Cool Core CPI has Markets Leaning the Wrong Way

- Treasury yields are lower and equities rallying on a near as-expected CPI report for December that obviously had the market leaning towards a more bearish surprise. The combination of friendly PPI and CPI numbers for December has restored hopes of a rate cut sometime around mid-year and that’s aiding in the rally in both stocks and bonds. Currently, the 10yr Treasury is yielding 4.66%, down 13bps on the day, while the 2yr is yielding 4.27% down 10bpson the day.

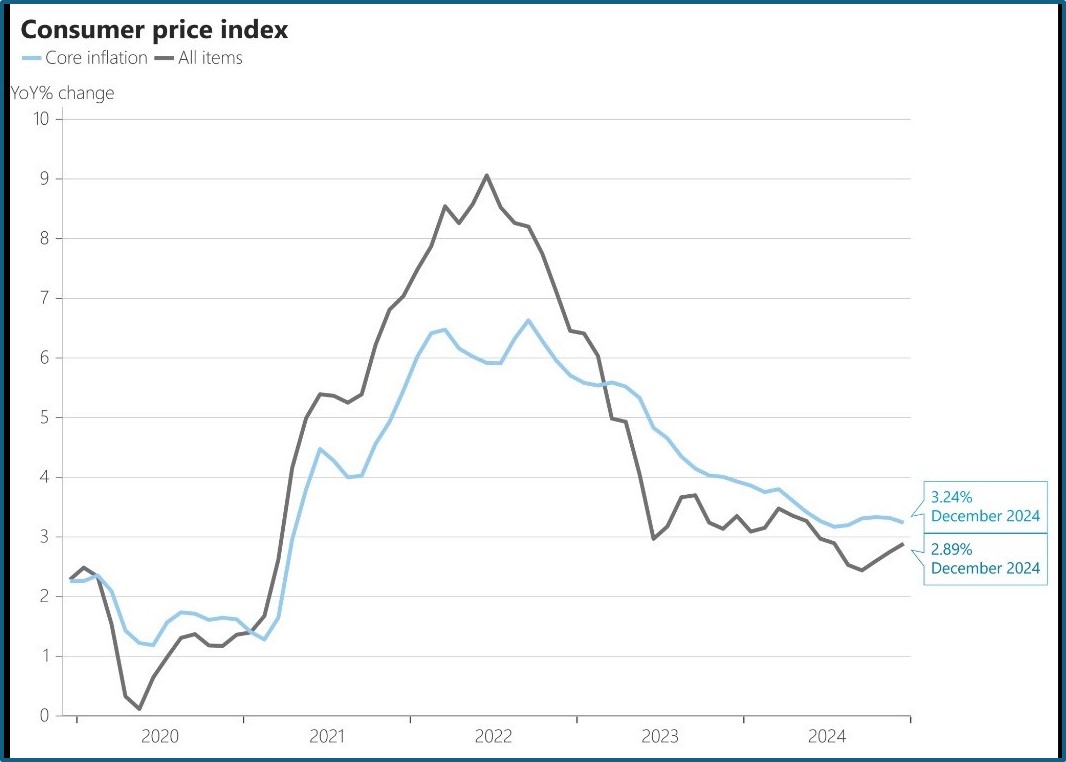

- Cooler PPI numbers for December were followed at the retail level with CPI coming in at or below expectations. Core CPI rose 0.2% (0.225% unrounded), a tenth below the 0.3% expectation, while the YoY rate ticked lower to 3.2%, also a tenth lower than the 3.3% expectation which was the November YoY rate. The 0.2% MoM rate broke a four-month string of 0.3% prints. In addition, beginning next month, we’ll see three straight months of 0.4% prints from last year roll off, so if we can see 0.3%, or lower, prints this year the improvement in the YoY rate should continue.

- Overall CPI rose 0.4% matching expectations but above the 0.3% the November print. The 0.4% MoM rate was the highest since March 2024 and was driven by a bump in energy prices which accounted for 40% of the monthly increase. Food rose 0.3% MoM, which is better than the 0.4% November print, but it was running at 0.2% during the summer months. If you want a culprit there blame those darn eggs which rose 3.2% MoM and that’s after an 8.2% increase in November as the avian flu has crimped supply. The overall CPI YoY rate rose 2.9%, matching expectations but two-tenths above the 2.7% pace in November. That’s the highest YoY rate since July. While the overall rate was hot, it was concentrated in the volatile energy area which is why the core measure gets more attention from the Fed.

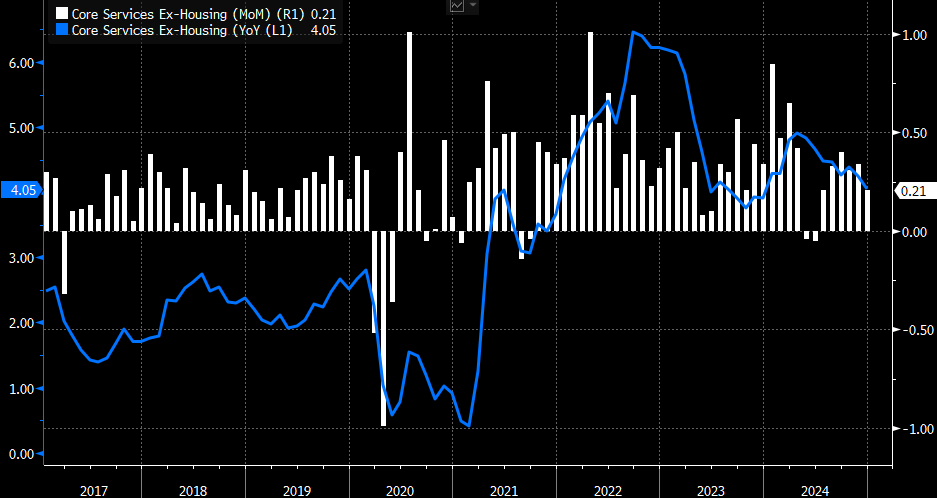

- Moving back to the core reading, core services ex-housing put in a good month increasing 0.21%, the lowest since a 0.21% in July (see graph below). The YoY rate dipped to 4.05% which is the lowest since December 2023 (see graph below). The service sector has been driving the economy for more than a year, so to see core services moderate in the face of strong economic performance speaks to price increases remaining modest, despite this economic strength. That’s certainly a positive that will be noted by the Fed.

