Annual Benchmarking Adjustments May Cloud January Jobs Report

- Treasury yields are lower this morning as talk of a US takeover of the Gaza Strip has a flight-to-safety trade happening, but equities are rebounding off earlier lows as markets and investors become more circumspect on White House announcements that may be more rhetorical rather than statements of new fact or policy. In any event, the tape bombs aren’t likely to relent anytime soon, and we do have some first-tier labor market data to deal with. Currently, the 10yr Treasury is yielding 4.45%, down 6bps on the day, while the 2yr is yielding 4.24%, down 2bps on the day.

- Have you booked your 2027 Spring Break stay at the Trump Resort, Gaza Strip edition yet? While we say that tongue-in-cheek, it’s just another day at the White House, where Trump claimed that the US will “takeover” Gaza. While the geo-politics of such a move are provocative, to say the least, it’s a good example that you never know from one day to the next what will imminent from 1600 Pennsylvania Ave and that will keep traders and markets on edge. Strap in if you haven’t already.

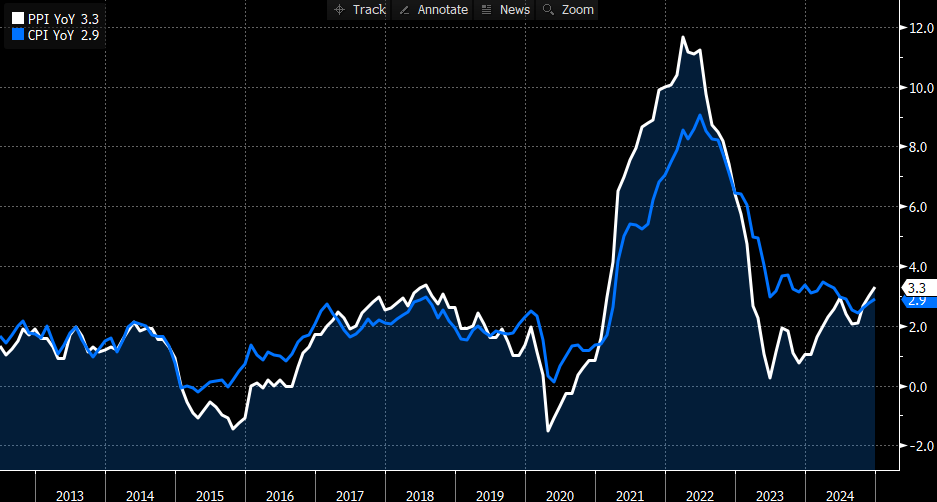

- Stepping back to previous actions, the calculations are in for the potential inflationary impact from China’s limited set of tariffs set to go in effect February 10th. While estimates are still in a range, it looks like there will be a 0.3-0.4% increase in core-PCE and that assumes they remain in place as announced (which as we’ve seen from the Mexico/Canada dustup is subject to change). Expect a flow-through into the realized data take 3 to 4 months. So, by this summer’s Fed meetings, the Committee should have a good sense of at least the initial fallout from this set of new levies. The tougher calculation is the influence on intermediate goods, as the pass-through from PPI to CPI is not 1 to 1 (see graph below). So, while the expectation is for the Fed to be ready to cut at mid-year, that could be when the Chinese tariff impact starts to arrive at American shores.

