April PCE Inflation as Expected but Spending Slows

April PCE Inflation as Expected but Spending Slows

- Treasuries are rallying a bit after this morning’s Personal Income and Spending Report saw inflation as expected but with definite slowing in spending (more on that below). Currently, the 10yr note is yielding 4.50%, down 5bps on the day while the 2yr is yielding 4.90%, down 3bps on the day.

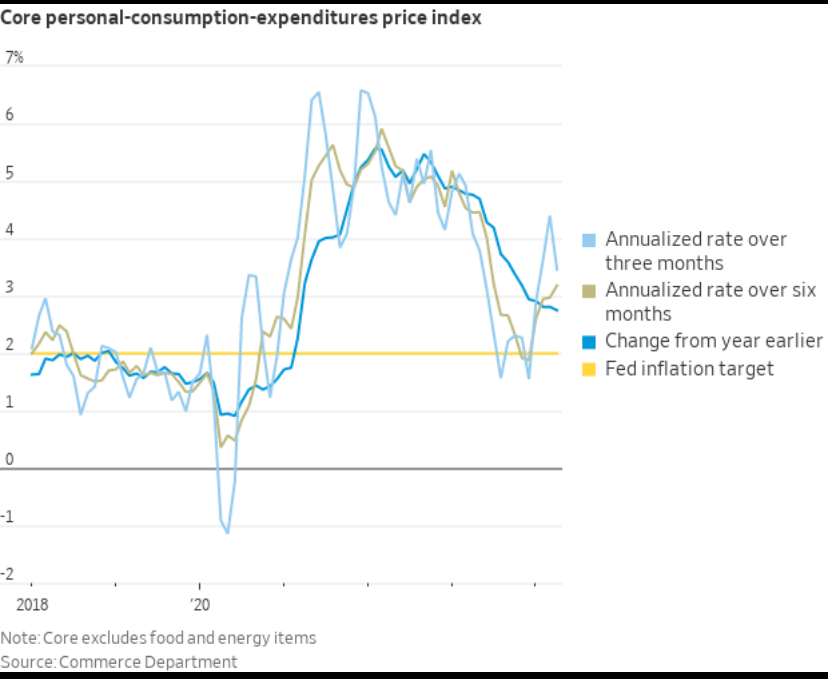

- Today’s Personal Income and Spending Report offered few surprises, but a softening in spending adds to other signs of slowing growth and that may complicate the Fed’s higher-for-longer messaging. The highly anticipated core PCE inflation reading for April came in at 0.2% (0.249% unrounded), down from 0.3% in March but the YoY rate remained at 2.8% (2.75% unrounded) given the “high” 0.2% MoM. Overall PCE came as expected with a 0.3% increase, same as March, and the YoY rate remained at 2.7%.

- The inflation results came mostly as expected, but the lack of improvement in YoY rates, which is likely to continue given the unfavorable base effects in the second half of the year, may keep the higher-for-longer chorus going, assuming the labor market and economic growth don’t materially weaken, and that’s becoming an increasingly dubious assumption.

- Personal spending for April came in at 0.2% MoM light of the 0.3% expectation and off a strong 0.7% pace in March, which was revised down from 0.8%. Recall, retail sales earlier this month disappointed but the personal spending numbers here are more comprehensive capturing more of the services-side which is where the consumer has been focused lately. That was the case again in April with service spending increasing $49 billion while goods spending declined $10 billion. Adjusted for inflation, real spending declined -0.1% which was light of the 0.0% expectation. So, while a bit better than the retail sales numbers consumption unequivocally slowed in April and that may get the Fed’s attention, but will it be enough to soften the higher-for-longer message?

- Finally, personal income for April rose 0.3% MoM, matching expectations, and just below the 0.5% gain in March. The 0.3% gain works out to a YoY rate of just under 4% and that is in keeping with the Average Hourly Earnings gain from the April jobs report. The moderating income gains are what the Fed is after as it implies some moderation in spending down the road, and that certainly happened in April, but is it a case of be careful what you wish for?

- Building on that point, the second estimate of first quarter GDP was revised lower to 1.3%, matching expectations, and off from the 1.6% first estimate as consumer consumption slowed to 2.0% from 2.5% in the first estimate. Expectations were for a 2.2% revision, but a 2.0% consumption rate is historically decent. Recall, the real drag for the quarter were volatile inventory and trade categories that were down but could very well reverse in the current quarter, but if consumption slows further that will complicate the growth picture. The revision also saw a slight downtick in the inflation readings with the price index dipping to 3.0% vs. 3.1% in the first estimate while the core price index also dipped one-tenth to 3.6% from 3.7%. Expectations were for unchanged readings on both. While still above Fed targets the downtick in the revision at least nudges the inflation readings in the right direction.

- Finally, we mentioned this on Wednesday but wanted to remind readers that we recently recorded an episode of The Community Bank Podcast with Joe Keating, who is now part of SouthState’s Wealth Management Group. We discussed his latest thoughts on the economy and where it and Fed policy are headed. It’s been a while since we’ve had Joe on the show. He always has some interesting and informative views, so go give it a listen here.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.