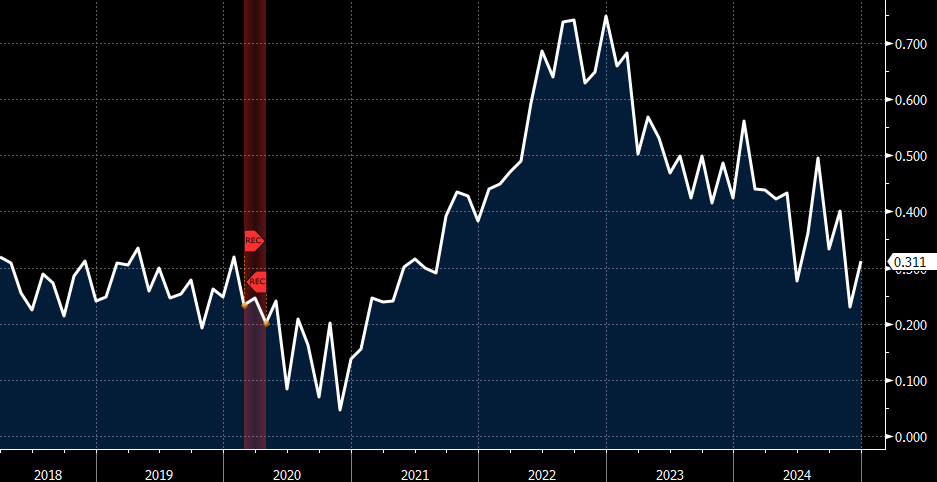

- Meanwhile, the ever-important Owners’ Equivalent Rent (OER) ticked higher to 0.31% vs. 0.23% in November but remained below the 0.4% – 0.5% readings that prevailed for much of 2024 and is within shouting distance of the 0.2% – 0.3% pre-pandemic level for OER. Given that it’s the largest single component of CPI at 27% as it goes the overall CPI will follow to a certain degree. Thus, the long-expected roll-over of OER, while not occurring in a straight line, does seem to be moderating which bodes well for future inflation readings in early 2025 (see graph below).

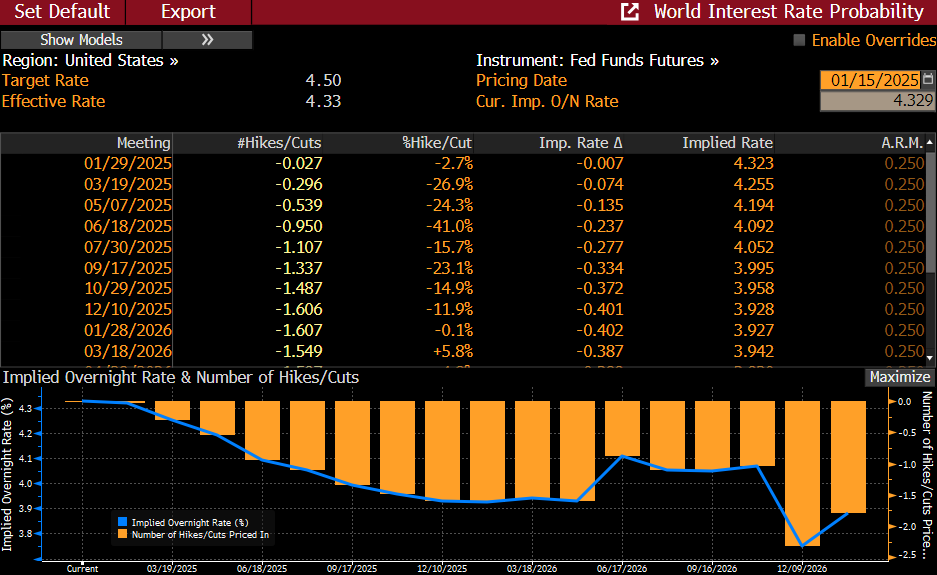

- On net, the market is rallying on the report as there was a bearish lean with a fear that it would come in hotter-than-expected and further dash hopes of rate cuts in 2025. The cool PPI and CPI reports have moved futures market back to June and/or July as a possible next rate cut, but only 40bps of cuts for all of 2025. So, baby steps in the futures market in rate cut expectations.

- We’ll get a trio of Fed speakers today: Barkin, Kashkari, and Williams who will certainly opine on the latest inflation numbers so look for those headlines to hit during the day. We suspect, however, that with a pause expected at the January 29 meeting, the comments will be more in the “good, but more work to be done” category.

- Tomorrow, December retail sales will be the last of the key reports for the week. Overall sales are expected to increase 0.6% vs. 0.7% in November with the less volatile sales ex-auto and gas up 0.4% vs. 0.2% in November. If expectations are met it will show once again the consumer is not yet retreating, which will limit rate cut expectations.

First Rate Cut Now Estimated Around June/July but Only 40bps Estimated for all of 2025

Source: Bloomberg

Core Services Ex-Housing – Lowest Since July Source: Bloomberg

Source: Bloomberg

Owners’ Equivalent Rent Ticked Higher but Still Close to Pre-Pandemic Levels Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.