August PCE Inflation Matches Estimates, While Income and Spending Beat

- Treasury yields are finding it hard reading the latest Personal Income and Spending Report. While the inflation data came in as expected, the solid income and spending figures argue again, like the reports yesterday, that numerous rate cuts may not be needed. Odds of two more cuts this year are down to approximately 60% vs. over 80% on Wednesday. Currently, the 10yr Treasury is yielding 4.18%, unchanged on the day, while the 2yr note yields 3.66%, also unchanged in early trading.

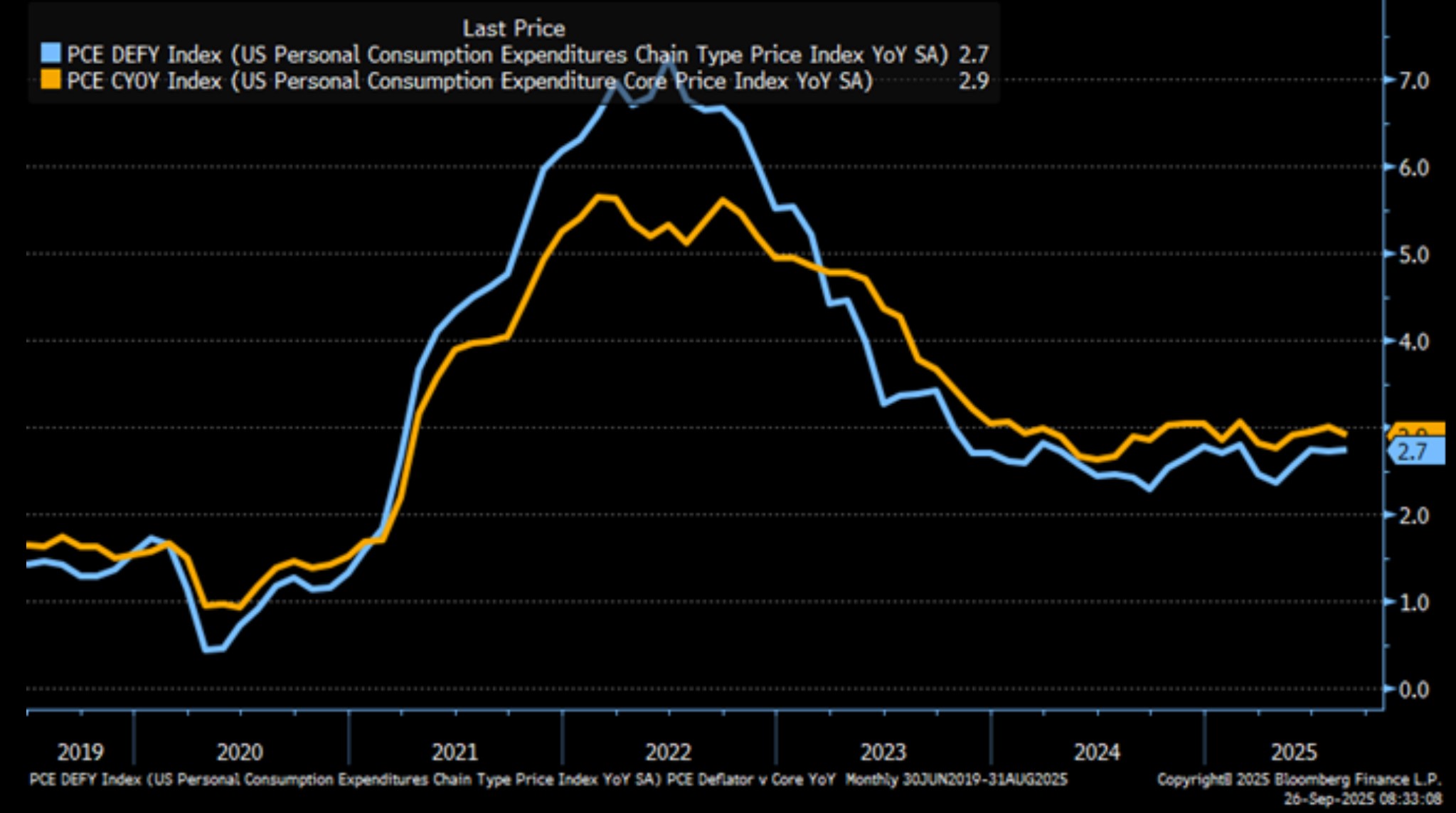

- The big report for the week is out with August Personal Income and Spending with the Fed’s preferred inflation gauge PCE. Core PCE rose 0.2% (0.23% unrounded) which matched estimates but eased from July’s 0.3% (0.28% unrounded). YoY core remained at 2.9% for a second straight month, matching expectations, but also the highest since February’s 2.949%. In addition, goods inflation increased 0.9% YoY from 0.6% in July and continues to move up from the deflationary trend prior to the tariff policy change. Service side inflation edged higher as well to 3.6% YoY vs. 3.5% in July.

