Cool Inflation Numbers Keep Bid in Treasuries

Cool Inflation Numbers Boost Treasury Prices

- More cool inflation reads are boosting Treasury prices this morning. First, UK CPI came in below expectations and then German PPI did the same. That builds on the bull/easing case that the improving inflation picture is becoming a broadening global story and not just US-centric. Presently, the 10yr Treasury is yielding 3.89%, up 10/32nds in price and the 2yr Treasury is yielding 4.38%, up 3/32nds on the day.

- The push back from Fed officials on the market’s rate-cutting expectations continued yesterday with Atlanta Fed President Raphael Bostic and Richmond Fed President Barkin offering their views. Both are on the moderate to dovish spectrum, yet both refused to embrace the market’s outlook. While their comments were more measured than their more hawkish colleagues, Bostic’s comment that he didn’t “see a need to rush into rate cuts” succinctly summarized both official’s take on the state of policy.

- Just as in earlier Fed pushback the comments did little to shake the markets aggressive rate-cutting views. Odds are over 86% for a March rate cut and nearly 150bps in cuts for all of 2024. Chicago Fed President Goolsbee, who we’ve already heard from this week, will be on a Wall Street Journal podcast today and Philly Fed President Harker will conduct a radio interview this afternoon. That appears to be it for Fed speak this week as Fed members, and investors, turn their attention to the approaching holidays.

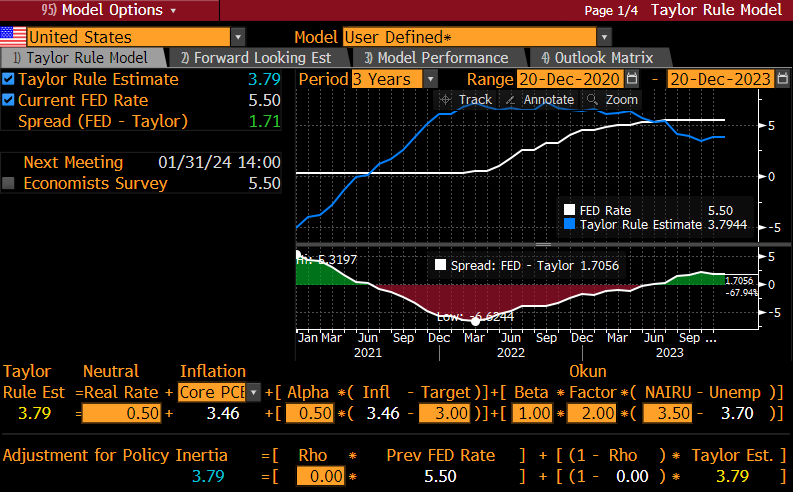

- All this talk of rate-cutting and the dovish pivot had us revisiting what the Taylor Rule has to say on the subject. The Taylor Rule is the creation of Professor John Taylor who served in the US Treasury and Council for Economic Advisors for several administrations. The model attempts to derive what the funds rate should be given various inputs like the core PCE rate, unemployment rate, and the neutral rate. In the period before the rate-hiking cycle commenced the rule was consistently above the actual funds rate, indicating very accommodative policy. Lately, the rule has been well below the current policy rate indicating a restrictive policy.

- The latest Taylor Rule estimation is 3.79% (see calculation below). Fed policymakers will be quick to add that they don’t set policy by models but they no doubt keep an eye on what they’re projecting in helping to guide policy decisions. The dip in the Taylor rule rate, and the expectation that Friday’s PCE could be another soft number further lowering the model rate, could be one factor behind the Fed’s dovish pivot.

- Finally, Lelia Coggins from our Strategies Group and I sat down to review our economic outlook for 2024, along with some recommended portfolio strategies for the upcoming year. The following links will take you to the podcast which is about 30 minutes in length. We invite you to give it a listen.

Spotify: https://open.spotify.com/episode/4QHQiBBXXb2lGHWN4WlSG4?si=xJfXsnjwSmuZaGGWya8JDg

Taylor Rule Estimates Fed Funds Rate Should Be 3.79%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.