Concern Over Fed Independence Grows

- The Treasury curve is steepening a bit as the debate over Fed Independence grows and term premiums begin to edge higher on longer-term debt, while shorter maturities eye a September rate cut. Meanwhile, a day devoid of data will allow DC machinations to dominate the trading tone, albeit with 5yr supply on the docket for this afternoon. That should keep any rally attempts on a short leash. Currently, the 10yr note is yielding 4.29%, up 3bps on the day, while the 2yr yields 3.66%, down 2bps in early trading.

- President Trump’s demand that Fed Governor Lisa Cook be dismissed from her position has forced the issue of Fed independence front and center. The first broadside to that independence came as Trump berated Fed Chair Powell to cut rates NOW. At Jackson Hole last Friday, Powell finally indicated a cut may be coming in September. Trump then turned his sights on Fed Governor Lisa Cook after FHFA Head Bill Pulte claimed she falsified two mortgage applications. The documents were executed before her 2022 appointment to the Board, but Trump is using it as a pretext in demanding her dismissal for “cause”.

- As the lawyers parse the law, and the meaning of cause, the impact, whether Cook remains or not, will be to chill, or at least give Fed members pause, when legitimate concerns over policy clash with the administration’s desires for lower rates. When Powell says, as he often does, that policy decisions will be data dependent will that still be the case in an era when the president openly demands lower rates, despite what the data may say? Economic history is not flattering when central banks have succumbed to political pressure rather than economic realities. The market, for now, is taking it all rather calmly, albeit term premiums are edging higher on longer-dated debt which is a logical move and works directly against Trump’s desire to force mortgage rates lower to restart the housing market. One will find the Fed can force some rates lower, but the market will have its say about others.

- The August Conference Board Consumer Confidence reading came in at 97.4, a slight beat to the 96.5 Bloomberg consensus, but a modest decline from 98.7 in July. The Present Situation reading decreased to 131.2 from 132.8 (lowest since April) while the Expectations index fell from 76.0 to 74.8. Importantly, average year-ahead inflation expectations bounced to 6.2% from 5.7%. This is the highest since May, and first monthly increase since April.

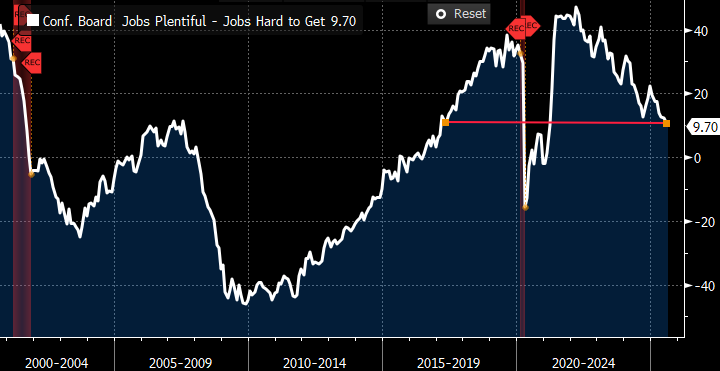

- Meanwhile, employment sentiment deteriorated further with the Labor Differential falling to 9.7 from 11.0 in July (see graph below). This is the eighth consecutive month in which the Labor Differential has declined, and the lowest the measure has been since February 2021. It continues a discouraging trend for new hires which has started to appear in the monthly BLS new job totals. Within the details of the release, it was mentioned that, “Notably, consumers’ appraisal of current job availability declined for the eighth consecutive month, but stronger views of current business conditions mitigated the retreat in the Present Situation Index. Meanwhile, pessimism about future job availability inched up and optimism about future income faded slightly.”

- July’s headline decline in durable goods orders was driven by a drop in the transportation category but activity rebounded in less volatile areas. Headline orders declined -2.8% in July vs. -9.4% n June. The Bloomberg consensus expected a -3.8% decline. Transportation weighed on the headline number for a second straight month, with Boeing receiving 31 orders in July, down from 116 prior and 303 in May. Airbus received only seven orders in July, down significantly from 203 prior. While one often excludes transportation to see less volatile trends, it should be noted that the transportation category typically constitutes nearly one-third of total orders with motor vehicles contributing 60% to the category and 40% from aircraft. So, despite its volatility it’s not a category to be entirely dismissed.