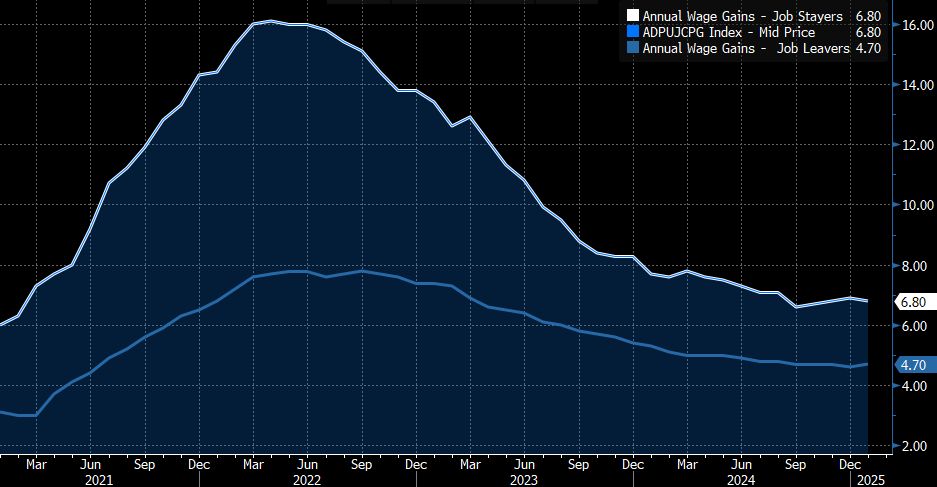

- Meanwhile, the weekly data continues to roll in with the ADP Employment Change report for January surprising to the upside with 183 thousand private sector jobs vs. 150 thousand expected and 176 thousand in December (revised up a healthy margin from 122 thousand initially reported). Service producing jobs totaled 190 thousand while goods-based jobs lost -6 thousand positions. Meanwhile, wage gains for job-stayers ticked a tenth higher to 4.70% vs. 4.60% in November. The level has been stable to descending over the last two years. For job-leavers wage gains increased 6.80%. The trend for job-leavers has been lower as well, and recall it peaked at 16.0% in the second quarter of 2022. So, while still higher than the 4.0% YoY gains reflected in the non-farm payroll report they are well off the boil from a few years ago. Finally, while the ADP/BLS correlation has been nearly non-existent the forecast for Friday is for private sector job gains to total 150 thousand vs. 223 thousand in December.

- The ISM Services Index was expected to show a near-unchanged 54.0 level, but it came in a lower at which is solid growth, which is not surprising in the service side of the economy. The one caveat is that the manufacturing sector showed surprising strength, finally moving above 50 for the first time since October 2022. Did that come at the expense of services, or does it represent a broadening out of economic strength? We shall see.

- The jobs report looms on the horizon with a solid gain of 170 thousand new jobs expected and the unemployment rate unchanged at 4.1%. The caution here is that benchmarking estimates for both the Establishment Survey and Household Survey could make for a noisy report. First, the Establishment benchmarking that comes from more complete employment data via quarterly unemployment insurance filings is expected to show a sizeable decrease in jobs from March 2023 to March 2024. While that won’t affect the January number it does provide a warning to not read too much into a hot number. It may be subsequently revised lower. Also, the birth-death model adjustment is due for a downsizing as well which will further hit the previously reported job gains last year. Bloomberg estimates the combination of the two revisions will lower 2024 employment by 934 thousand jobs (700 thousand from the benchmarking to unemployment insurance records and 234 thousand from the birth-death model revision).

- While somewhat mysterious, the birth-death model of new companies created a total of 1.2 million jobs in 2024, 55% of the year’s total 2.2 million job gains. For 2025, Bloomberg estimates the model will show 900 thousand jobs, reflecting an adjustment to the overcount in 2024.

- Post-revisions, Bloomberg estimates the average monthly job gain in 2024 was 150 thousand vs. 182 thousand before revisions. And if this wasn’t confusing enough, the Household Survey will get its own revision in this week’s report. Recall that for much of 2024 the two surveys often told different stories. Part of that is the revisions noted above but also the Census Bureau has been undercounting population growth. The expectation is that the annual adjustment due to better Census Bureau estimates is that 3 million more people are included in the population. Prior Household Survey data isn’t revised like in the Establishment Survey so the entire 3 million increase will get dropped into January. That will subsequently increase the labor force and employment totals (the Household Survey is much smaller than the Establishment Survey and the results are extrapolated across population estimates. With a larger population estimate, job gains and losses from the Household Survey will now be larger). The net-net of this is that Friday’s report could be full of noise and head-scratching results.

CPI & PPI Movements Aren’t Always Perfectly Correlated

Source: Bloomberg

January ISM Services Slips a bit to 52.8 vs. 54.0 Expected

Source: Bloomberg

ADP Employment Change Report – Annual Wage Gains Were Trending Lower but now Appear to be Stabilizing

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.