China Trade “Deals” and the Fed

- Treasuries are treading water this morning as another earnings boost in the AI space has equities on the front foot as October ends. Amazon beat earnings yesterday, backed by its cloud business, with that familiar segment leading the equity market higher this morning. Next week should be Jobs Week, but other than ADP and private sector reports the market will be reading tea leaves as much as anything else trying to determine the state of the labor market. Currently, the 10yr Treasury is yielding 4.10%, up 1bp on the day, while the 2yr note yields 3.61% flat in early trading.

- President Trump’s swing through Asia this week finally brought him face to face with Chinese Premier Xi yesterday. The much-anticipated meeting did bring about a flurry of trade-related announcements, but you can think of them more as delays in some of the more onerous proposals that have been floated by both countries rather than a real trade agreement.

- The US will cut fentanyl-related tariffs from 20% to 10% and China will again buy some US soybeans. In addition, the 100% tariff threat by the US is tabled for now. The parties did discuss Nvidia and allowing access to Chinese firms, but not the premier Blackwell chips that are the cutting edge of chip technology. China also agreed to suspend for one-year rare earth export controls while China mentioned that the US agreed to suspend for one-year export controls against certain blacklisted Chinese firms.

- There was no commitment by China to limit the purchase of Russian oil, a key funding source for Russia’s Ukraine war. Meanwhile, Trump did mention that China had agreed to buy more US energy, types and amounts uncertain. Also uncertain is the levies on vessels calling on US and China ports. In its readout of the discussions, China said the tit-for-tat levies on vessels will be suspended for one year, but US Trade Representative Jamieson Geer was vaguer on the matter. Finally, plans are also being drawn up for President Trump to visit China in April with Xi reciprocating with a US visit later in the year.

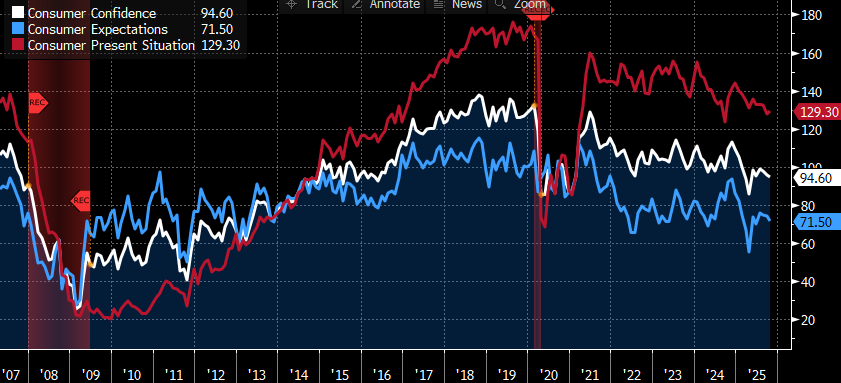

- While the data blackout continues, privately sourced reporting is filling in some gaps and the New York-based Conference Board released its October Consumer Confidence Survey this week. Consumer confidence fell 1.0 point to 94.6. The reading, however, was above the consensus estimate of 93.9. Consumer assessments of the present situation improved (129.3 vs. 127.5 prior), but future expectations declined (71.5 vs. 74.4 prior).

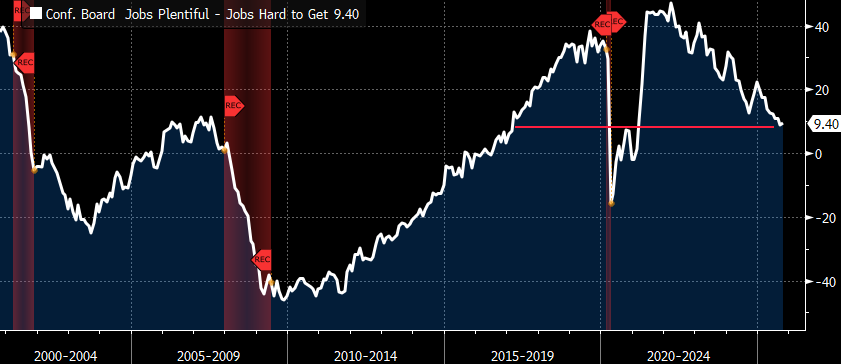

- Consumers views of current job availability improved in October for the first time since December, but that was overshadowed by pessimism about the job outlook going forward. Digging into the details, perceptions of current labor-market conditions were mixed. Even as consumers found jobs slightly more plentiful (27.8% vs. 26.9% prior), more people said jobs were hard to get (18.4% vs. 18.2% prior). Fewer respondents expected more jobs going forward (15.8% vs. 16.6%prior), while more anticipated that fewer jobs would be available (27.8% vs. 25.7% prior). Those lower labor expectations overshadowed the slight improvement in current labor conditions.