- New orders excluding transportation jumped 1.1% vs. 0.3% in June. Core orders —non-defense capital-goods, excluding aircraft — also increased 1.1%, vs. -0.6% prior. Meantime, core shipments — an input for GDP— were up 0.7% vs. 0.4% in June. As in the economy as a whole right now, Investment in AI remained a bright spot. Spending on business equipment grew 4.8% in the second quarter vs. 23.7% prior, with computers and peripheral equipment leading the way. The business community benefitted from the recently passed budget legislation which extends bonus depreciation, but uncertainty as to future trade policies is acting as a headwind to more aggressive spending in this category. Net-net, orders were generally solid, outside the volatile air transport category, but it’s easy to envision more business spending if there is less uncertainty on future trade policies.

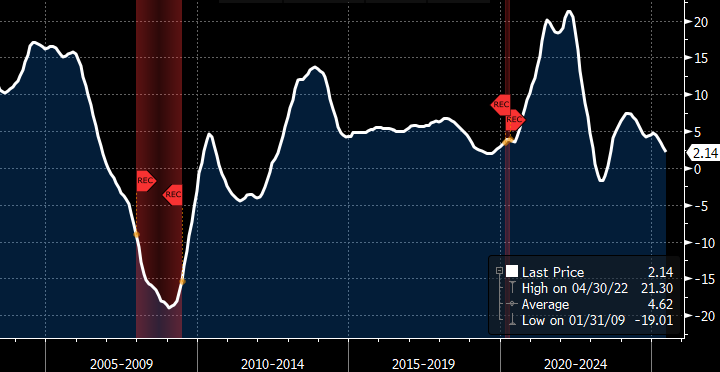

- Home prices in more major US cities fell in June, continuing a downshift in the housing market. Prices in just three of the 20 cities tracked by the S&P Cotality Case-Shiller composite index rose last month, the fewest since December 2022. The 20-city measure rose just 2.14%, the lowest since August 2023. The national home price measure increased 1.9% year over year — also the slowest pace since summer 2023 — and ticked up just 0.1% from May to June.

- Overall, home prices are now failing to keep pace with inflation. The deceleration in the data has broadened. In February, prices in a majority of the 20-city composite were growing, while they advanced in 19 last December. The geographic divergence has also reversed. Southern and West Coast cities showed the strongest growth during the Covid pandemic but are now leading declines. Prices in Phoenix fell 1.2% in June. The only three cities with monthly growth were Chicago, New York, and Minneapolis.

10-Year Term Premiums Edging Higher as Fed Independence is Challenged

Source: Bloomberg

Conference Board’s – Labor Differential (Jobs Plentiful – Jobs Hard to Get) Keeps Declining

Source: Bloomberg

S&P Case Shiller 20-City Home Price Annual Price Change – Dipping Below the Inflation Rate

Source: Bloomberg

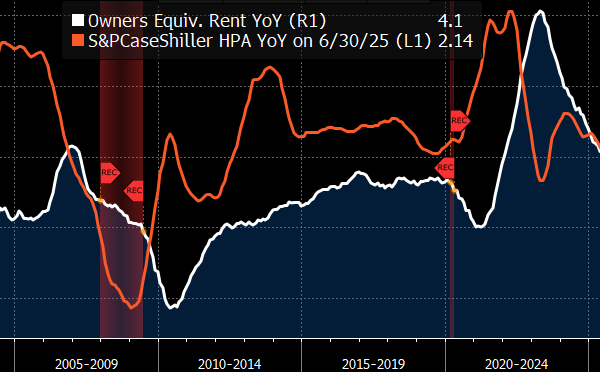

The Good News on Slowing Home Price Appreciation – Maybe OER Continues to Drift Lower Easing Inflation Pressure?

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.