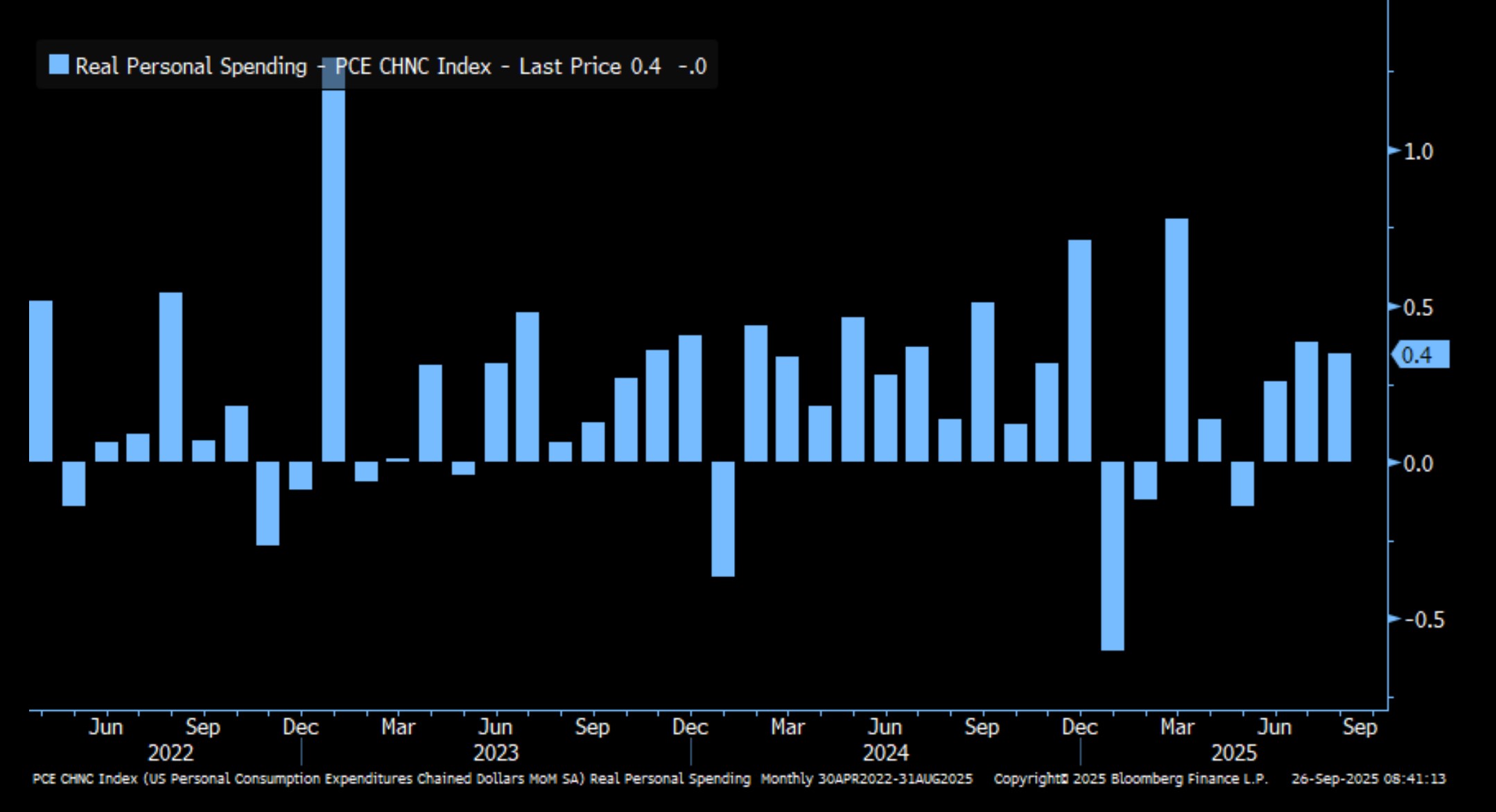

- Personal income increased 0.4% vs. 0.3% expected and 0.4% in July. Personal spending increased 0.6% vs 0.5% expected and 0.5% in July. It’s the highest monthly spending gain since March’s 0.8%. Real spending (net of inflation) remained at 0.4% MoM, beating the 0.2% expectation but matching the prior month’s pace. Along with July, it’s the highest real spending since March’s 0.8%. While personal spending has slowed some from its torrid 2024 pace, it remains solid despite the swirl of economic uncertainty and slowing job growth and has clearly been the lynchpin of this economy.