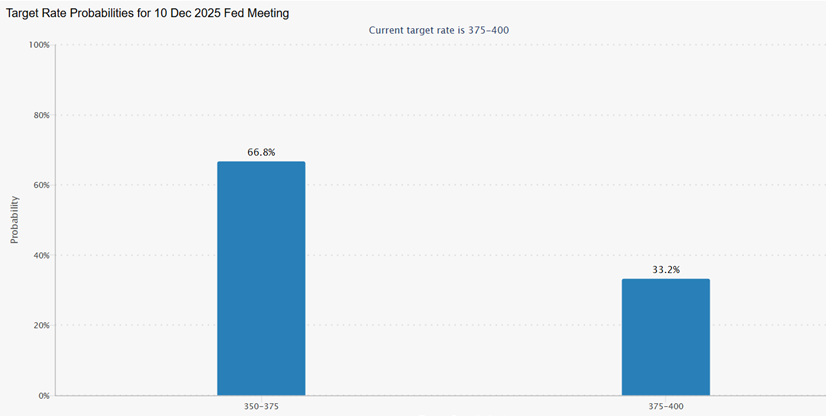

- While the Fed did cut rates 25bps at Wednesday’s FOMC meeting, Chair Powell was quick to remind investors that a December rate cut is far from a done deal. While that dealt a blow to Treasury prices, especially on the short end, it shouldn’t surprise most veteran Fed watchers as Powell has a habit of dialing back market expectations when they get extreme. Prior to the meeting, odds were pushing above 90% for a December rate cut and that probably rubbed Powell the wrong way.

- While we still see a rate cut coming in December, as labor market weakness continues, Powell doesn’t want to be boxed into a corner. He has a fair number of committee members primarily concerned with inflation (and we saw one dissent on Wednesday). That number will only grow with another rate cut in December if inflation continues to reside around 3.0%, which it’s likely to do.

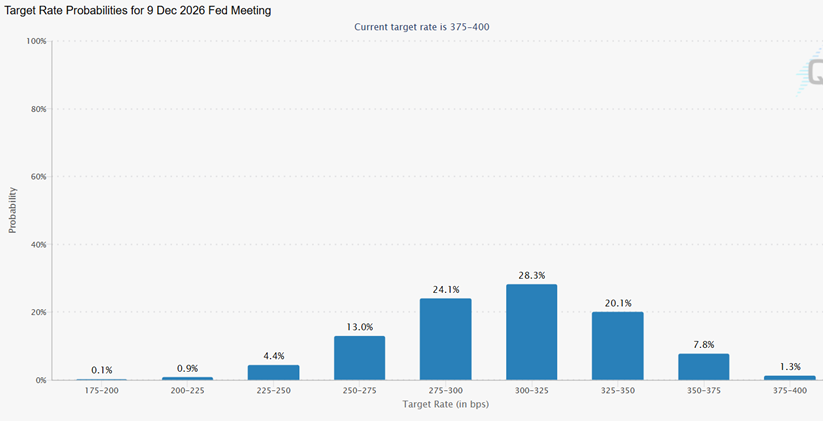

- If we get a December cut, that will put the funds rate at 3.50% – 3.75% which is approaching the neutral rate estimate for many Fed officials. While the median rate is 3.00%, the latest SOFR curve puts it at 3.11% and there are plenty of Fed members with estimates ranging between 3.25% and 3.75%. If inflation continues to reside in the 3.00% range, and we see no reason for it to take a sudden dive lower, those members will get increasingly agitated, and vocal, about cutting further. Thus, while we do expect another cut in December it’s likely to come with more than one dissenting vote. The real test, however, will come in the first quarter next year as additional cuts will clearly be seen as moving from restrictive to accommodative, which could be a bridge too far for those already concerned about inflation.

- Finally, the FOMC also decided this week to end Quantitative Tightening after November. Thus, any maturities in Treasuries after November will be reinvested in a like security (i.e., a maturing 2yr Treasury will be reinvested in a new 2yr Treasury). Meanwhile, the bulk of portfolio paydowns are coming from the MBS portfolio which any principal returning will be reinvested in Treasury Bills. So, expect any marginal benefit from ending QT to be reflected in a larger share of Treasury Bill purchases going forward. It’s not likely to have any material impact to coupon Treasuries, especially the longer maturities.

Futures Odds of a Cut in December Still Strong but Down from the 90% Level Source: CME Group

Source: CME Group

Futures for December 2026 Now See Getting Below a 3-Handle as a Challenge Source: CME Group

Source: CME Group

Consumers Continue in a Bad Mood Source: Conference Board

Source: Conference Board

Jobs Plentiful – Jobs Hard to Get: Continues to Edge Lower Source: Conference Board

Source: Conference Board

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.