Another Goldilocks Report

Another Goldilocks Report

- The December personal income and spending numbers, along with the PCE inflation series, are out this morning and were pretty much in line with the Goldilocks-like GDP report from yesterday. Good growth on the back of healthy consumer spending, while inflation continues to trend lower. It’s doesn’t improve the odds of a March rate cut, but it shows the economic airplane is in a stabilized approach for a soft landing. Presently, the 10yr Treasury is yielding 4.14%, while the 2yr Treasury is yielding 4.35%.

- Digging into the details of today’s income and spending numbers, personal income increased 0.3% MoM which matches expectations and just off the 0.4% from November. Meanwhile, it was a good month for retailers as consumer spending rose 0.7% MoM which beat the 0.5% forecast and well clear of the 0.2% in November. That was the highest level of spending since January 2023. Netting out inflation, real personal spending rose 0.5% MoM matching November but ahead of the 0.3% expectation. That real level of spending was also the highest since January 2023.

- It’s also interesting to note that in the spending category, goods spending increased 1.1% in December while service-side spending rose 0.3%. What was curious though was the goods-side spending was led by recreational goods and vehicles. Perhaps the so-called revenge spending isn’t over yet!

- For the all-important PCE inflation series, the numbers continue the recent disinflation trend. Overall PCE rose 0.2% which matched expectations but was up from the -0.1% booked in November on the back of lower energy prices. The YoY rate held at 2.6% for the second straight month.

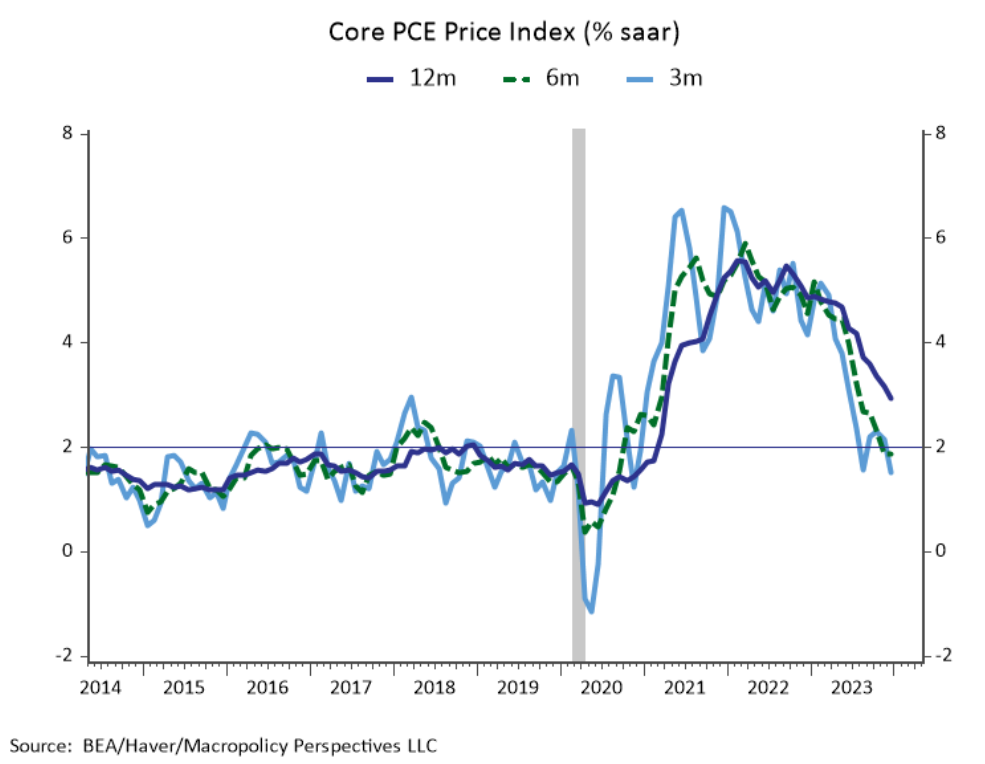

- Core PCE rose 0.2% MoM (0.17% unrounded)which matched expectations but was up from the 0.1% print in November. This led to the YoY rate dipping into 2-handle territory at 2.9%. That beat the 3.0% expectation and 3.2% in November. The 2.9% print is the lowest since March 2021. On a six-month basis core PCE is down to 1.9% annualized and the three-month rate down to 1.5% annualized (see graph below). As we’ve noted before, the time to see improvement in the YoY rate is now through June as some large monthly prints from 2023 roll off. After June, the comps become much tougher to improve on.

- Overall, a solid report with the consumer continuing to spend their additional income and then some, and inflation continuing to trend toward the Fed’s 2% target. Do the numbers today increase the odds of a March rate cut? Probably not. The inflation trend is heading in the right direction, but with the consumer still showing little sign of fading the Fed is likely to continue with the patient pause approach.

- Also, keep in mind we will see two more CPI and employment reports before the March meeting so the numbers today will be more of a footnote on the rate decision in March. The numbers today, however, continue the Goldilocks theme from yesterday’s GDP report that found solid growth, led by solid consumer spending, with inflation trending in the right direction.

- Also buttressing the case that the economy continues to chug along, the preliminary PMI surveys from S&P Global earlier this week found a rebound in manufacturing (highest since October 2022) along with continued strength in the services-side of the economy (highest since June 2023). The more consequential ISM surveys will be out next week, but it looks like any thoughts of a January slowdown are just that.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.