BLS 2023 Payroll Revisions and FOMC Minutes on Tap for Today

BLS 2023 Payroll Revisions and FOMC Minutes on Tap for Today

- We’ve arrived at mid-week with investors waiting on Powell’s Jackson Hole address on Friday, so the range trade remains in place. We do get, however, some important items today with the BLS payroll revisions for 2023 and the minutes from the July 31 FOMC meeting (more on those stories below). So, some volatility may get injected into the market, but we think it will be a muted affair with the Jackson Hole address looming. Currently, the 10yr note is yielding 3.81%, down 1bp on the day while the 2yr is yielding 3.99%, down 2bps on the day.

- While the week of light data rolls on, we did hear from Fed Governor Michelle Bowman yesterday and while still getting in her typically hawkish digs, she relented that, “should the incoming data continue to show that inflation is moving sustainably toward our 2 percent goal, it will become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive on economic activity and employment.” We’ll count her as a yes vote for the 25bps rate cut in September but probably not for 50bps. So far this week we’ve heard from two of the more hawkish members (Kashkari and Bowman) and both indicate they’re on board with a rate cut, so the road seems well-paved at this point for the rate-cutting cycle to commence next month.

- Much like Bowman’s comments, Powell’s Jackson Hole address is expected to reveal a Fed open to rate cuts in September. But investors looking for clues as to the size and timing of cuts will probably be left disappointed. Given the data dependent nature of this Fed, and the fact they will see August employment and inflation reports before the September 18 FOMC meeting, it’s unlikely Powell will over-promise before those reports are in hand. We continue to see 25bps cuts in September and December, followed by quarterly 25 bps cuts in 2025.

- Later this afternoon, we’ll get the minutes from the July 31 FOMC meeting. While they lose some luster coming just before Jackson Hole, it will provide some insight as to how seriously a July rate cut was discussed. Powell mentioned in the press conference there was a back-and-forth discussion about a July cut so we’ll see how animated, if at all, that discussion was. Although, to be honest, trying to determine the level of passion from dry meeting minutes will be a particular challenge.

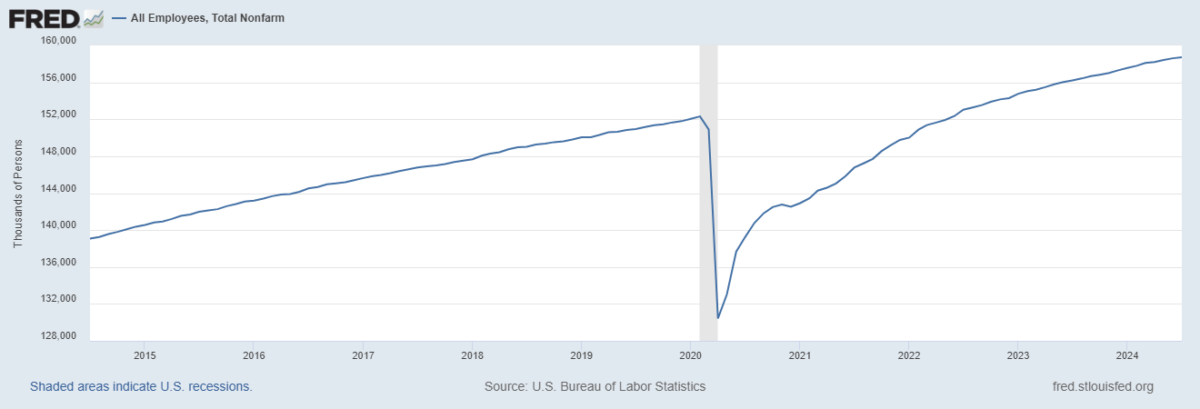

- At 10am ET, the BLS will release its annual benchmarking revisions to payroll totals. This adjustment is made annually and comes after the BLS receives more comprehensive payroll data from the Quarterly Census of Employment and Wages report. It’s expected that the payroll adjustment will be downward and align somewhat better with the Household Survey that had been picking up less job creation for much of 2023 than the initial Establishment Survey results.

- We’ve seen estimates from 500 thousand to a million less jobs than initially reported. While hitting the high end of the range may not be enough to rekindle hopes for a 50bps cut, it would be another signal that the labor market was not as robust in 2023, and yet another message to the Fed to get on with rate cuts. A million less jobs in a 159 million job economy may not seem all that consequential, but on a monthly basis that works out to about 83 thousand less jobs which if deducted from the 225 thousand monthly average for reported payroll growth would be significant.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.