Before the Thanksgiving Meal, a Feast of Data Awaits

- Treasury yields are a touch lower this morning as a deluge of reports start to roll in. The big one, however, core PCE, will come at 10am ET so expect some further moves in yields before thoughts of Thanksgiving take over. Currently, the 10yr Treasury is yielding 4.26%, down 4bps on the day, while the 2yr is yielding 4.21%, also down 4bps from Friday’s close.

- With the Thanksgiving holiday tomorrow and the quasi-holiday that is Black Friday, all the data that would normally come on Thursday and Friday are jammed into today. First up, initial jobless claims came in at 213 thousand vs. 217 thousand expected and 215 thousand the prior week. Continuing claims, which have been rising of late, were 1.907 million vs. 1.889 million expected and 1.898 million the prior week. Thus, layoffs remain muted but those that have are finding it tougher to get rehired.

- The other 8:30 release was the second estimate of third quarter GDP which remained unchanged at a solid 2.8% with the core price index ticking down from 2.2% to 2.1%. The Atlanta Fed GDPNow model for fourth quarter GDP is sitting at 2.6%.

- The preliminary read on durable goods orders for October was 0.2% vs. 0.5% expected, while ex-transportation it was 0.1% matching expectations but off the 0.4% gain in September. Capital goods orders non-defense ex-air and shipment of same were -0.2% and 0.2%, respectively. In September, capital goods orders were up 0.3% while shipments were down -0.1%.

- The 10am ET releases include October’s Personal Income and Spending report. With CPI/PPI and Import/Export Prices already in hand the estimates for core PCE are coming in at 0.26%, or 0.3% rounded, but a “low” 0.3% which should not rile markets. Powell has already mentioned that inflation is traveling a bumpy path, so a 0.3% core PCE wouldn’t necessarily dim odds of a December rate cut but anything above that will certainly call a cut into question.

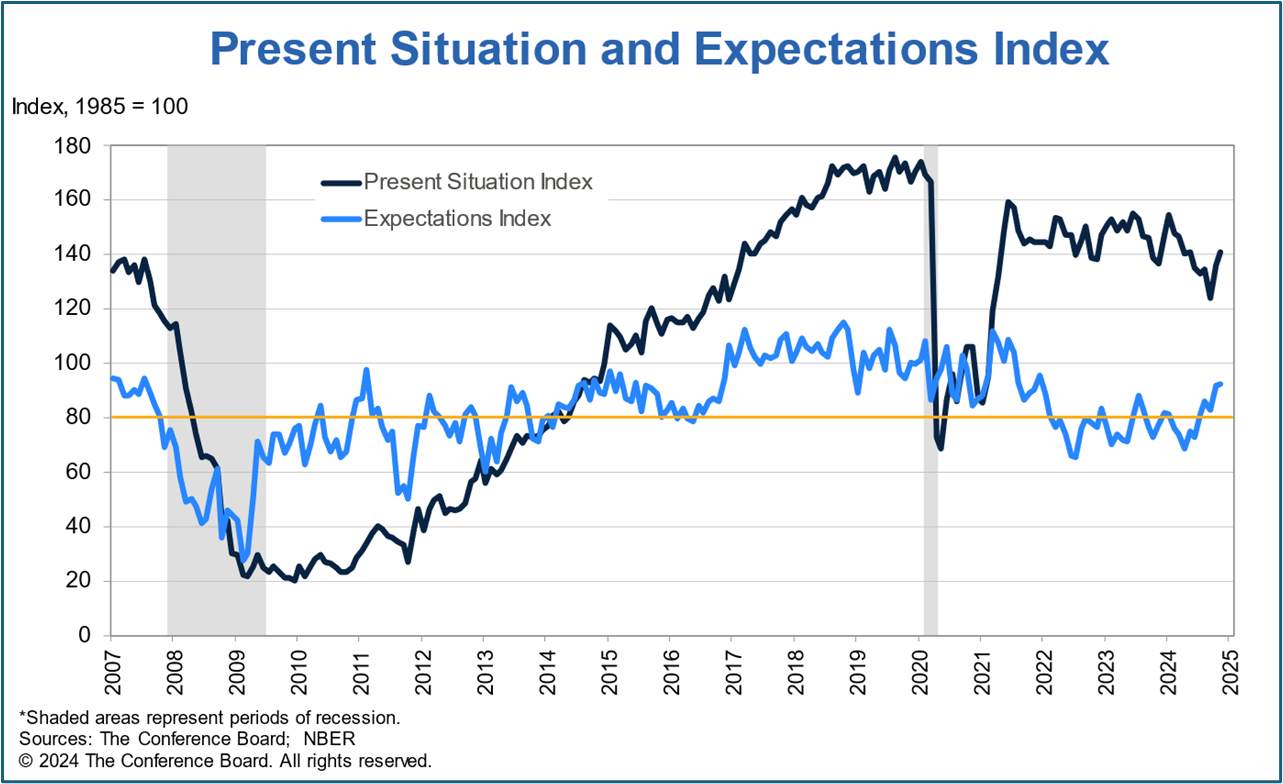

- The second biggest report of the week was yesterday’s Conference Board’s Consumer Confidence reading for November. The headline reading on consumer confidence beat the prior month 111.7 vs. 108.7 (see graph below). The Present Situation and Expectations Index both increased and that bodes well for consumer spending during the holiday shopping season.

