Cool PCE and FOMC Thoughts

- Treasury prices have improved after a cool read on inflation from the Fed’s preferred inflation measure PCE. The spending numbers and savings rate indicates the consumer is not going away and still has plenty of ammunition to continue spending which bodes well for fourth quarter GDP. There remains a skittish risk-off tone in equities, but levels improved from pre-open after the cool inflation read. Currently, the 10yr Treasury is yielding 4.50%, down 7bp on the day, while the 2yr is yielding 4.27%, down 5bp on the day.

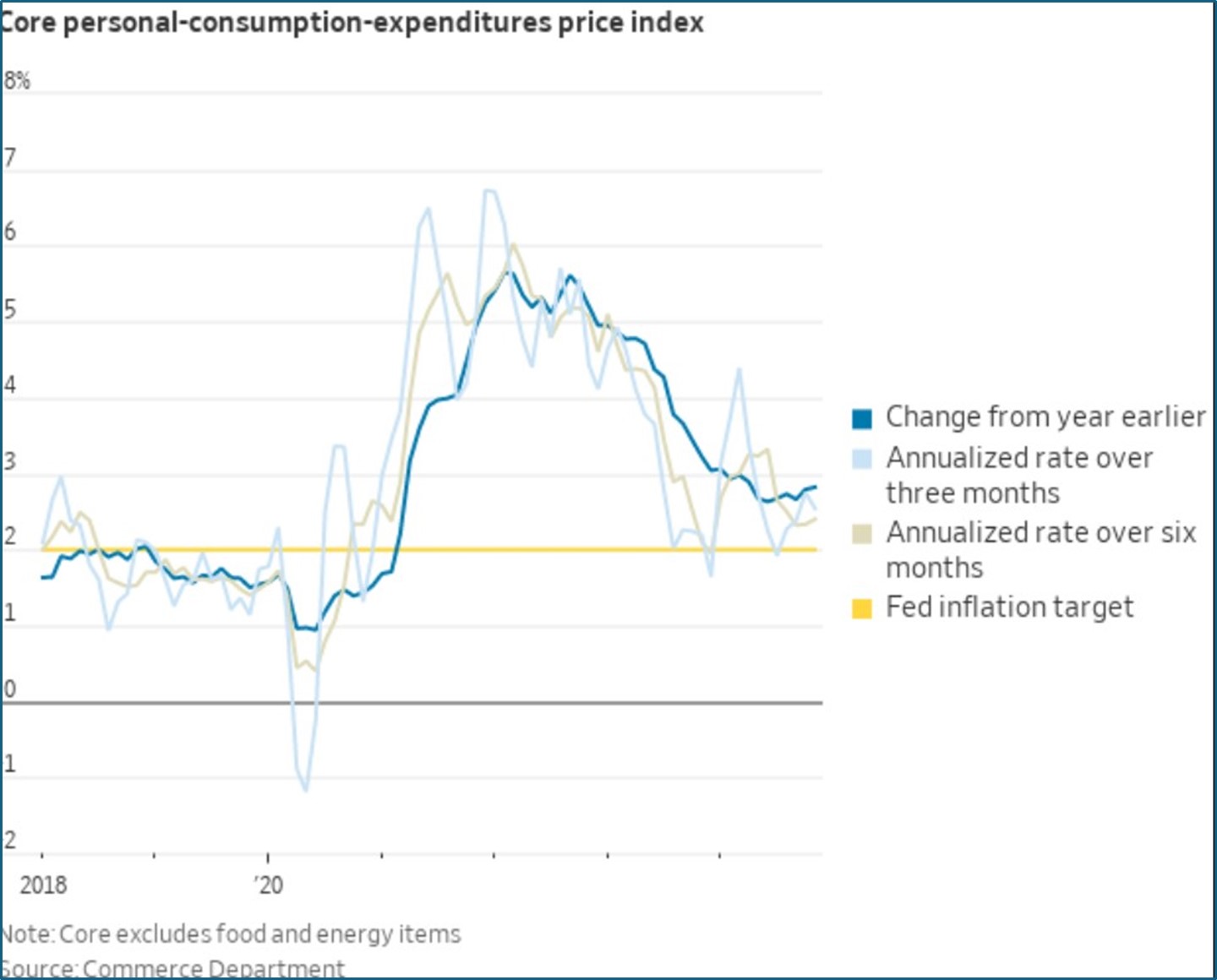

- The last of the inflation numbers for November are in this morning with the PCE inflation series as a part of the Personal Income and Spending Report. Overall, PCE inflation came in cooler than expected. Headline inflation rose 0.1% MoM vs. 0.2% expected and 0.3% in October. Despite that light monthly number, the YoY rate ticked up at tenth to 2.4% vs. 2.3% in October as those pesky base effects from last year continue to stall YoY improvement. That may change next quarter as the higher inflation rates from early 2024 start to roll off. That’s assuming, however, that the typically higher seasonal inflation at the beginning of a new year doesn’t reach the same level as 2024. That’s a big if. Meanwhile, the all-important core PCE series also came in cooler at 0.1% (a very tame 0.11% unrounded) vs. 0.2% expected and 0.3% in October. That kept the YoY rate unchanged at 2.8%, but better than the 2.9% expectation. The cooler inflation read should reduce some recent inflation angst at the Fed, but their real concern is what happens next year.

