As Expected, Fed Keeps Rates Unchanged but Notes Moderating Growth

Meeting Highlights

- As expected, the Fed kept the funds rate range unchanged at 4.25% – 4.50%, with two Fed governors dissenting (Waller and Bowman). The double dissent from governors is the first since 1993. Truth be known, It’s not really surprising the pair dissented as they’ve been increasingly vocal about cutting now, and it does keep their hopes of a Fed Chair nomination intact.

- In relation to statement changes, they were just two of note. The statement noted some slowing in output with, “growth of economic activity moderated in the first half of the year” vs. “growth has continued to expand at a solid pace” in the prior statement. Uncertainty about the economic outlook was changed from “has diminished but remains elevated” to “remains elevated.” So, growth expectations are reduced while uncertainty continues to be elevated.

- Since this was not a quarter-end meeting there were no updated economic or rate forecasts. The only information coming from the meeting is the attached statement and the post-meeting press conference where Powell will add more color to today’s decision.

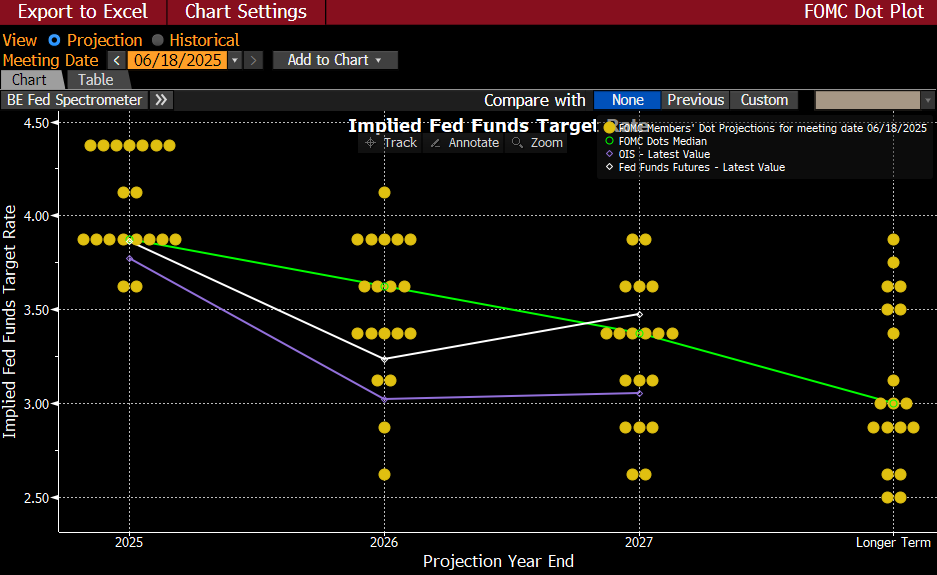

- Futures pricing prior to the announcement had odds of the first rate at 58% for the September meeting, with the 2025 year-end rate at 3.89%, implying 44bps in cuts by year end. Those futures levels have improved in early post-meeting trading with September odds of a cut increasing to 66% and year-end cuts totaling 46bps.

- In the June FOMC rate and economic forecast, the Fed saw core PCE ending 2025 at 3.1% then dropping to 2.4% in 2026 and finally 2.1% in 2027. Core PCE currently stands at 2.7% with the June release due tomorrow with expectations at also at 2.7%. With expectations of a 0.4% increase by year-end, the Fed believes tariffs will continue to add inflationary price pressure, and some are already speculating that tomorrow’s PCE update could be as high as 0.5% MoM. That would certainly add inflationary angst to a possible September cut.

- In summary, the Fed delivered a somewhat as expected message while recognizing moderation in growth with uncertainty about that trend and inflation remaining a central issue clouding policy decision making. With the labor market and economy exhibiting resilience, but certainly less so in the most recent data, the Fed feels the best course of action is waiting and watching before adjusting policy. The fact that two governors dissented in wanting to cut today does complicate matters somewhat for Powell, but it also shows that “group think” isn’t something the Fed can be accused of.

Dot Plot from June FOMC Meeting

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.