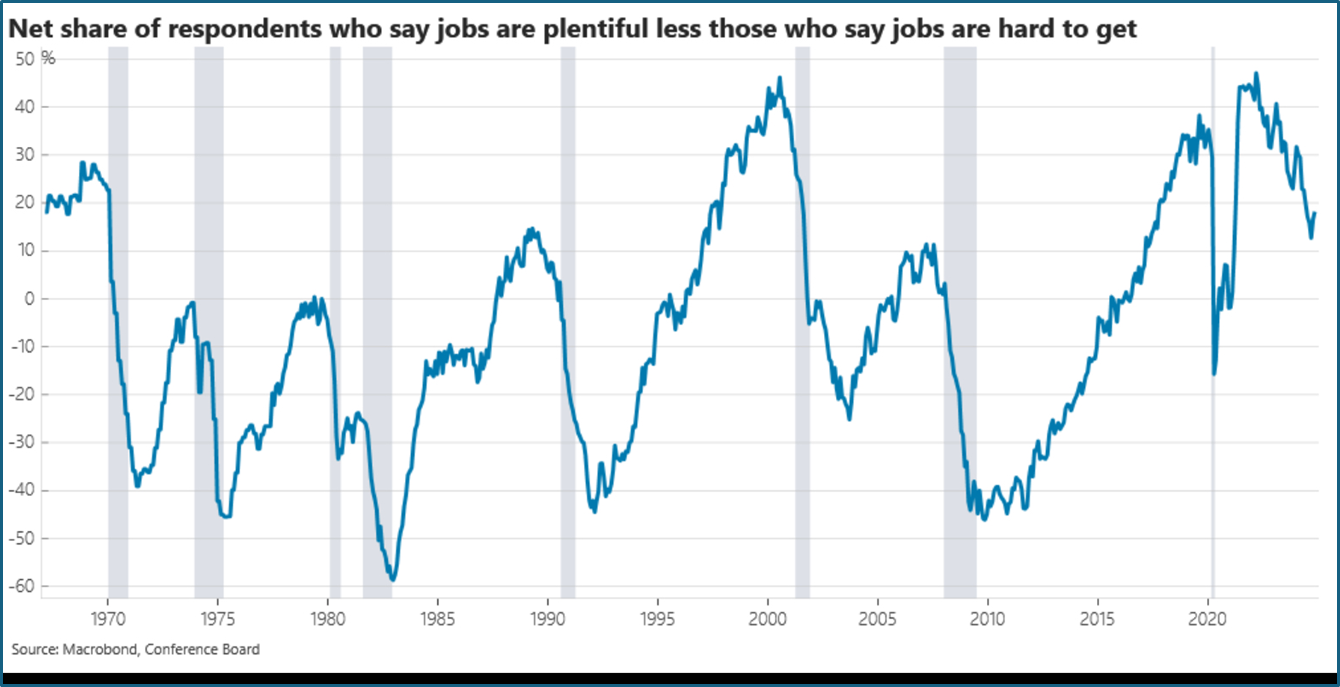

- The other big number from the report was the Labor Differential reading (Jobs Plentiful less Jobs Hard to Get). It had been trending lower as labor market momentum slowed but did tick up in October and again in November, indicating a bit of a rebound in that measure of the labor market. There is speculation too that some employers are stockpiling workers should deportations begin early in Trump’s term.

- The FOMC minutes from the November meeting were released yesterday afternoon and they had a little for both dove and hawk alike with little to no surprises. Here is a sampling, “In discussing the positioning of monetary policy in response to potential changes in the balance of risks, some participants noted that the committee could pause its easing of the policy rate and hold it at a restrictive level if inflation remained elevated, and some remarked that policy easing could be accelerated if the labor market turned down or economic activity faltered.”

- The uncertainty of the neutral rate made it into the minutes as well: “Many participants observed that uncertainties concerning the level of the neutral rate of interest complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually. So, there you go, something for just about everyone, right down the middle of the fairway, but it does increase the importance of both the November jobs and CPI reports before the December 18 meeting.

- With the holiday tomorrow, and the lack of releases on Black Friday, our next Market Update will be on Monday, December 2. Enjoy your Thanksgiving!

Conference Board Labor Differential (Jobs Plentiful – Jobs Hard to Get) Improves for a Second Straight Month

Consumer Confidence Moves Higher after Election Results

Present Situation and Expectations Indices Both Improve as Well

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.