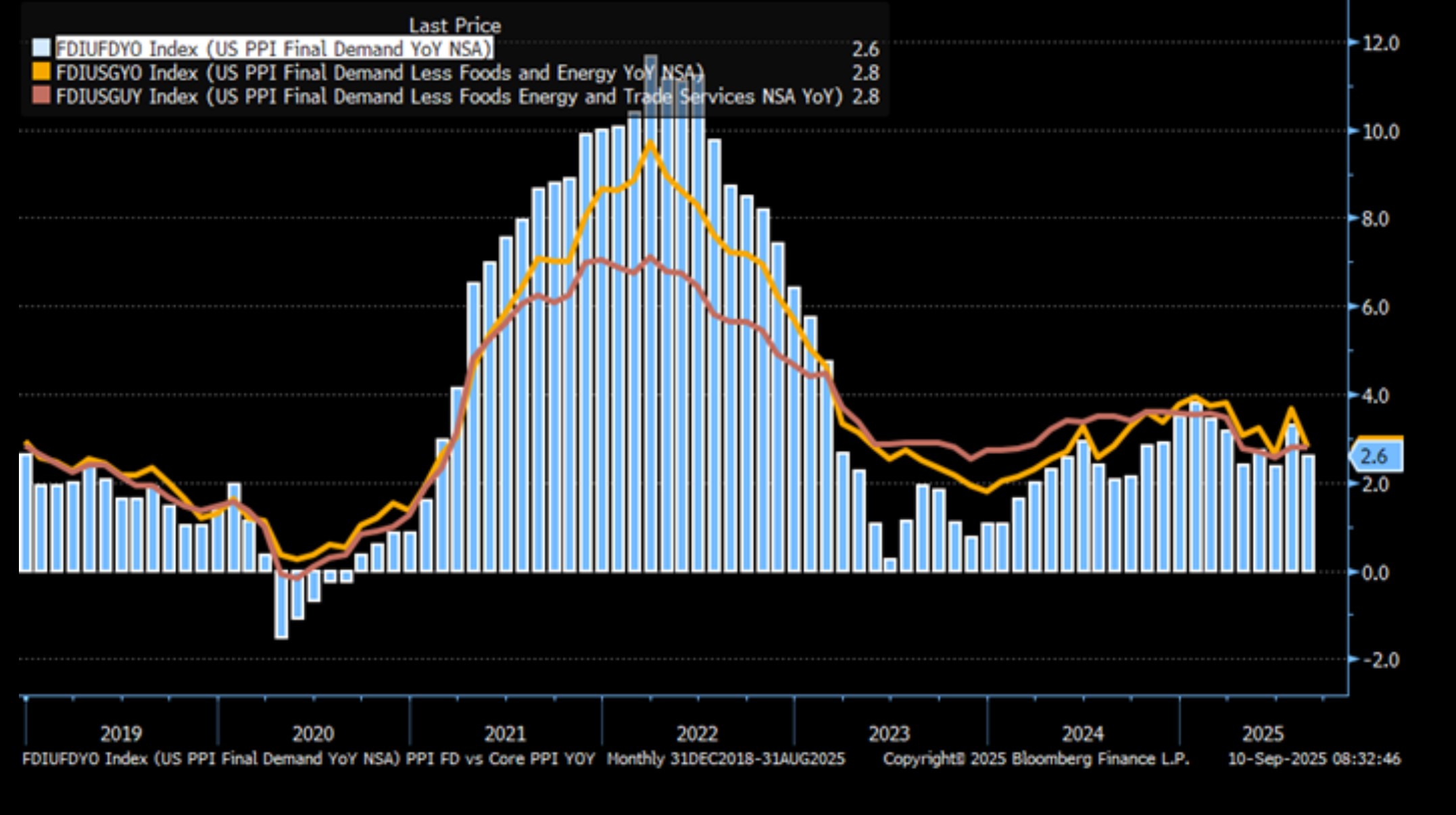

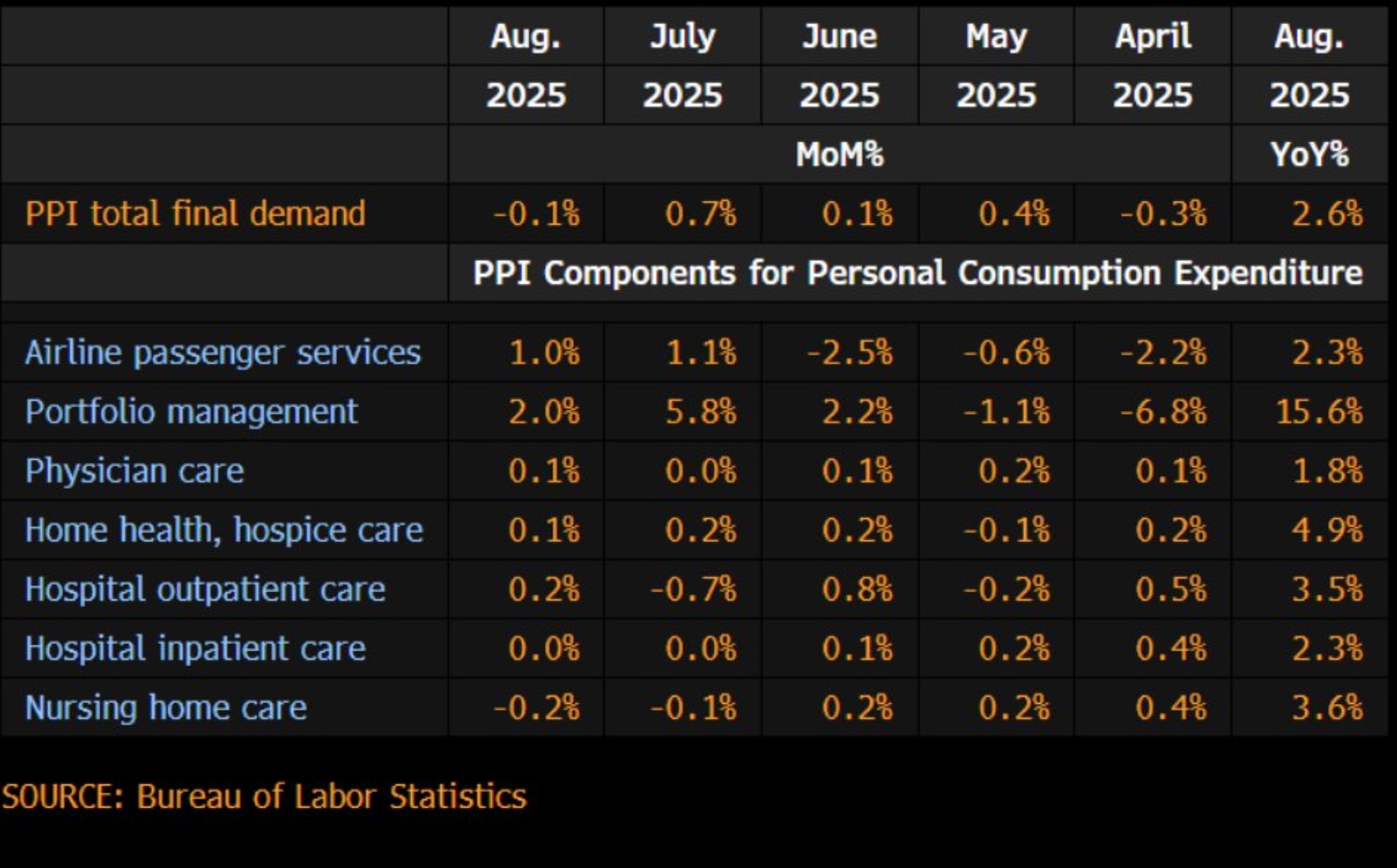

- Meanwhile, back to Inflation Week. This morning, August PPI was released with headline PPI Final Demand down -0.1% MoM, cooler than the 0.3% expectation and much improved from the 0.7% pop in July. The YoY rate improved from 3.3% to 2.6%. The dip was due to a drop in the services-side of 0.2% as margins for vehicle and machinery wholesaling dropped -4.0%. PPI ex-Food and Energy was also down -0.1%, less than the 0.3% expectation and quite a bit cooler than the 0.7% jump the prior month. The YoY rate moderated from 3.7% to 2.8%. Importantly, the components that feed into the Fed’s favorite PCE inflation series were mostly lower than July (see table below), and that could see those expectations adjusted a bit lower as a consequence.

- Tomorrow, August CPI is expected to increase 0.3% for the month vs 0.2% in July, with the YoY rate ticking up from 2.7% to 2.9% as low readings from last summer continue to roll off. Meanwhile, core CPI is expected to increase 0.3% MoM matching the prior month and keeping the YoY at 3.1%. The next four months will see 0.3% prints from last year roll off, so if core can print at 0.2% or less the YoY pace could dip below 3.0% before year end. That could be an optimistic stance, however, as core services took an unexpected jump in July. That will be watched this month for any sign of renewed “stickiness” with tariff-inspired price increases. The fact that services were lower in today’s PPI, while measured differently than CPI (margins vs. prices), does give one some hope for a better services print tomorrow.

- Once we have PPI and CPI in hand the inflation analysts will have a good idea what core PCE (the Fed’s preferred measure) will be later this month. The current expectation is for core PCE to match July’s 0.3% level with the YoY pace ticking higher from 2.9% to 3.0% as a 0.17% print from last year rolls off. In fact, through the end of this year we’ll see prints of 0.25%, 0.29%, 0.10%, and 0.21% roll off from last year which means it will be tough to expect any improvement in the annual rate if we’re adding 0.3% on average until the lumpier first quarter of 2025 prints start to disappear. Thus, while a cut in September is a sure thing, the cuts coming after will face a tougher vote if the economy retains some resilience in the face of what is likely to be sticky inflation figures.

Downward Benchmark Revision Removes 911 thousand jobs from 2Q24 through 1Q25

Source: BLS

PPI and Core PPI Cooler in August Due to Softer Services Margins

PPI Components in PCE – Mostly Lower from July

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.