August PCE Inflation Cool as Expected but Spending Slows

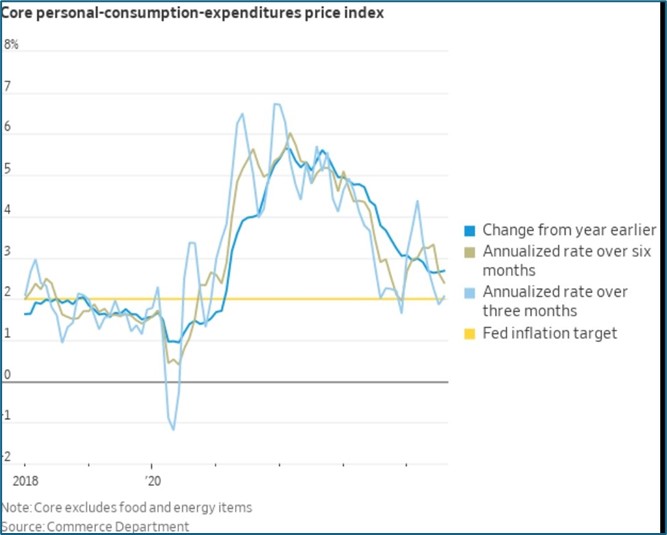

- Treasury yields are a bit lower as the Fed’s preferred inflation measure came in slightly cooler than expected, but the YoY rate ticked up from 2.6% to 2.7% as tough base effects (a .008% MoM rolled off from last year) make YoY gains in the second half of this year challenging. On net, the report will do nothing to dissuade the Fed from cutting rates again in November. Currently, the 10yr note is yielding 3.76%, down 3bps on the day, while the 2yr is yielding 3.59%, down 3bps on the day.

- The highly anticipated core PCE inflation reading for August came in at a “high” 0.1% (0.13% unrounded), below the 0.2% expectation, but the YoY rate still rose from 2.6% to 2.7%, as expected. We’ve mentioned for a while the second half of 2024 would be more challenging for improving YoY rates and we’re seeing that here. Meanwhile, the 3-month annualized rate stands at 2.1%. The cool inflation read offsets some of the angst of a slightly hotter read from the August CPI report and will keep a November rate cut firmly in place. However, the 25 or 50bps question will be answered by the September and October employment reports. Overall PCE rose 0.1% (0.009% unrounded) matching expectations and below the 0.2% in July. That lowered the YoY rate from 2.5% to 2.2%, under the 2.3% expectation, and the lowest since February 2021.

