Closer Polls Have Treasury Yields Moving Lower

- Improved polling results for Harris over the weekend have investors pulling back some on the Trump Trade that had dominated the market over the last couple weeks and that has Treasuries in the green as this consequential week opens for business. While everyone will be glad to see the event risk of the election conclude tomorrow, the fear remains that the close race may not be fully known by Tuesday night. We can only hope it doesn’t drag on into December like the 2000 election. Currently, the 10yr Treasury is yielding 4.28%, down11bps on the day, while the 2yr is yielding 4.14%, down 7bps on the day.

- With this week dominated by non-economic releases in the form of elections tomorrow and the FOMC rate decision on Thursday, the economic calendar obliges with few first-tier data releases. The good news is the election is finally upon us and will be over tomorrow evening. However, whether we have a clear winner is another matter. Also, the House and perhaps some Senate races may be too close to call on election night so what we know on Wednesday may not be much.

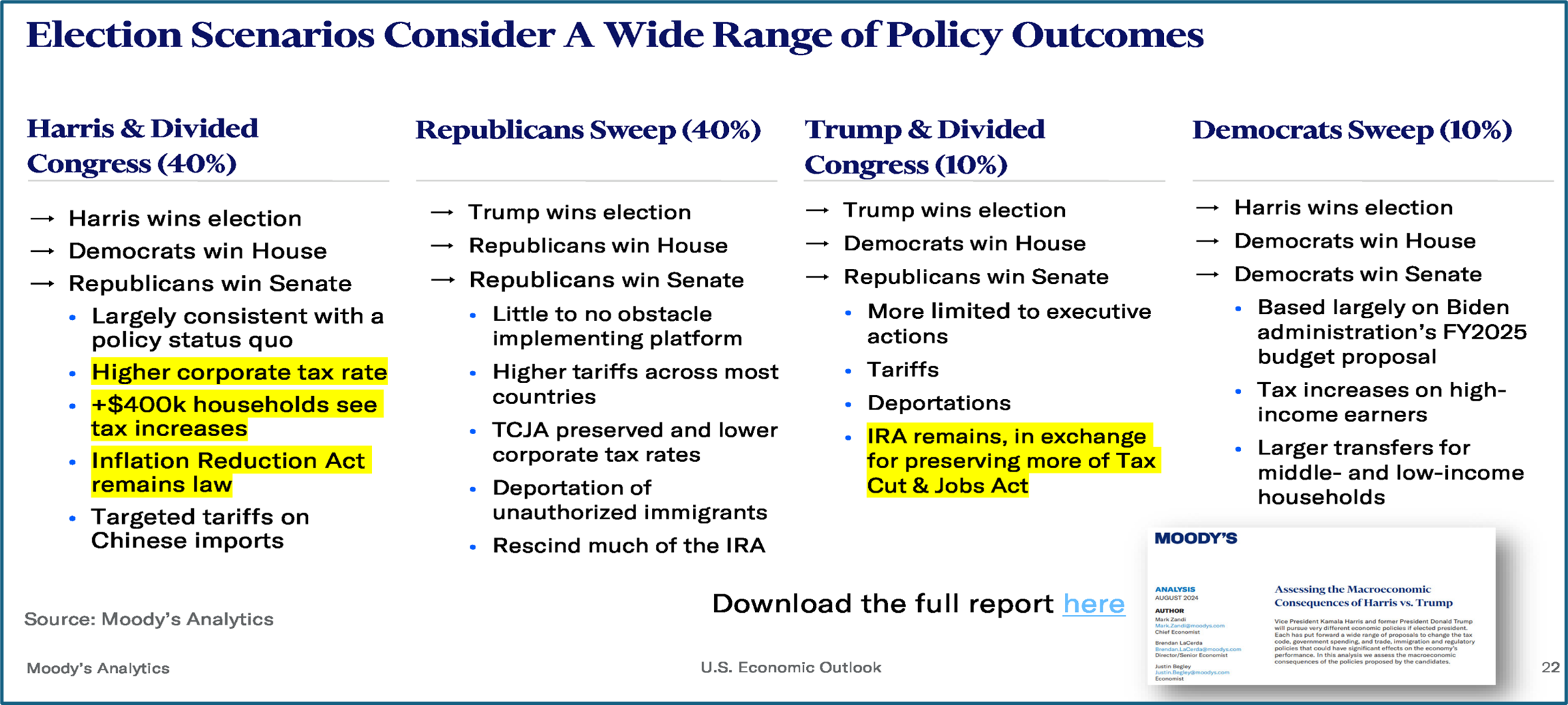

- The latest polls are giving Harris improved odds to win than was the case last week, and that has markets reversing some of the inflation-inducing Trump Trade as a result. But the race is still too close to call with any conviction which is another reason we expect it will be a long evening. The two scenarios with the greatest odds of happening are a Trump win with a Republican sweep (40%), or a Harris win with a divided Congress (40%), The simple calculus right now is a Trump win and the resulting tariffs and deportations and extension of the 2017 tax cuts will be inflationary. The question is how much of that has been priced in, and admittedly, some of that is being reversed today. Meanwhile, a Harris win is seen as a status quo move that would result in a bullish flattener with the potential for the long end to rally off reduced inflationary implications.

