Busy Week of First Tier Numbers, But Will it Matter?

- It’s a busy week of first-tier economic reports, headlined by Friday’s April release of nonfarm payrolls. The question is, with much of the data coming pre-tariff impact, will it matter much to investors as tariff “negotiations” continue in the background? Equity futures are quiet as is Treasury trading as the data flow doesn’t get started in earnest until tomorrow. Currently, the 10yr is yielding 4.28%, up 1 bp on the day, while the 2yr is yielding 3.76%, unchanged on the day.

- As mentioned, it’s a busy week of first-tier data, culminating in the April employment report on Friday, and with the Fed on pre-meeting radio silence this week it will have to be the data that distracts enough from tariff talk to influence trading. And diminishing the data somewhat this week, the expectation is that any tariff impact of these mid-March to mid-April reports will be minimal with more impact seen in the May numbers. So, in the end, despite the plethora of new data this week, it might already be considered a little stale.

- As we mentioned, the big release of the week comes Friday with the April Nonfarm Payroll Report. Expectations are muted with 125 thousand new jobs expected vs. 228 thousand in March. The unemployment rate is expected to remain unchanged at 4.2% and wages also unchanged at 0.3% MoM. Anything south of expectations will add to angst that the economy is slowing even before the full brunt of tariff effects are felt.

- Tomorrow, the Job Openings and Labor Turnover Survey for March will be released and it’s expected to show a modest decline in job openings which has been the trend of late. With job openings now running close to 1 to 1 with the number of unemployed it’s back to pre-pandemic levels indicating a loosening in labor market conditions that the Fed has been after.

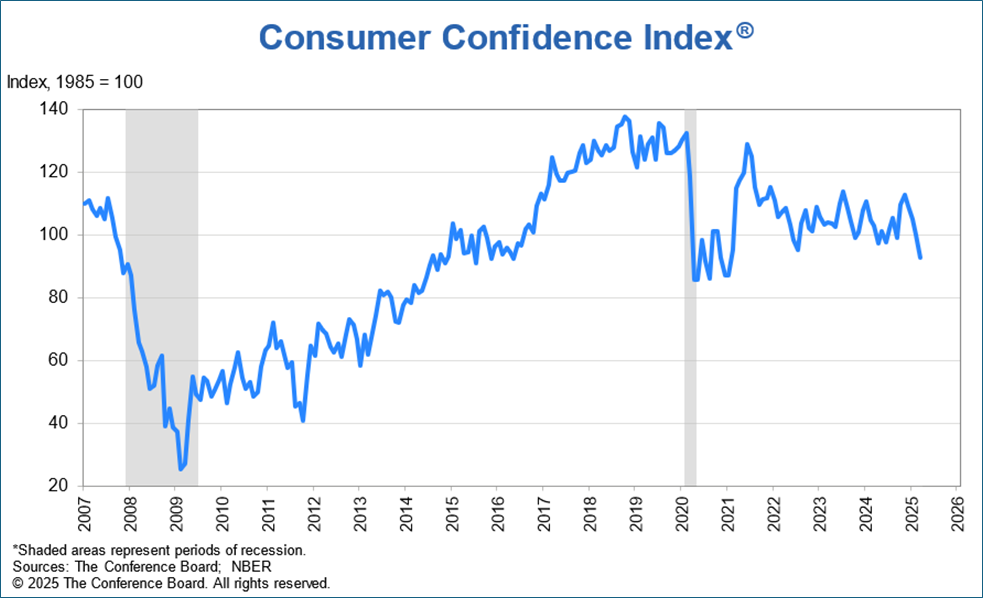

- We’ll also get the latest consumer confidence reading from the Conference Board. The April reading is expected to see the headline confidence reading dipping further from 92.9 to 88.5 (see graph below). We’ll be on the lookout too for the labor differential reading (jobs plentiful minus jobs hard to get). It’s been trending lower, indicating jobs harder to get, which is another sign of labor market cooling. We suspect that trend will continue.

- The first look at first quarter GDP will be on Wednesday with expectations of a slight 0.2% GDP vs. 2.4% in the fourth quarter. The Atlanta Fed is still showing a -0.4% (using the ex-gold model). The original model is looking much worse at -2.5% as many central banks were busy buying gold reserves and that contributed to the wider drop in the GDP model. Personal consumption will get a lot of attention as will the inflation numbers from this report so expect it to generate some post-release volatility. Keep in mind, fourth quarter consumption by consumers ran at 4.0%. Something much less is expected for this quarter, while PCE inflation last quarter was 2.3% and 2.6% core (annualized).

- The Wednesday release of first quarter GDP will steal some of the thunder from the March Personal Income and Spending Report that will also be released on Wednesday. While that report is incorporated in the GDP totals, at least we’ll get the breakdown for March. As for inflation, overall PCE is expected to be unchanged for the month vs. 0.3% in February with the YoY dipping from 2.5% to 2.2%. Core PCE is expected to be 0.1% MoM vs. 0.4% in February with the YoY rate dipping from 2.8% to 2.6%. The question is, even if these favorable monthly numbers are realized, how long before tariff-induced price increases start to undo the expected improvement in March? That’s the question the market will be wrestling with this week with all the new releases.

- Before the jobs report on Friday, the ISM Manufacturing Index (Survey) will be released Thursday with another dip in manufacturing expected. The April headline reading is expected to drop from 49.0 to 47.8, indicating continued weakening/contraction in the manufacturing sector. The ISM Services Index will be released next Monday with early expectations that the services sector slides into contraction at 49.0 vs. 50.8 in March. Just another sign of a slowing economy.

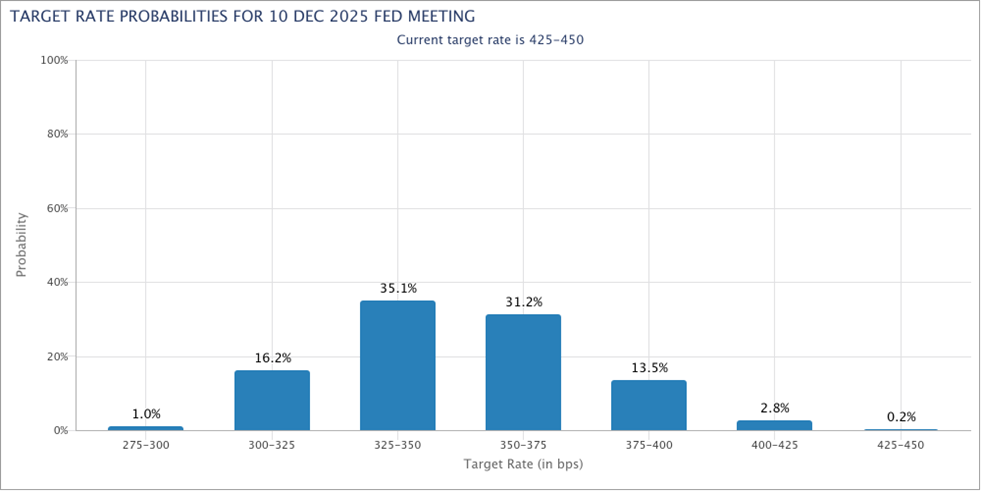

Futures Market Still Sees 3 to 4 Cuts by Year-End

Source: CME

Consumer Confidence Expected to Dip Again this Week

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.