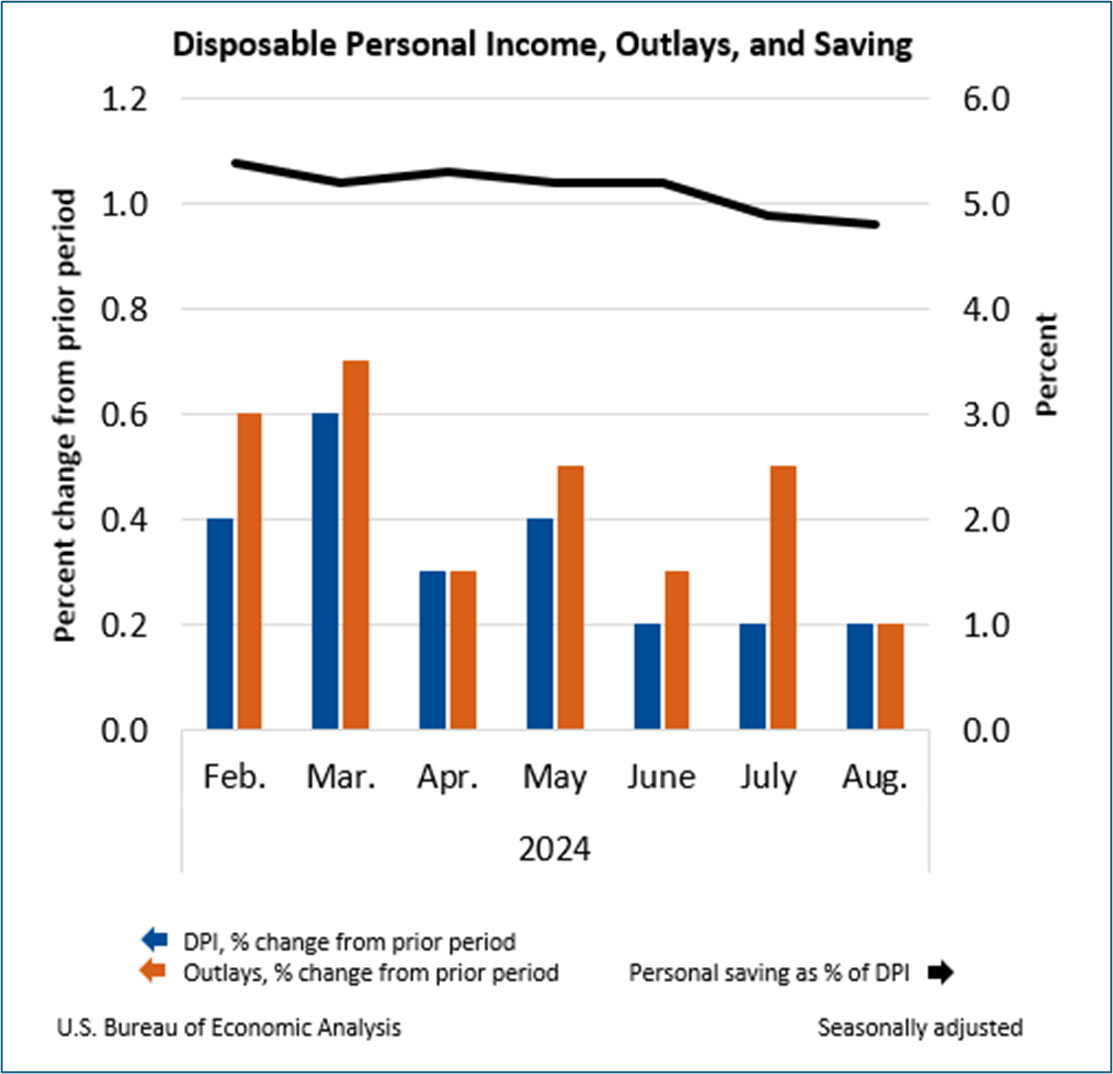

- Personal spending for August came in at 0.2% MoM, missing the 0.3% expectation and less than July’s 0.5% increase. Real spending (net of inflation) rose 0.1%, matching expectations, but well below the 0.4% pace in July. Recall, the retail sales series for August was slightly ahead of expectations but less than the spending in July. So, while spending growth continues the momentum is slowing and will be another issue to consider for the Fed in determining the pace and magnitude of rate cuts.

- Personal income for August rose 0.2% MoM, missing the 0.4% expectation, and July’s 0.3% gain. After a pop of 1.1% in January, income gains have oscillated between 0.2% and 0.4% which works out to a YoY rate close to the 3.8% Average Hourly Earnings gain from the August jobs report. That implies wage gains continue to moderate and are approaching the 3.5% target at the Fed.

- In all, the Personal Income and Spending report for August missed on the low side for income and spending which could add emphasis to the Fed’s rate-cutting pace. In addition, the monthly inflation numbers, both overall and core, certainly green light a November and December rate cut, but again, the 25 or 50bps question will be settled with the September and October employment reports.

- Despite the modest increase in income (0.2%), which matched the spending gain (0.2%), annual benchmarking revisions by the BEA led to an increase in the savings rate from July’s initially reported 2.9% to 4.8%. After revisions, the July rate rose to 4.9%,so a slight dip in August. That will ease some concerns that the consumer’s ability to continue spending at their recent pace will cool, and as we’ve said before calling for the demise of the consumer has been a losing trade for over a year.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.