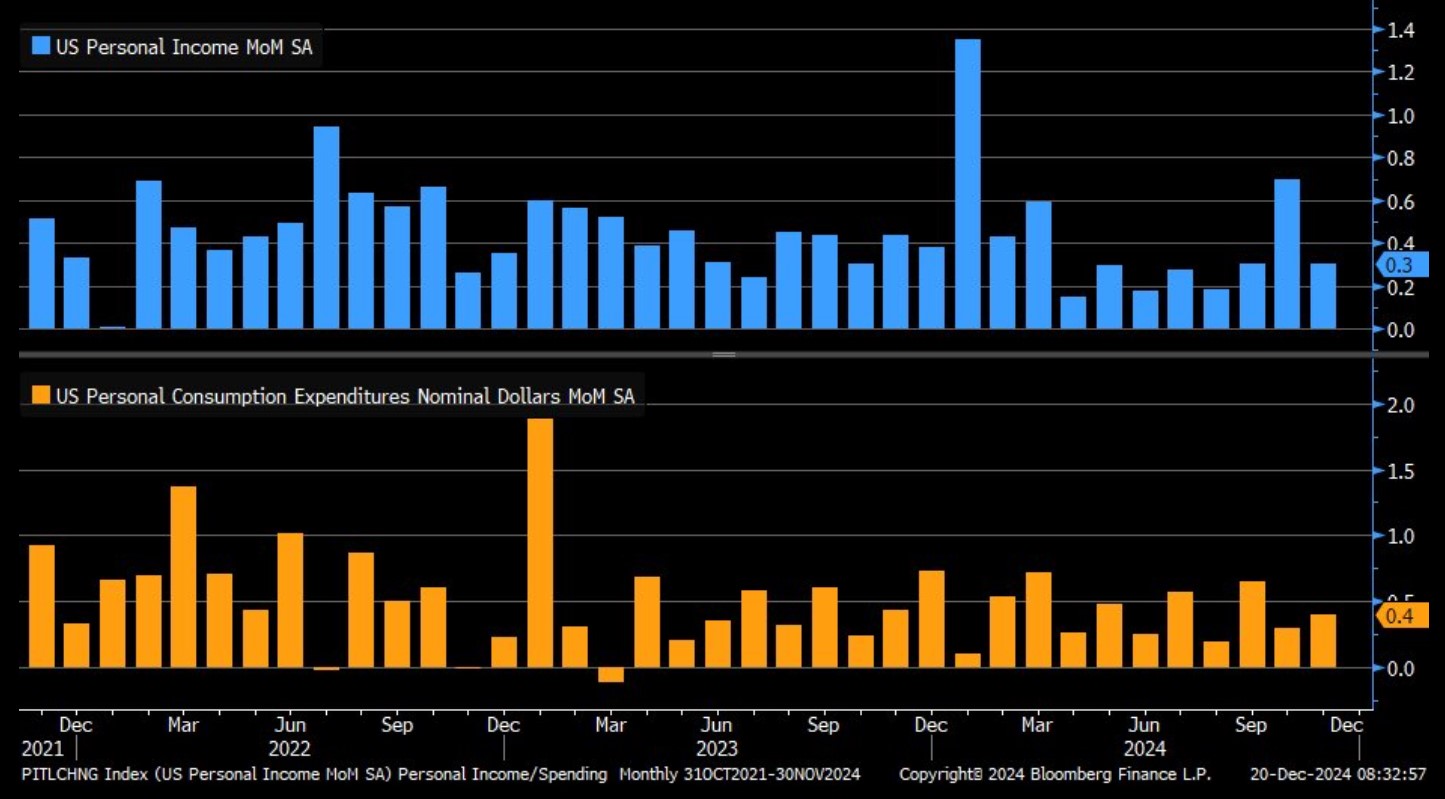

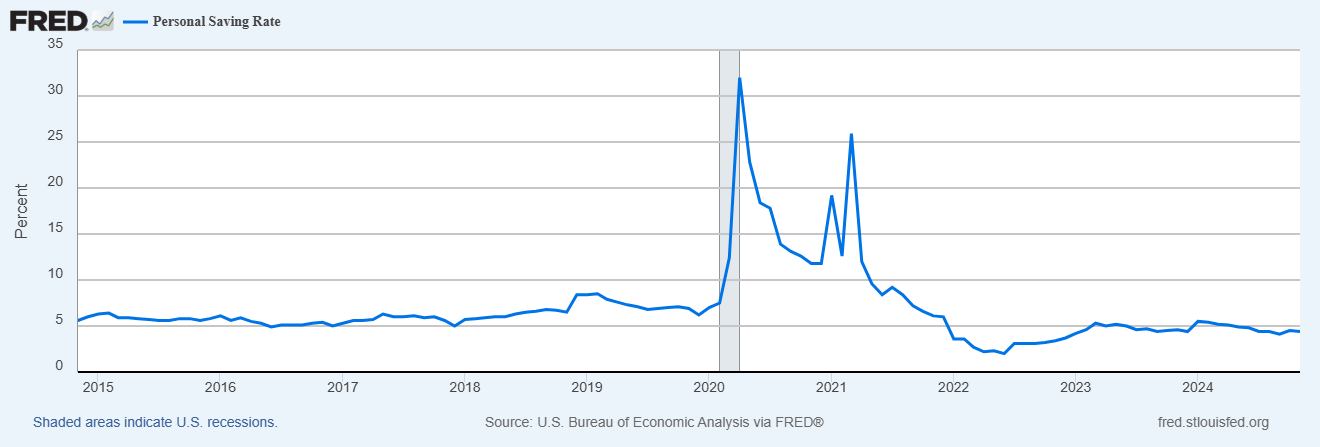

- Meanwhile, personal income rose 0.3% vs 0.4% expected and 0.7% in October (revised up from 0.6%). Personal spending rose 0.4% vs. 0.5% expected and 0.3% the prior month (revised down from 0.4%). Real personal spending (spending adjusted for inflation) rose 0.3% vs. 0.1% in October as the cooler inflation helped in that metric. With the dip in income and acceleration in spending the personal savings rate dipped a tenth from 4.5% to 4.4%. The consumer has been powering the economy ever since we emerged from lockdowns and the expectation has been they would exhaust their spending power at some point but that hasn’t been the case. Some strain has been spotted in higher delinquency rates for car loans and credit cards, but the levels remain modest and the savings rate, while ticking lower in November, still signals plenty of dry powder for spending (see graph below). Second and third quarter GDP were both at or above 3% and the current Atlanta Fed GDPNow estimate for fourth quarter is the same, and much of that growth is attributable to the consumer who doesn’t seem to be relenting.

- That’s a decent segue to some thoughts on the FOMC meeting from Wednesday and what we learned. First, the inflation mandate is back to being the focus for the Committee. After Powell’s Jackson Hole speech in August about not wanting to see any additional labor market cooling, the full employment mandate briefly held equal footing with the price stability mandate. That is over.

- The Committee, and it was broad-based, is clearly concerned about the inflationary aspects of Trump’s proposed policies and it showed in their updated inflation forecasts from the Summary of Economic Projections (SEP). The median level of PCE for year-end 2025 was bumped from 