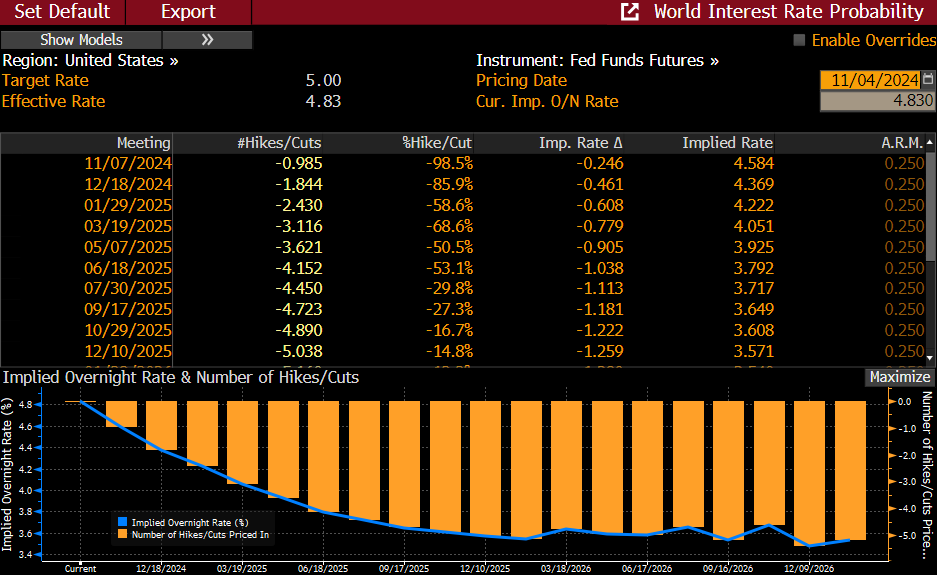

- Meanwhile, Thursday’s FOMC rate decision should prove to be anti-climactic compared to the election. The Fed is widely expected to cut 25bps on Thursday but with no updated rate or economic forecast until December the only real drama will come from any statements at the post-meeting press conference. Not wanting to show too many cards before the December meeting, Powell is probably not going to be divulging much in the way of market-moving comments. We continue to believe the Fed will cut another 25bps at the December meeting, but the data-dependent phrase is likely to be heard more than once during the press conference.

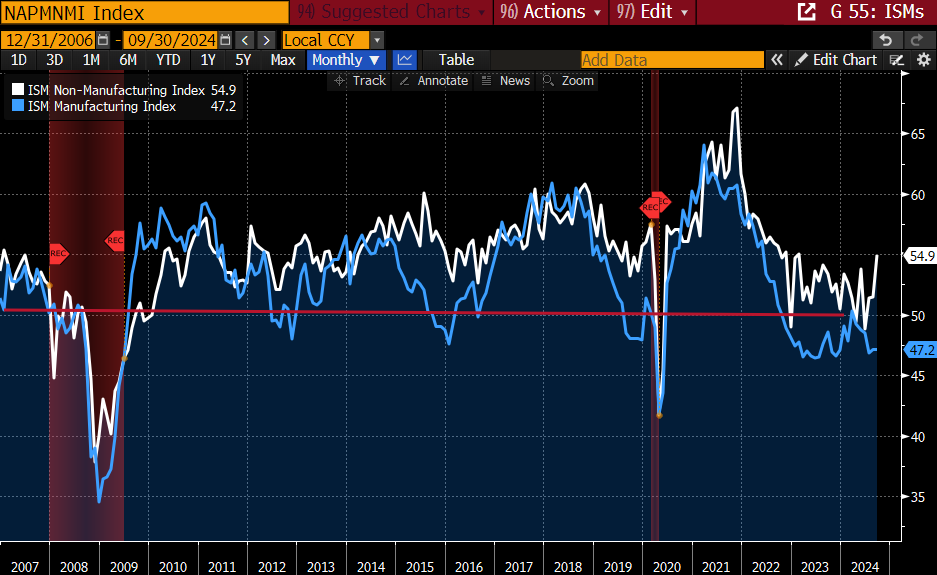

- Some of the sparse data we receive this week will be headlined by the October ISM Services Index due tomorrow. Another solid result is expected at 53.8 vs. 54.9 in September but attention will also be paid also to the prices paid component, employment, and new orders. The service side has carried the economy for the past year so any softening here would be a concern in relation to the soft-landing scenario.

- Almost as an afterthought to the main events, the Treasury will be selling more debt this week. $58 bn 3-year notes will be sold today followed by $42 bn in 10-year notes tomorrow, and $25 bn 30-year bonds will be offered on Wednesday. the Treasury Department did reassure investors last week that coupon issuance will be stable for at least the next several quarters which should prove constructive in moving the new debt without large concessions. We’ll get to test that theory this week.

Futures Market Sees 98% Odds of Rate Cut Thursday and 86% Odds of December Cut

ISM Manufacturing Sector Remains in Contraction Territory While the Services Sector Remains in Expansion

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.