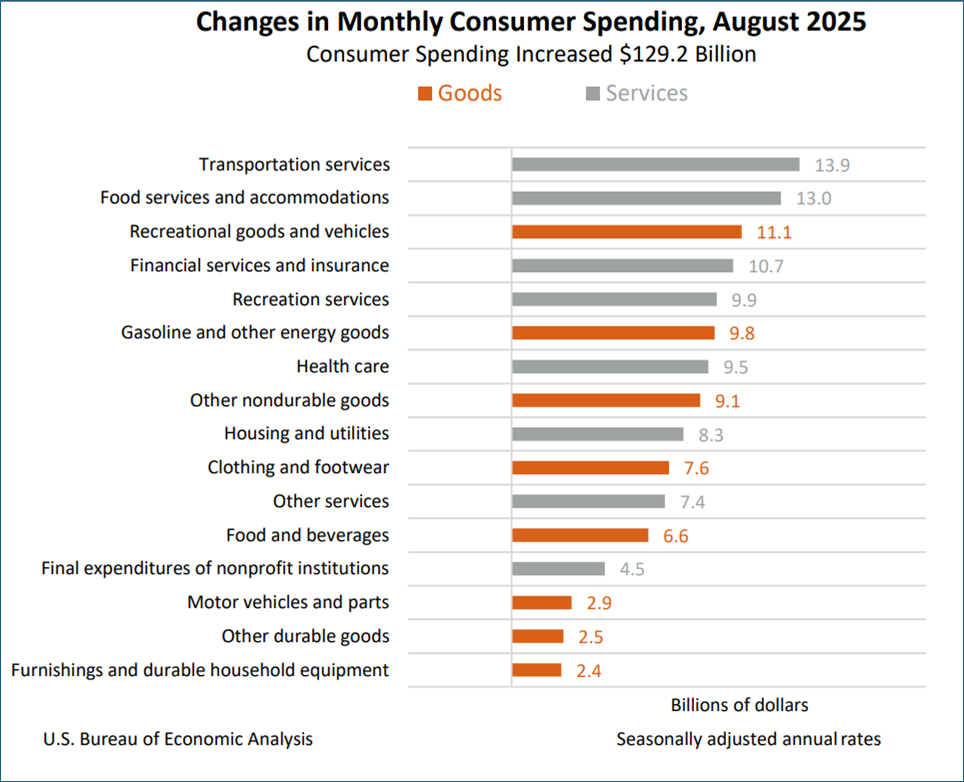

- However, in a reversal from July, August spending gains were highest in discretionary items vs. essential items like housing and healthcare. This is a break from a three-month trend that had the consumer showing more caution about what they were buying (essentials vs. discretionary), but that pent-up demand for more “fun” spending gave way in August, (see table below of spending categories).

- Speaking of the consumer, the third estimate of second quarter GDP was revised up from 3.3% to 3.8%, beating the 3.3% unchanged expectation. The improvement came from an increase in personal spending vs. earlier estimates with real final sales to domestic purchasers increasing a full percentage point from 1.9% to 2.9%. That level of spending is like 2024 and shows again that the consumer has not abandoned their spending habits despite the increased uncertainty.

- In the week ending September 20, seasonally adjusted initial jobless claims totaled 218,000, a decrease of 14,000 from the previous week’s revised level, which was increased by 1,000 from 231,000 to 232,000. The 4-week moving average was 237,500, a decrease of 2,750 from the previous week.

- Meanwhile, seasonally adjusted continuing claims for the week ending September 13 were 1,926,000, a decrease of 2,000 from the previous week’s revised level. The previous week’s level was revised by 8,000 from 1,920,000 to 1,928,000. The 4-week moving average was 1,930,000, a decrease of 4,500 from the previous week’s revised level. So, not to sound like a broken record but the jobless claims series continues to reflect a low-fire, low-hire environment that has persisted for all of 2025.

Consumer Back to Spending on Discretionary Items

PCE and Core PCE Inflation (YoY) – Plateauing for Now

Spending Net of Inflation (MoM) – Matching July and Highest Since March

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.