2.1% in the September forecast to 2.5%. That’s the same level they have for core PCE which was estimated to be 2.2% back in September’s forecast. When you look at the Central Tendency numbers (throw out the three high and three low projections) the uptick was even greater, and the Range (which includes all participates) the uptick was greater still. So, clearly there is concern over inflation accelerating in 2025, or at the very least improvement slowing.

- This renewed focus on inflation was buttressed by Powell’s comments that the economy is in a good place, and with 3% GDP being the recent norm it’s hard to argue with him. He did offer that while the labor market has cooled it hasn’t deteriorated to a concerning level. The lack of layoffs as depicted in the weekly jobless claims is an example of that. So, while hiring has slowed, layoffs remain muted. Thus, the Committee feels it’s right to slow the pace of rate cuts in 2025 and beyond until the economic impact of the new administration’s policies can be better understood.

- One thing to consider, however, is that yields have moved higher since the September meeting. The 10yr yield has risen nearly 100bp since then. That will have a dampening effect on interest sensitive sectors, but the Fed may well reply that the housing market has been in the doldrums since the hiking cycle began back in 2022 and the overall economy has weathered that without too much trouble, thanks mostly to the consumer. As long as that is the case, and the income and spending numbers this morning vouch for that, expect the tough line on inflation to continue.

PCE and Core PCE YoY Source: Bloomberg

Source: Bloomberg

Personal Income and Savings MoM Source: Bloomberg

Source: Bloomberg

Personal Savings Rate: Still Holding Near Long-Run Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.